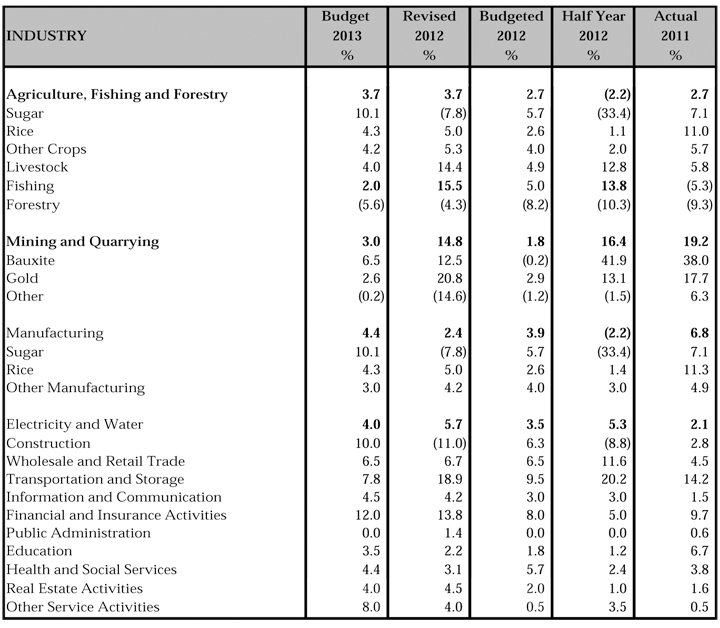

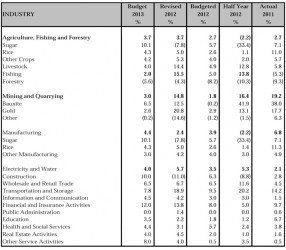

Sectoral Performance

Source: Annual budget speeches and Half Year reports.

The Table shows the sectors in which the economy is divided; by what percentage they are expected to grow in 2013; how the Sectors performed in 2012 compared with how they were expected to perform in 2012, their first half year in 2012 and their actual performance in 2011. .

The Table shows the sectors in which the economy is divided; by what percentage they are expected to grow in 2013; how the Sectors performed in 2012 compared with how they were expected to perform in 2012, their first half year in 2012 and their actual performance in 2011. .

The Global Economy

The Minister estimated growth in global output of 3.5% in 2013 compared to 3.2% in 2012. He said that much of global performance will be influenced by developments in the United States, in particular in relation to the pace of fiscal consolidation which, if excessive, could prove harmful to US and global growth prospects. Among the BRICS (Brazil, Russia, India, China and South Africa) and emerging economies, China continued to lead with growth of 7.8 percent in 2012, while growth in India slowed to 4.5 percent. Among the advanced economies, the Euro area and the United Kingdom both recorded negative growth of 0.4 percent and 0.2 percent respectively, offset by modest growth of 2.3 percent and 2 percent in the United States and Japan respectively.

Growth in Latin America and the Caribbean amounted to 3% in 2012 and is projected at 3.6% in 2013.

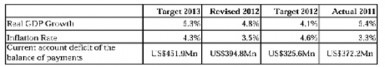

The Domestic Economy

Source: Annual Budget Speeches and National Estimates

Source: Annual Budget Speeches and National Estimates

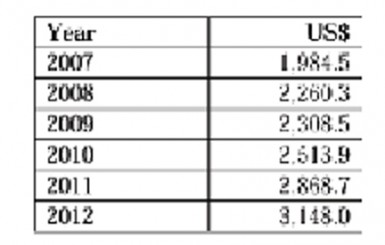

Per Capita GDP

Source: Annual Budget Speeches

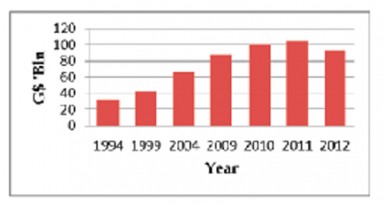

Domestic Debt

While the Minister made no reference to the stock of domestic debts, the June 30, 2012 BOG bulletin reported a 9.35 decline in the debt levels due to a contraction in the stock of outstanding government treasury bills. The growth in the domestic bonded debt from 1994 to 2012 is shown in the following graph:

While the Minister made no reference to the stock of domestic debts, the June 30, 2012 BOG bulletin reported a 9.35 decline in the debt levels due to a contraction in the stock of outstanding government treasury bills. The growth in the domestic bonded debt from 1994 to 2012 is shown in the following graph:

Source: BOG Statistics.

The above table includes only central government borrowing and therefore excludes any borrowings by public corporations and non-interest bearing debt, such as the Special Issue of Government of Guyana Securities by the Bank of Guyana.

External Debt

The movement in the external debt from 1997 to 2012 is shown in the following table:

The movement in the external debt from 1997 to 2012 is shown in the following table:

Source: BOG Statistics and Budget Speech – All shown at December 31

Balance of payments

The current account on the balance of payment returned a surplus of US$12.4Mn in 2012, compared to US$15Mn deficit in 2011. This improved performance was due to higher export earnings and transfers, outweighing the projected increase in import commodity prices. In 2013, the capital account is projected to register a surplus of US$509 million reflecting higher capital inflows and foreign direct investment.

Banking and Interest Rates

There was continued decline in the 91-day Treasury bill rate to 1.45%, the weighted average prime lending rate to 11.08% and the small savings rate declined from 1.99% to 1.69%.

The commercial banks have generally reported significant profits as most borrowers pay rates that are higher than the prime lending rate while the banks’ effective borrowing rate is lower than the savings rate as most demand deposit accounts earn no interest. Despite the spread, both loans and deposits have continued an upward trajectory.

The Exchange Rate

There was a slight depreciation in the value of the Guyana dollar to the US dollar by 0.37%.

Ram & McRae’s Comments

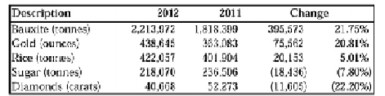

1. The output for several sectors stands out in comparison with the prior year as follows:

Source: 2012 and 2013 Budget Speeches

2. With gold prices falling from a high of US$1,794.10 per oz. in October 2012 to just above US$1,600 at the time the budget was presented, the Minister may soon find it necessary to review his expectations for 2013.

3. The performance in Rice is driven by the agreement with Venezuela (see Commentary and Analysis). Any changes to the Agreement would have several consequences, including balance of payments, international reserves and the rice sector which benefits from special prices.

4. Manufacturing output grew by 2.4 percent, much slower than the 6.8% realised in 2011. Investment in this sector is affected by the high cost of power and manufacturers will no doubt be looking forward to completion of the Amaila Falls project.

5. Population Growth is reported at 1.5% compared with an average of 0.3% in the preceding four years (Appendix B – 4.2).

6. A surprise GDP indicator is the 11% decline in the construction sector. This is immensely counter-intuitive and the Minister’s explanation that it was due to a slower than anticipated start up in public sector construction projects is not convincing. Chinese investors and contractors are increasingly involved in every sector and the danger is that they are part of the under-reported economy. This seems evident from import data, NIS statistics and possibly income tax as well. Tax revenues do not reflect the reported performance let alone the unreported performance.