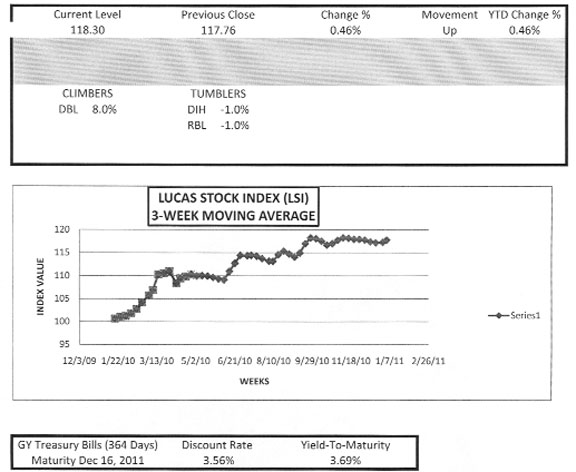

As Guyanese lethargically recovered from the exhausting Christmas and New Year celebrations, so did the trading wheels of the Guyana Stock Exchange (GSE). The GSE made a slow start to the new trading year despite the notable rise in the stock price of Demerara Bank Limited (DBL) on the opening day of trading for the New Year. Only four of the stocks on the exchange participated in the first trading session for 2011. These were Banks DIH, Demerara Bank Limited (DBL), Republic Bank Limited (RBL) and Sterling Products Limited (SPL). The performance among the four participating stocks was mixed with two of them, DIH and RBL, losing one per cent each of their value. The stock price of Sterling Products remained stable with no change in value. This is the second time that the stocks of DBL have come out of the gates flying between the old and new years. Even though significant, the increase on this occasion is far less than the increase posted by the stocks of the same company two years ago. At the start of the trading session in 2009, the stocks of DBL soared by 38 per cent to settle within G$5 of its normal price range.

The performance of the four stocks which are part of the Lucas Stock Exchange (LSI) enabled the index to continue its upward trend for three straight weeks. On the last trading day of 2010, the LSI ended with a slight gain of 0.43 per cent over trades from the previous week in December to conclude the year at 117.76. Trading for the last week of 2010 which occurred on December 29 involved the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC). DIH and DDL recorded no change in their stock price while the stocks of DBL and DTC had contrasting performances. The stock price of DBL rose nearly 6 per cent while that of DTC fell by about 2 per cent. This week the LSI added another half of one per cent to its value amidst the continually light trading on the GSE. The total market capitalization of the stocks in the LSI at the end of the 2010 trading period was G$66.9 billion. The slight gain for the first week of the year puts the market capitalization at G$67 billion.

The performance of the four stocks which are part of the Lucas Stock Exchange (LSI) enabled the index to continue its upward trend for three straight weeks. On the last trading day of 2010, the LSI ended with a slight gain of 0.43 per cent over trades from the previous week in December to conclude the year at 117.76. Trading for the last week of 2010 which occurred on December 29 involved the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC). DIH and DDL recorded no change in their stock price while the stocks of DBL and DTC had contrasting performances. The stock price of DBL rose nearly 6 per cent while that of DTC fell by about 2 per cent. This week the LSI added another half of one per cent to its value amidst the continually light trading on the GSE. The total market capitalization of the stocks in the LSI at the end of the 2010 trading period was G$66.9 billion. The slight gain for the first week of the year puts the market capitalization at G$67 billion.

The stocks on the GSE have shown periodic bursts of energy that confound analysis. For example, the stocks of DIH jumped 13 per cent between its last trade in 2004 and the first trade in 2005. Demerara Tobacco Company also recorded a significant change in stock price between the end of 2007 and the start of the 2008 trading period. Its stock rose nearly 15 per cent between the two trading periods. The stock price of Guyana Stockfeeds Incorporated (GSI) jumped 46 per cent between its last trade in 2007 and its first trade in 2008. Other stocks that showed substantial increases include that of RBL which jumped 67 per cent between its last trade in 2004 and its first trade in 2005. The largest change in price between trades was recorded by Guyana Bank for Trade and Industry (GBTI) in 2005 when the price of its stock climbed dramatically by 86 per cent within a four-week period.

So, the large increase in price shown by the stock of DBL is not exceptional.

However, the event does raise the question why did the DBL stock show such a rapid change in 2011 when all the other traded stocks did not? The question is worth pondering for two reasons. One, based on the price/earnings ratio (P/E) and the earnings per share (EPS) data shown in the Financials posted by the stock exchange, the DBL stock should be trading around the same price at which it closed out the old year. With an EPS of G$1.67 and P/E ratio of G$9.7, the stock should be valued at around G$18.43.

The other reason to consider the price change has to do with the supply and demand for the stock. The total volume of all outstanding orders to sell DBL shares exceeded the total volume of all outstanding orders to buy shares. In other words, the end of period supply balances exceeded the end of period demand balances by 141,000 for four straight weeks. The volume of outstanding orders to buy did not change and suggests that the bid price for that group of orders is much lower than the best bid price of G$17.50. In a case of market disequilibrium, the price of the stock should decline instead of rise. It is interesting to note that the new price came from the seller and not the buyer and that the seller was able to obtain the asking price. The stocks that are most active on the GSE appear to be more successful in obtaining the ask price. For example, DIH and DDL were able to obtain the ask price while the stocks of DTC and SPL could not.

But none of the foregoing explains the reason the seller asked for the price at which the stock was sold. There is no clear answer from the available data, but hopefully it is a sign of positive things to come in 2011.