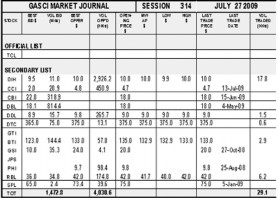

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 314’s trading results showed consideration of $1,078,715 from 29,107 shares traded in 14 transactions as compared to session 313 which showed consideration of $2,044,306 from 64,543 shares traded in 8 transactions. The stocks active during this week’s session were DIH, DDL, DTC, BTI and RBL.

Banks DIH Limited’s (DIH) five trades totalling 17,848 shares represented 61.32% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $10.0, which showed no change from its previous close. DIH’s trades contributed 16.49% ($177,841) of the total consideration. DIH’s first trade of 1,000 shares was at $10.0, its second and third trades totalling 6,386 shares were at $9.9, while its fourth and fifth trades totalling 10,462 shares were at $10.0.

Banks DIH Limited’s (DIH) five trades totalling 17,848 shares represented 61.32% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $10.0, which showed no change from its previous close. DIH’s trades contributed 16.49% ($177,841) of the total consideration. DIH’s first trade of 1,000 shares was at $10.0, its second and third trades totalling 6,386 shares were at $9.9, while its fourth and fifth trades totalling 10,462 shares were at $10.0.

Demerara Distillers Limited’s (DDL) single trade of 1,500 shares at $9.0 represented 5.15% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $9.0, which showed no change from its previous close. DDL’s trade contributed 1.25% ($13,500) of the total consideration.

Demerara Tobacco Company Limited’s (DTC) two trades totalling 644 shares represented 2.21% of the total shares traded. DTC’s shares were traded at a Mean Weighted Average Price (MWAP) of $375.0, which showed no change from its previous close. DTC’s trades contributed 22.39% ($241,500) of the total consideration. Both of DTC’s trades were at $375.0.

Guyana Bank for Trade and Industry Limited’s (BTI) three trades totalling 2,915 shares represented 10.02% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $132.9, which showed a decrease of $2.1 from its previous close of $135.0. BTI’s trades contributed 35.92% ($387,474) of the total consideration. BTI’s first two trades totalling 2,215 shares were at $132.9, while its third trade of 700 shares was at $133.0.

Republic Bank (Guyana) Limited’s (RBL) three trades totalling 6,200 shares represented 21.30% of the total shares traded. RBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $41.7, which showed a decrease of $0.3 from its previous close of $42.0. RBL’s trades contributed 23.95% ($258,400) of the total consideration. RBL’s first trade of 1,000 shares was at $40.0, while its second and third trades totalling 5,200 shares were at $42.0.

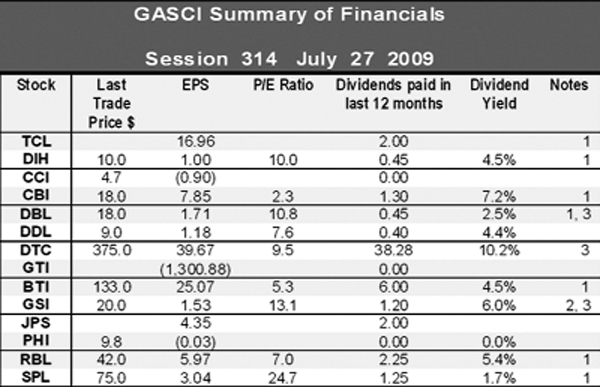

1 – Interim results

2 – Prospective

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2002 – Final results for PHI.

2005 – Final results for GTI.

2008 – Final results for CCI, DDL, DTC, GSI and JPS.

2009 – Interim results for TCL, DIH, CBI, DBL, BTI, RBL and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price Earnings Ratio = Last trade price / EPS

Dividend yield = dividends paid in the last 12 months/last trade price.