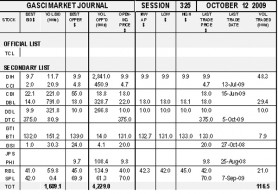

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 325’s trading results showed consideration of $3,038,470 from 116,522 shares traded in 20 transactions as compared to session 324 which showed consideration of $1,054,254 from 31,163 shares traded in 15 transactions. The stocks active during this week’s session were DIH, DBL, DDL, BTI and RBL.

Banks DIH Limited’s (DIH) six trades totalling 48,281 shares represented 41.44% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $9.9, which showed no change from its previous close. DIH’s trades contributed 15.73% ($477,982) of the total consideration. All of DIH’s trades were at $9.9.

Banks DIH Limited’s (DIH) six trades totalling 48,281 shares represented 41.44% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $9.9, which showed no change from its previous close. DIH’s trades contributed 15.73% ($477,982) of the total consideration. All of DIH’s trades were at $9.9.

Demerara Bank Limited’s (DBL) five trades totalling 29,391 shares represented 25.22% of the total shares traded. DBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $18.0, which showed a decrease of $4.0 from its previous close of $22.0. DBL’s trades contributed 17.46% ($530,438) of the total consideration. DBL’s first trade of 14,000 shares was at $18.1, while its other four trades totalling 15,391 shares were at $18.0.

Demerara Distillers Limited’s (DDL) single trade of 10,000 shares at $10.0 represented 8.58% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $10.0, which showed no change from its previous close. DDL’s trade contributed 3.29% ($100,000) of the total consideration.

Guyana Bank for Trade and Industry Limited’s (BTI) two trades totalling 7,850 shares represented 6.74% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $132.7, which showed an increase of $1.7 from its previous close of $131.0. BTI’s trades contributed 34.30% ($1,042,050) of the total consideration. BTI’s first trade of 1,000 shares was at $131.0, while its second trade of 6,850 shares was at $133.0.

Republic Bank (Guyana) Limited’s (RBL) six trades totalling 21,000 shares represented 18.02% of the total shares traded. RBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $42.3, which showed an increase of $2.3 from its previous close of $40.0. RBL’s trades contributed 29.22% ($888,000) of the total consideration. RBL’s first trade of 2,000 shares was at $45.0, while its other trades totalling 19,000 shares were at $42.0.

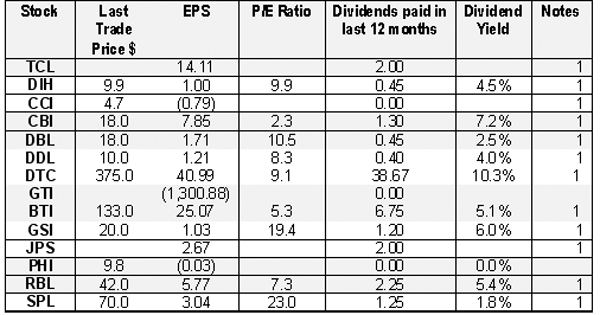

1 – Interim results

2 – Prospective

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2002 – Final results for PHI.

2005 – Final results for GTI.

2009 – Interim results for TCL, DIH, CCI, CBI, DBL, DDL, DTC, BTI, GSI, JPS, RBL and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price Earnings Ratio = Last trade price / EPS

Dividend yield = dividends paid in the last 12 months/last trade price.