Normalcy

Two decades after the passage of the Dealers in Foreign Currency (Licensing) Act, it is reasonable to inquire of the state of foreign currency trading in Guyana, given the dysfunctional condition of the market before the Act was passed. For sure, foreign currency trading has come a long way in Guyana from the days of backstreet and hide-and-seek sales and purchases to where the government is no longer the central player in the market and private operators now jockey openly for business. The normalcy of foreign currency trading today in Guyana makes talking of those bygone days of personal risk taking to acquire or sell foreign currency on the black market seem like “Anansi” stories fit for bedtime amusement. The change that transformed the market for foreign currency trading came in the form of the aforementioned legislation that the Guyana Parliament passed in 1989 under the government of the late President Desmond Hoyte.

That legislation created the opportunity for individuals and private companies that were not commercial banks to sell and purchase foreign currency without fear of retribution by the government. The law requires participants in the foreign currency market to register their business and obtain a licence to operate it. When the law first came into effect, the Minister of Finance had the power to grant licences to trade in foreign currency. However, that responsibility now resides with the Bank of Guyana. The principal purpose of the law was to eliminate the black market and increase the safety and efficiency with which foreign currency was bought and sold. As a consequence, the money traders or cambios were born.

That legislation created the opportunity for individuals and private companies that were not commercial banks to sell and purchase foreign currency without fear of retribution by the government. The law requires participants in the foreign currency market to register their business and obtain a licence to operate it. When the law first came into effect, the Minister of Finance had the power to grant licences to trade in foreign currency. However, that responsibility now resides with the Bank of Guyana. The principal purpose of the law was to eliminate the black market and increase the safety and efficiency with which foreign currency was bought and sold. As a consequence, the money traders or cambios were born.

Geographic Spread

By virtue of the nature of the black market, it was difficult to determine the actual number of money changers participating in the trade and to know exactly who they were. That changed with the establishment of cambios. Figures from the available 1996 Annual Report of the Bank of Guyana reveal that the structure of the foreign currency market in Guyana has undergone significant change since the law permitting the opening of cambios was passed. There were 29 licensed cambios in 1996. Nine of the cambios were run by financial institutions of which seven were commercial banks and two were Trust companies. The other 20 cambios were operated by non-bank entities. The geographic spread of the cambios was very limited. All but one of the cambios conducted business in Georgetown. The single cambio that represented 3 percent of operators was located in Rose Hall on the Corentyne.

Change

By 2000, the foreign currency market had demonstrated noticeable change. The number of registered cambios had declined from 29 to 25. Six non-bank cambios ceased operations while two new ones came on board. One of the new cambios was established in Georgetown while the other was set up in Linden, and became the only entity outside of Georgetown since the one at Rose Hall discontinued operations.

Advantage

Between 2000 and 2009, there has been further realignment of the market in foreign currency with the change in the market structure being more pronounced. Much of the change is induced by the corporate and business strategies of commercial banks with the use of their branch network. Even though Guyana had 21 registered cambios by the end of 2009, there were 46 locations in which cambios operations were taking place. The majority of registered Cambios, 15, are non-bank operations. The remaining cambios are operated by the six banks in Guyana. With the six banks having branches in different parts of Guyana, there is an additional 31 cambios located across Demerara, Essequibo and Berbice. The county of Demerara accounts for the vast majority, 67 percent, of the dealers in foreign exchange. With Georgetown being the centre of business and administration, it accommodates 56 percent of the foreign currency dealers and 83 percent of those operating in Demerara. Three of the eight in Berbice can be found in Corriverton, while the Corentyne and New Amsterdam each has two. Rosignol located on the West Bank of the Berbice River hosts one cambio. Three of the foreign exchange markets located in the county of Essequibo operate in Parika, two in Anna Regina and one each in Bartica and Lethem. The use of branch networks gives the commercial banks an advantage in the foreign currency business. They are able to operate much closer to more customers than the single branch non-bank cambios.

Firm Grip

The volume of business performed by the cambios also has grown over time and is also dominated by commercial banks. In 1996, cambios conducted an estimated US$976.1 million in business. That was equivalent to US3.7 million per day changing hands. At that time, none of the commercial banks had cambios outside of Georgetown and only one non-bank operator was conducting business beyond the limits of the capital. With the competition concentrated in Georgetown, the cambios of the commercial banks accounted for 85 percent of the transactions and there was a feeling that the non-bank cambios would challenge the commercial banks for supremacy of the foreign exchange market. That fear never materialized and by 2001, even though cambio transactions had fallen under US$900 million, the commercial banks had maintained a firm grip on the market.

By 2009, cambio transactions had reached over US$2 billion and the cambios of commercial banks had increased their market share to 90 percent or an estimated US$8 million per day. For their part, the non-bank cambios conducted US$94 million in business in 2001. With such a small market share, non-bank cambios remain marginal players in the foreign exchange market. Even though the volume of business was up by 2009, the business transacted by non-bank cambios remained small relative to the cambios of the commercial bank. Daily business averaged US$951,000 for the group and US$63,000 for individual non-bank cambios.

Contribution

The cambio businesses play an important part in the market for foreign currency. The importance of cambios is not only in giving safe and orderly access to foreign currency. They help stabilize the exchange rate by removing the hidden hand of the “black market”. The importance of cambios in Guyana is larger than might be well known. Cambios were designated the principal merchants of foreign currency transactions in 1997. This meant that persons or businesses seeking foreign currency to settle international trade transactions or to meet travel needs had to obtain foreign currency from the cambios. Even the Bank of Guyana was told that it had to satisfy its own foreign currency needs through the cambios.

Unlikely

The cambios have come a long way and are very legitimate contributors to the Guyana economy. The dominant role in the money trade is performed by the commercial banks and it is unlikely that the non-bank cambios would surpass the commercial banks as the leading providers of foreign currency. These money changers will continue to play a role in helping to keep the Guyana economy afloat. Given the dominance of commercial banks, Guyanese should not be surprised to see more non-bank cambios fold, unless the tourism industry takes off.

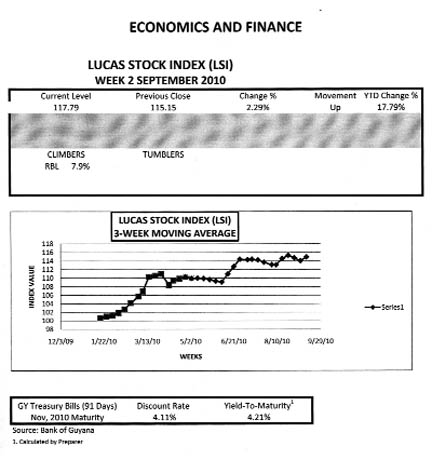

LUCAS STOCK INDEX

In week two of September 2010, the Lucas Stock Index gained an additional 2.29 percent to bring the index to 117.79. No stocks lost value this week, however, only the stocks of Republic Bank (RBL) recorded an increase in value during trading. This increase helped the index to record a gain for the week. The positive movement in the index pushed the yield above four times that of the risk-free Treasuries with maturity in November 2010.