Introduction

![]() If everything goes according to plan and the new Kingston Power Plant finally comes into operation within the next week or two, Guyanese can expect a reduction in the spate of blackouts that for the better part of 2009 have been plaguing the business sector, torturing households, arousing tempers and making any planning almost impossible. So bad and widespread has the situation become that it is non-discriminatory in its impact – affecting with equal effect rural and urban Guyana alike; children at school and housewives at home; commerce and industry, successful and loss-making. The financial statements inform us that the company has spent some $3.1 billion in capital expenditure for 2008, obviously with more to come in 2009, though the level of capital commitments has not been disclosed. Whatever the technical (de)/merits of these massive sums, all borne in the final analysis by the long-suffering, impoverished consumers, any kind of relief will surely be welcome, not least so that Guyanese can have a lit, if not bright Christmas. This will indeed be good news even as the Guyana Power and Light Inc. (GPL) continues to haemorrhage money for the state and the taxpayers of this country.

If everything goes according to plan and the new Kingston Power Plant finally comes into operation within the next week or two, Guyanese can expect a reduction in the spate of blackouts that for the better part of 2009 have been plaguing the business sector, torturing households, arousing tempers and making any planning almost impossible. So bad and widespread has the situation become that it is non-discriminatory in its impact – affecting with equal effect rural and urban Guyana alike; children at school and housewives at home; commerce and industry, successful and loss-making. The financial statements inform us that the company has spent some $3.1 billion in capital expenditure for 2008, obviously with more to come in 2009, though the level of capital commitments has not been disclosed. Whatever the technical (de)/merits of these massive sums, all borne in the final analysis by the long-suffering, impoverished consumers, any kind of relief will surely be welcome, not least so that Guyanese can have a lit, if not bright Christmas. This will indeed be good news even as the Guyana Power and Light Inc. (GPL) continues to haemorrhage money for the state and the taxpayers of this country.

According to GPL’s financial statements for the year ended December 31, 2008 posted on its website, the company racked up losses before tax in 2008 of $2.9 billion, a 23% increase over 2007 and close to double the corresponding loss two years earlier. What makes this loss even more significant is that over the same period the company has shed hundreds of employees even as a handful of senior staff are paid several millions of dollars each. The financial statements show the Government advancing to the company, cumulatively, more than $7 billion, much of it interest-free, whether authorised by the National Assembly or not being another matter. It is obviously hard to understand what drives this financial irrationality and one must wonder whether the Government is satisfied with the results following changes at the top of the company.

Haemorrhage

The past few years have seen a number of changes in the company including the replacement of former Chairman Chartered Accountant Ronald Alli with privatisation czar Mr. Winston Brassington, the appointment to the Board of PPP member Desmond Mohammed and Mr. Rajendra Singh, recently appointed Deputy CEO of Guysuco. Sitting on the GPL Board as well is Mr. Carvil Duncan of FITUG, who does not seem uncomfortable at the loss of hundreds of jobs under his watch. The shedding of jobs has taken place over the token, tepid opposition from Mr. Kenneth Joseph, President of the government-friendly National Association of Agricultural, Commercial and Industrial Employees (NAACIE) to an earlier proposal to lay off 250 workers. Mr. Joseph may not have noticed but that number has been exceeded by more than 25%! It is hardly reassuring to the members of NAACIE that in the two entities in which the Union has historically been most effective – sugar and electricity – workers have seen their numbers shrink and influence reduced.

But it is not only money that the company has been losing. It is losing approximately one out of every three units of electricity it generates under the rubric of Technical and Commercial Losses, losses which have to be borne by consumers. In the past couple of years, it has also lost key management personnel including former Chief Executive Officer Rabindranath Singh, Deputy CEO Martica Thomas, Commercial Services Director Kesh Nandlall, Legal Officer Neil Bollers, and Human Resources Director Donna Tucker. Such a situation makes for depressing reading by consumers who in both absolute and relative terms pay some of the highest rates and receive some of the poorest service for electricity in the region.

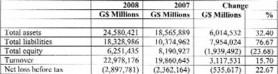

Source: GPL’s Audited Financial Statements Report 2008.

But back to the finances

Total assets of the corporation increased in 2008 by $6 billion or 32%, even as inventory declined from $2.1 billion to $1.6 billion or approximately 25%. The largest drop in this asset group was in the value of fuel stock but disturbingly, the value of spares declined by 25%. Normally, as the value of plant and equipment increases, the spares to support them should increase as well, but this did not happen. Another major item in assets was what the accounts refer to as Deferred Tax Assets of $2 billion, of which a large proportion is in respect of the tax value of losses carried forward. It is open to speculation whether consumers are as optimistic as the company’s management and its auditors about the prospects of these losses being reversed any time soon and these tax losses realizing any value to the company.

Some 27% of the total assets of the company are financed by capital contributions from the Inter-American Development Bank, the Government of Guyana and private customers. GPL is one of the few service providers which can insist that its customers pay for the infrastructure to supply them which the supplier then owns, to share with other consumers as it chooses. Now it is telling those customers that they must prepay for their electricity consumption as well!

The gross amount of receivables from customers is $8.2 billion against which there is a whopping $5.2 billion Provision for Bad Debts or 64%. In other words, for every three dollars owed by customers, the company is confident of receiving only one dollar. Yet, only a couple of weeks ago, the company was boasting in one of its PR moments that the company has achieved a 100% rate of collection. That too makes little sense.

Who are the auditors?

The website financial statements bear an audit report signed by the Auditor General suggesting that he has audited the company’s financial statements. In fact the statements were audited by PKF, Barcellos, Narine & Co. to whom the audit was subcontracted. This is no simple legal technicality of principal and agent and it is entirely incorrect and highly misleading for the Audit Office to make such a misrepresentation. These statements are circulated to a wide group of users who may rely on them for a number of purposes. Unvarnished truth is therefore necessary.

Subject to that, the public would have better been able to understand the numbers if the directors act properly and post on the web the Annual Report as well. That report is ready but responding to my request for a copy, a senior member of the company told me that the report which was presented to the company’s annual general meeting some weeks ago could not be released until it has been authorised by Cabinet! Yet, only recently the company hosted media personnel over dinner and announced the appointment of Mr. Ron Robinson as its public relations consultant. The press persons should have asked about that Report and Mr. Robinson’s first piece of advice to the directors is that the best PR for any service provider is good service, transparency and accountability and that the annual report is a major PR tool. It has taken letters and several calls to the Chairman for me to have a rotting pole at my residence replaced. After about one year a new pole was planted but the old pole is still there, leaning precariously, while my calls to the GM find him always at meetings.

Prepaid meters

Another development announced by the company is the prepaid meter which would require the consumer to pay in advance for the electricity supply s/he receives. This I understand has received support from some quarters of the consumer movement and at least one prominent businessman.

I discussed the matter of prepaid meters with the relevant persons and I believe that they now realise that they may have too readily accepted the company’s arguments about the virtues of the proposed arrangement. One issue that arose during our conversation was whether the proposed arrangement falls within the Standard Terms and Conditions for Electric Service and that any amendments will have to be approved by the Public Utilities Commission.

GPL has touted its proposed move as benefiting customers since the “prepaid metering system … will allow them to manage their consumption of electricity” and that “through the new system consumers will become more knowledgeable about their electricity use and a significant reduction in demand is expected.” If the company truly believes that there will be a significant reduction in demand, one must wonder why the company is bothering to expand its capacity. I was told that the company has told a consumer representative that the system will remove the opportunity for theft! Worse, the person actually believed. The truth is that the company sees its proposed move as helping it to resolve one of its perennial problems – the collection of receivables. If every consumer is required to have prepaid meters, amounting in effect to paying for their supply in advance, the company will collect some $2 billion upfront, interest free, helping it with its cash flow problem.

The company has preferred not to engage the public in any meaningful discussion on the use of such meters but if it had it would no doubt have sought some guidance from South Africa, New Zealand, India, Philippines and Singapore where such a system has been introduced. In South Africa a number of unanticipated problems surfaced and there is universal agreement that the system often militates against the poor, just like VAT does. It is unthinking to assume that electricity can work on identical principles as cell phones and the PUC needs to consider very carefully the conditions under which it will approve any amendments to the regime under which electricity is supplied and paid for.

State of the Art v Common Sense

The company has also announced that it is implementing a US$2.8M automated Customer Information System (CIS) which it claims will boost the accuracy of the cash receipting process, improve customer service by giving prompt responses to billing requests and allow new payments to be immediately credited to a customer’s account. Not only is this an extra-ordinary amount of money for such ordinary benefits but it seems untimely that this is being done when the company is moving to prepaid meters which will reduce the need for as many accounts.

Throwing its own money, or that of its customers or shareholder, behind problems is certainly not the way a modern, large public enterprise should be run. The company is indeed a complex operation but any attempt to solve its myriad problems will first require an examination of its business model. Is it planning sufficiently long in advance and is it taking account of potential developments such as hydro in a couple of years as the President has promised?

I recall my thought in reaction to the announcement about the new software constituting a state of the art billing system. I could not help thinking that what the company needed was nothing state of the art, but simple courtesy and common sense management that does not leave a rotting pole for more than one year or allow losses to keep mounting, year after year.