2010 has turned out as a bumper year for some of Guyana’s leading businesses. With several public companies having a September 30 year end, the results are welcome for the shareholders of Banks DIH Limited and its banking subsidiary Citizens Bank Guyana Limited, the DDL associated banking business Demerara Bank Limited and Republic Bank Guyana Limited.

Republic Bank, a subsidiary of the Trinidad and Tobago giant of the same name, and always the first of Guyana’s public companies to hold its annual general meeting, reported to its members profit after tax of $1.982 billion for the year ended September 30, 2010. This 8.8 % increase over 2009 turned out to be modest when compared with the results of some of the other businesses.

Citizens Bank had a whopping increase of 37% in net profit while the Demerara Bank Limited reported a more modest increase in net profit over 2009 of 4.2%. Banks DIH Limited, the beverage giant showed increases in before-and-after-tax profits of 21% over the corresponding period one year, inclusive of dividends from its banking subsidiary.

Citizens Bank had a whopping increase of 37% in net profit while the Demerara Bank Limited reported a more modest increase in net profit over 2009 of 4.2%. Banks DIH Limited, the beverage giant showed increases in before-and-after-tax profits of 21% over the corresponding period one year, inclusive of dividends from its banking subsidiary.

Contributing to these impressive results of the commercial banks is an 11.6% increase in credit to the private sector. Categorising the credits by economic activities, the September 30 report of the Bank of Guyana shows a 77.9 per cent increase to the mining sector, 36.5 per cent to agriculture, 22.1 per cent to manufacturing and 16.9 per cent to real estate (mortgage loans). Credit to the distribution and personal sectors reflected growth of 11.7 per cent and 4.1 per cent while the rice milling sector recorded a marginal growth of 0.3 per cent. Conversely, the other services sector reflected a decline of 8.9 per cent.

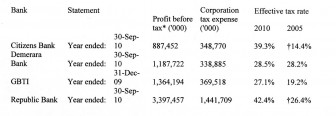

Taxes and corporate Guyana

It is interesting to see the effective tax rates paid by these businesses as the government continues to ignore tax reforms in which the private sector under its current leadership show little interest. For this purpose I include the other major domestic commercial bank – Guyana Bank for Trade and Industry whose year end is December 31 and for which the 2010 financial results will not be available for some time.

* adjusted for property taxes treated differently by certain banks

† adjusted for loss and minimum tax relief claimed

Source: Annual Reports of companies

Why the PSC is not taking any real interest in tax reform – an integral element in any developing economy – is really hard to understand, unless its priority is to avoid the public castigation one of its leaders received from Mr Jagdeo for daring to ask for a reduction in the corporate rates of taxes. As the table shows the effective tax rates have climbed quite significantly in some cases, with one bank almost up to the nominal rate of 45%. The Chairman of the PSC has said that tax reform has now been placed on the agenda of the National Competitiveness Council (NCC), of which he is the Vice-Chairman. This is an entity on which huge sums have been expended but it takes some effort to see if there have been any returns on those investments.

In fact even as the Chairman was disclosing to Stabroek Business the new responsibility on the NCC for tax reform, he was reported as giving no indication of the state of play regarding the tax reform discourses, alluding instead to what he said was a partnership between the government and the private sector to engage a consultant “to review the tax study that had been commissioned by government and to recommend appropriate changes to the country’s tax structure with the objective of formatting a new tax structure that would be friendlier to the business community and the average employee without compromising government’s tax collection.” This is quite a mouthful that really means very little.

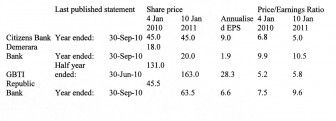

Share prices and the Stock Exchange

The annual reports have one other limitation running through them. None of them even mentions the movement in their company’s share prices as reported by the local Stock Exchange. Whether this is because they do not take the Stock Exchange seriously or do not consider share prices relevant to their members is a matter for speculation. This is clearly wrong since people buy shares not only for dividends but also for capital appreciation as reflected in the price for shares.

What is also interesting is how the ‘market’ seems to ignore the companies’ reported results. As the following table shows the increases in earnings are not reflected in the share prices, an indicator of an inefficient market which can be due to a range of factors including as an extreme but unlikely cause, market manipulation.

Share price analysis

The disappointment with our still fledgling Stock Exchange must be tempered by the fact that the regional exchanges are also facing difficult times with some companies choosing to de-list rather than face scrutiny and bear the cost of listing. There is no indication that the situation in Guyana will improve any time soon and the public’s lack of interest in the shares of Trinidad Cement Limited (TCL), the only regional company to list on our exchange will almost certainly discourage other regional companies for fear of repeating TCL’s experience. That would be unfortunate.