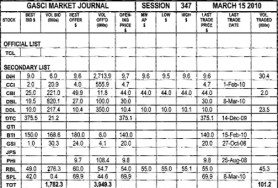

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 347’s trading results showed consideration of $3,109,381 from 101,222 shares traded in 13 transactions as compared to session 346 which showed consideration of $1,505,367 from 78,450 shares traded in 8 transactions.

The stocks active during this week’s session were DIH, CBI, DDL and RBL.

The stocks active during this week’s session were DIH, CBI, DDL and RBL.

Banks DIH Limited’s (DIH) four trades totalling 30,385 shares represented 30.02% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $9.6, which showed a decrease of $0.1 from its previous close of $9.7. DIH’s trades contributed 9.37% ($291,496) of the total consideration. DIH’s first trade of 2,000 shares was at $9.5, while its second, third and fourth trades totalling 28,385 shares were at $9.6.

Citizens Bank Guyana Incorporated’s (CBI) single trade of 2,000 shares at $ 44.0 represented 1.98% of the total shares traded. CBI’s shares were traded at a Mean Weighted Average Price (MWAP) of $44.0, which showed no change from its previous close. CBI’s trade contributed 2.83% ($88,000) of the total consideration.

Demerara Distillers Limited’s (DDL) two trades totalling 23,497 shares represented 23.21% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $10.0, which showed a decrease of $0.4 from its previous close of $10.4. DDL’s trades contributed 7.59% ($235,970) of the total consideration. DDL’s first trade of 10,000 shares was at $10.1, while its second trade of 13,497 shares was at $ 10.0.

Republic Bank (Guyana) Limited’s (RBL) six trades totalling 45,340 shares represented 44.79% of the total shares traded. RBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $55.0, which showed an increase of $1.0 from its previous close of $54.0. RBL’s trades contributed 80.21% ($2,493,915) of the total consideration. RBL’s first two trades totalling 2,150 shares were at $55.1, its remaining four trades totalling 43,190 shares were at $55.0.

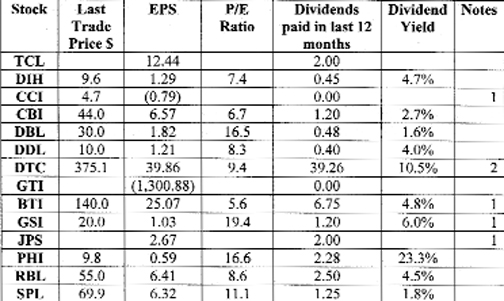

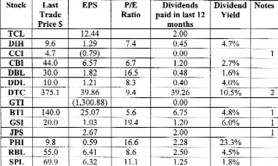

GASCI Summary of Financials Session 347 March 15, 2010

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

Notes

1 – Interim results

2 – Prospective

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2008 – Final results for PHI.

2009 – Interim results for CCI, DDL, BTI, GSI and JPS.

2009 – Final results for TCL, DIH, CBI, DBL, DTC, RBL and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.