The major economic powers of the world have completed their discussions on global issues their their G8 and G20 meetings in Canada over the past week. The G8 of course does not include either China or India, the two leading economic powers of what used to be called the ‘developing world.’ And it is unlikely that they would accept, as other developing countries have done, that they should be present only by invitation.

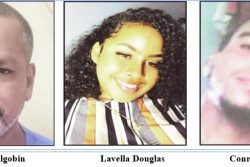

From a Caricom point of view, two such invitations came to Haiti and Jamaica, with the Canadian Prime Minister’s chief responsible public servant of the meeting being reported as indicating that Jamaica, along with Colombia and Haiti “would contribute to a discussion on ways to curb the global narcotics trade and criminal gangs.” There, Prime Minister Golding did make a strong plea for assistance with the fight against the drug trade and its related ills. And he also forcefully indicated that, in addition to the fact that many of these countries’ institutions are not up to the battle, it needed to be recognized that “rooting out crime is not just a law-enforcement exercise but must be seen as a major development issue.” The appearance of Mr Golding will have been important, at home and abroad, in his own and Jamaica’s resurrection from the destruction which has been caused by the Dudus affair.

Moving on to the G20, with the full participation of the emerging powers of BRICS, the leading Western powers found themselves already engulfed in a major issue relating to the relative balance to be maintained between a degree of austerity on the one hand, and a persistent stimulus to growth, on the other. The European Union states have seemed to favour austerity. In addition to recent tax-increasing and expenditure cutting budgets, these states, as indicated in the recent Budget exercises and statements by the German Chancellor and the new British Prime Minister, have insisted that this is the path for Western economies to follow at the present time. And they have been largely supported by the Canadian leadership.

But they have come up against an opposing view by the United States, with both President Obama and his Treasury Secretary insisting that while a certain temperance must be exercised presently with the aim of reducing budgetary deficits , the momentum gained by the fiscal stimulus measures implemented in the aftermath of the 2008-2009 recession must be sustained by a continuing stimulus, so that investors can be assured of sufficient financial resources, and an effort can be made to ensure that there is not only an end to current unemployment trends, but a resumption of sufficient growth to ensure a return to an increase in employment. This is a debate being conducted at both policy and academic levels in the OECD countries, the protagonists of continuing stimulus arguing that the avoidance of a relapse into recession and then depression, as occurred during the last Great Depression, should now the main objective to be pursued. With President Obama they insist that once an appropriate regulatory system is put in place to ensure that the excesses of the commercial banks and so-called non-bank financial institutions do not recur, and once governments do enough to persuade the financial markets that budgetary control measures are being sustained, then it is stimulus measures which must be given priority at this time.

The G20, functioning with its G8 expanded membership, and now proudly recognizing itself in its Toronto Declaration as “the premier forum for our international economic cooperation,” has had to cope with the arguments of the two contending positions. They have, in effect, concluded that they must wait and see what the emphasis on fiscal restraint brings, while ensuring that budgetary measures do not induce any resort to trade protectionism, and retaining their commitment to economic growth. Prime Minister Harper’s statement at the conclusion of the summit that the agreements reached are “important down payments” on a framework for “strong, sustainable and balanced growth” would appear to indicate the major economic powers concluding with a compromise sentiment.

From a Caricom point of view, and particularly from that of countries with economies led by tourism, the prospect of the major European economies, including Britain, being on a course of minimal growth and probably continuing unemployment over the next few years, is not encouraging news. When this is added to the decision of the British Chancellor of the Exchequer to continue the airline passenger tax for the time being, pending review, the situation would seem even gloomier. Larger emerging powers, particularly those which are major exporters of raw materials intended to supply industrial production in the major economies are likely to be concerned with the immediate future as well. Further, for developing countries in general, hopes will not be raised by reports that of the G8 US$50billion promised at the G8’s 2005 summit, only $5b has been pledged this year.

So in general it would appear that the developing world as a whole has been placed in a wait and see position by the recent G20 decisions. The emerging powers will wait to see if the Chinese commitment to some appreciation of its currency will be sufficient to provide an added stimulus to American exports to that country and so aid in a return to increasing economic activity and employment in the US. But the Chinese insist that they will not be pushed, involved as they have been more or less since the start of the current recession, in focusing on maintaining exports while undertaking a domestic stimulus to enhance the purchasing power of their own population, and thus a relative lessening dependence on exports to the industrialized economies.

Caricom states (none of whom have as yet reached the stage of being invited to a G20 meeting either as separate states or, like the Europeans, through both their separate entities and the European Union Commission), will have been reassured by the summit’s Declaration welcoming the launching of the Haiti Reconstruction Fund and the full cancellation of the country’s debt to the International Financial Institutions.

But we are left to see whether the G20’s playing for time at this summit will be rewarded by the success of the austerity policies being pursued by so many of the major players. Those presently in favour of greater fiscal stimulus of the European economies must be hoping that between now and the next meeting in November, a consensus nearer to their own view will have emerged. But in that context, it is unfortunate that, constrained at home by a conservative and resistant Congress which he seems to have to spend much of his time struggling against, President Obama has not found himself in a position to be too forceful abroad against those committed to austerity.