The table on page 24 presents a summary of the Government’s projected Financial Plan for 2010.

The 2010 Plan projects a surplus on the current account of $10.5Bn, but an overall deficit of $0.5Bn.

The main elements of the 2010 Plan are:

Total current revenues are projected to increase by $3.3Bn to $98.2Bn or by 3.5%. The Guyana Revenue Authority is expected to bring in revenues of $94.1Bn or 95.8% of current revenue, an increase by $5.0Bn, or 5.6% over 2009.

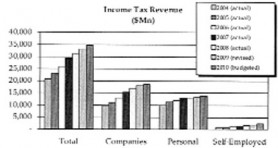

Of the GRA’s collections, the Internal Revenue is expected to bring in $38.6Bn compared with $36.7Bn in 2009, an increase of 5.1% or $1.9Bn while Value-Added and Excise Taxes are expected to earn $47.2Bn compared to $44.7Bn in 2009, an increase of 5.6%. Collections by the Customs and Trade Administration are anticipated to be $8.3Bn, an increase of $0.6Bn or 8.1% from 2009.

Of the GRA’s collections, the Internal Revenue is expected to bring in $38.6Bn compared with $36.7Bn in 2009, an increase of 5.1% or $1.9Bn while Value-Added and Excise Taxes are expected to earn $47.2Bn compared to $44.7Bn in 2009, an increase of 5.6%. Collections by the Customs and Trade Administration are anticipated to be $8.3Bn, an increase of $0.6Bn or 8.1% from 2009.

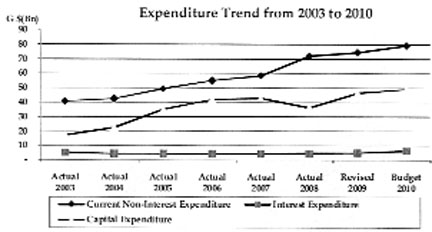

Total Current non-interest expenditure is projected to increase by $5.4Bn from $73.9Bn to $79.3Bn for 2010. Personal emoluments of $28.2Bn represent an increase of 7.6% or $2.0Bn over the revised figures for 2009.

Capital revenue and grants are projected to decrease by $0.7Bn to $16.0Bn for 2010 from $16.7Bn in 2009. HIPC and MDRI funds are projected at $2.0Bn or $0.4Bn more than 2009 of $1.6Bn, while Project and Programme funds will have a decrease of $1.3Bn.

Capital revenue and grants are projected to decrease by $0.7Bn to $16.0Bn for 2010 from $16.7Bn in 2009. HIPC and MDRI funds are projected at $2.0Bn or $0.4Bn more than 2009 of $1.6Bn, while Project and Programme funds will have a decrease of $1.3Bn.

Capital expenditure of $49.0Bn represents an increase of $2.0Bn or 4.2% over 2009 of $47.0Bn.

For a further analysis of current and capital expenditures, please refer to page 25 – ‘Who Gets What’.

Interest expenditure is projected to increase by 31.3% or $1.5Bn from $4.9Bn in 2009 to $6.4Bn in 2010, with domestic interest showing an increase of $0.5Bn while interest on external debt is projected to increase by $1.0Bn.

The principal element of debt repayments is projected at $8.1Bn (2009 – $2.6Bn), made up of domestic debt repayments of a projected $5.0Bn (2009- $1.0Bn), while external debt repayments are projected to double to $3.1Bn from $1.5Bn in 2009. During 2010, domestic and external debt service as a percentage of current revenue is projected at 14.8% compared with a revised for 2009 of 7.9%.

There is an overall deficit of $28.6Bn which will be financed by external borrowings.

Ram & McRae’s Comments

1. Total revenue appearing in the Government of Guyana Financial Operations (Accounting Classification) is $98.2Bn compared to $104.3Bn in the overall estimates, a difference of $ 6.1Bn. We presume these are the funds expected to be received from Norway.

2. Collections of value-added and excise taxes were 20.4% higher than in 2008, and are budgeted to increase a further 7.1% points in 2010 over the 2008 levels. These taxes now account for 50.15% of total tax revenue. Excise taxes increased by $8.3Bn while VAT collections decreased by $0.8Bn. The Minister attributed increased collection of excise taxes on motor vehicles of $1.5Bn to higher levels of imports, returns from the computerisation of the registration process, and increased surveillance activities. He also noted an increase in excise taxes on fuel of $6.5Bn as a result of the restoration of the tax (which were increased in October and December of 2008 and subsequently lowered in June of 2009).

Strangely, no explanation was given for the decrease in the level of value-added taxes collected despite reported growth in most sectors, in imports and in the economy as a whole. Despite high incidence of acknowledged evasion, high tax collections reduce the incentive to go after non-compliance.

3. As Budget Focus has reported on in previous years, the disparity between the taxes paid by the employed and self-employed continues. Employed persons have little control over the taxes deducted under the PAYE system, and once again, there is a lack of enforcement against the self-employed. The Self-employed dominate the reported growth sectors but pay minimal taxes. Indeed, encouraged by the tax system, companies are now de-incorporating so tax revenues from the self-employed should be significantly higher. With PAYE accounting for 14.7% of tax revenues, the tax system is now heavily directed against the employed and the consumers.

4. Expenditure continues to trend upwards with no proposed curtailments while the proposed deficit is the highest for this decade.