(Part 1)

Equally worrisome

The first part of this article considered what oil would mean for the production structure of Guyana. The shift from consumer of oil to producer of oil will provide the country with large amounts of revenue which could be used to invest in the infrastructure and human development of the country. This second part looks at the risks associated with oil production and oil revenues.

The matters considered here appreciate how useful oil would be to an economy like that of Guyana where relatively low productivity and high cost structures could change favourably and help increase the competitiveness of various industries. But there are equally worrisome evidence and views that often converge into a consensus that oil-rich countries, especially developing countries, squander the many economic dividends that cheap oil offers them. They also do a poor job of lifting their people out of poverty.  These countries seem to share some common characteristics of corruption, mismanagement and low levels of democracy. Whether necessary and sufficient conditions or not, many writers contend that developing oil producers were twice as likely to experience some type of severe internal strife as non-oil producers. Before discussing the aforementioned consequences of oil ownership, one more point is made about the production structure.

These countries seem to share some common characteristics of corruption, mismanagement and low levels of democracy. Whether necessary and sufficient conditions or not, many writers contend that developing oil producers were twice as likely to experience some type of severe internal strife as non-oil producers. Before discussing the aforementioned consequences of oil ownership, one more point is made about the production structure.

Attractive place

Apart from savings, cheap oil also means that foreign investors could see Guyana as an attractive place to set up production. Guyana can look to larger amounts of foreign investment and a widening of its economic structure once the conditions are set in place to accommodate those investments. A greater number of its raw materials could be included in a wider production structure. Bauxite and manganese, for example, could be added to the list of items for which value-added operations could occur in Guyana. The country would no longer have to use cheap labour or overly generous tax incentives to encourage investors to come. Though fiscal incentives are always an option for encouraging resource allocation from foreign to domestic soil, the competitive benefits of cheap oil can help to minimize the need for the excessive generosity of apparent unlimited tax exemptions which the defeated PPP/C regime has been selectively encouraging for years.

In an attractive investment climate well-educated human resources as well as an effective safety and security service matter most. Singapore serves as a good example in this regard. Singapore does not have natural resources of any significance.

Yet, it is one of the few countries which foreign investors seek out in order to place their investments because of its well-trained labour force and low security risk. The intention of the new administration in Guyana to focus on strengthening education, health and security is therefore a good and welcome one and should be pursued with the urgency, vigour and seriousness that they deserve.

Yet, it is one of the few countries which foreign investors seek out in order to place their investments because of its well-trained labour force and low security risk. The intention of the new administration in Guyana to focus on strengthening education, health and security is therefore a good and welcome one and should be pursued with the urgency, vigour and seriousness that they deserve.

Important risks

Guyana faces important risks in the management of the oil and the lessons of others should guide the country in this responsibility. Guyana’s foreign policy outlook must begin to accommodate this development. Linked to the issue of oil is also the economic phenomenon known as the Dutch disease. The Dutch disease is one in which a sudden increase in income coming from natural resources could lead to a rise in the exchange rate. The appreciation in the exchange rate causes other export products to become uncompetitive, leading to a decline in their production. Additional pressure on domestic production comes from the spending effect where cheaper imports compete with locally produced products for the purchases of consumers.

Things worsen with the resource pull effect which causes labour and other factors of production to leave other sectors and head to the more lucrative oil sector. Studies also show that the natural resource sector tends to boost the construction industry at the expense of other industries. An additional danger of the Dutch disease is that it leads to a rise in income inequality. In other words, under the law of concentration, a country could move from low levels of income equality to high levels of income inequality simply because workers in the oil sector are earning far higher incomes than those left in other sectors. Oil, in effect, can be a perennial threat to the education and security policies of the new government with its constant pressure on wages.

Explicable

But for many, the Dutch disease is explicable for it follows rational economic thinking and behaviour. Moreover, there are practical ways to attend to the effects of the Dutch disease. One popular initiative is to create a sovereign wealth fund. Sovereign wealth funds are investments by countries in financial assets to help smooth out the deleterious effects of rapid revenue inflows. They are made up often of asset classes of fixed-income instruments and the stocks of companies. Popular sovereign wealth funds are savings funds that convert non-renewable resources into intergenerational wealth; stabilization funds used to shield public money from economic shocks; development funds which are used for public infrastructure; and pension funds which focus on the social protection of old-age pensioners.

Availability of options

The availability of options to confront the Dutch disease eases fears of the phenomenon becoming a debilitating one. The greater concern is the more disastrous consequences of oil ownership that have descended on several developing countries. Many experts who study the politics of oil contend that countries with high levels of income from oil and gas have been unable, in many instances, to escape authoritarian rule and to avoid the temptations of corruption. The many incidents of violence, a penchant for financial volatility and noticeable resistance to gender equality do not leave many with a comfortable feeling about the usefulness of oil to the human condition. Experts see oil income as giving leaders a chance to buy off citizens and avoid the need to function as a democracy. This view is expressed in an online publication about the “Oil Curse” which contends that oil helps authoritarian governments to stay in power. The same online article argues and shows that oil also makes corruption worse.

There is no evidence that these countries are in a permanent state of anarchy, even though many have had long-running strife. Iraq has been in a state of instability frequently since 1980 when it engaged Iran in a cross-border conflict. By the turn of the next decade, Iraq had invaded Kuwait and had to be removed with force by an international coalition of forces led by the USA. The aggression in Iraq seems never-ending with the conflict that emerged after the USA deposed Saddam Hussein. Angola and Sudan were the scene of long-running conflicts. Algeria and Nigeria have experienced periodic internecine conflicts stemming from disaffected domestic interlocutors. There is disquiet too about democracy in Iran and Venezuela and their overreach in the affairs of other states. It should be recalled that even Trinidad and Tobago has not been spared the vicissitudes of the oil scourge having been the target of one coup attempt in 1990.

Guard against corruption

Ironically, the PPP/C administration did not have to wait for an oil find to engage in highly inappropriate behaviour. The confluence of VAT revenues which became available in 2007 and the large revenues from gold which emerged in 2008 enabled successive PPP/C administrations to spend money on preferred individuals, groups and business entities. Their removal from office has exposed already disturbing signs of mismanagement of the resources of the nation. It should be no surprise to anyone that, with the profligate spending of the PPP/C administration, the Consolidated Fund was overdrawn as reported by the Finance Minister of the new Granger administration.

The depth of the crisis facing the sugar industry is emerging daily. Oil revenues which were likely to be large give public officials the motive and means to steal as the article on the “Oil Curse” contends. Guyanese must guard against the risk of corruption by holding their new leaders to the code of conduct that they signed.

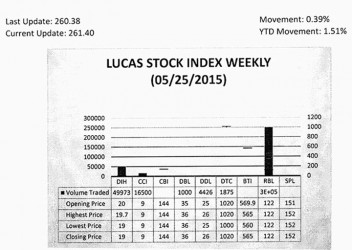

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose 0.39 per cent in trading during the final period of May 2015. The stocks of six companies were traded with 323,924 shares changing hands. There were two Climbers and one Tumbler. The stocks of Demerara Bank Limited (DBL) rose 2.86 per cent on the sale of 1,000 shares and the stocks of Demerara Distillers Limited (DDL) rose 6.12 per cent on the sale of 4,426 shares. The stocks of Banks DIH (DIH) fell 5 per cent on the sale of 49,973 shares. In the meanwhile, the shares of Caribbean Container Inc. (CCI), Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 16,500; 1,875 and 250,150 shares respectively.