Dear Editor,

Minister of Human Services Ms Priya Manickchand behaved with apoplectic rage in response to a conclusion in a report by her parliamentary colleague Mrs Sheila Holder that the number of persons to whom the Old Age Pension (OAP) is paid is inflated by 17,640 (phantom persons, according to Mrs Holder) with a loss to the state of over $1.3 billion.

Ms Manickchand reacted badly too to a cartoon in the Stabroek News of January 27 depicting her unflatteringly, prompting a letter by her which appeared with another by Mr Ivelaw Henry, her Chief Statistical Officer, both on the same day in the Stabroek News (Saturday, Jan 29) challenging Mrs Holder’s numbers. They both cited in support of the numbers being challenged projections done in November 2006 by a Mr Sonkarley T Beaie, who is described as a UN demographics expert and the holder of an MPhil, perhaps with a view to impress us.

To understand the conflicting positions, it is convenient to address three separate but related issues – statistics, the legal framework for the payment of OAP, and the arrangements in place for the payment of Old Age Pensions.

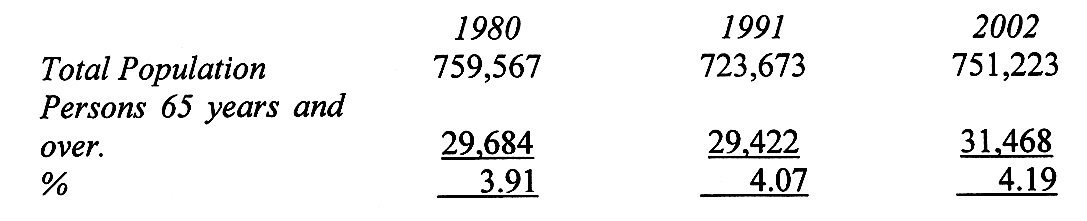

The most recent census done in 2002 shows the following data in relation to persons 65 years and over:

Between censuses, the country’s mid-year population is tracked by the Bureau of Statistics from data on births, deaths and migration, and is reported on in an appendix to the annual Budget Speech by the Minister of Finance. This is what the Bureau of Statistics reports for the years following the 2002 census: 2003 – 752,500; 2004 – 755,100; 2005 -757,600; 2006 – 760,200; 2007 – 763,200; 2008 – 766,200, 2009 – 769,600, 2010 – 777,900.

One must always be cautious about population data and even more careful about making assumptions from them. I therefore wonder why instead of taking the actual population figure Mr Henry and his Minister chose to rely on Mr Beaie’s increasingly incorrect projections which for total population in 2010 were “wrong” by 10,000. It is fair to say that any major change in the characteristics of a population – other than through migration, a plague or a baby boom – takes place very slowly. From 1980 to 1991 the shift in the over 65 age group was a 0.16 percentage point and from 1991 to 2002 it was a 0.12 percentage point as shown in the table above. Even if we generously assume that the percentage of that group as a percentage of the current population has climbed to 4.5%, the maximum number of persons eligible for OAP would be approximately 35,000, or 7,000 less than the “around 42,000” the Minister of Finance referred to on more than one occasion in his Budget Speech.

That is not the end of the story, since not every person 65 and over is entitled to OAP. The Old Age Pensions Act sets as the conditions for eligibility for OAP that the person must have: (a) attained the age of sixty-five years; (b) been a citizen for ten years; (c) been ordinarily resident in Guyana during the last twenty years; and (d) passed a means test based on income and assets. Therefore any returnee to Guyana before 1991 is not entitled to a pension because of condition (c) and many if not most of the senior citizens living in Courida Park, Queenstown, Pradoville, Oleander Gardens, Republic Park, former senior public servants, professionals including doctors and lawyers, etc, are not entitled under condition (d).

We all have and know of countless others of our friends and relatives and their parents who do not claim Old Age Pensions. These would include persons 65 and over in the population not entitled to on account of their income and/or assets, plus those who are entitled to but do not claim because they do not know they qualify, plus those not entitled because they returned to Guyana less than twenty years ago. Those probably number between 8,000 and 12,000. To get to the number who meet all the tests, we need to deduct these from the maximum, theoretical 35,000, leaving between 23,000 and 27,000 persons who are entitled. This means that there is a gap of between 15,000 and 19,000 who are paid, but who are not entitled to the pension under the law.

At the current rate of $7,500, between $1.4 billion and $1.7 billion is being paid out unlawfully each year.

A recent Value-For-Money audit done by the Audit Office identifies a host of accounting and audit issues that could have given rise to the wide gap.

While the Audit Office must be commended for undertaking the exercise, it is regrettable that it did not attempt to put in dollar terms the range of values involved in its findings, and that it did not look at the related public assistance programme that is subject to even fewer rules and is more politicised and corrupted.

Let us put the calculation into perspective. If Old Age Pensions were paid only to persons legally entitled, then each pensioner could easily receive another $4,000 to $6,000 per month out of the money allocated in the 2011 Budget.

Ms Manickchand should now be willing to make her list publicly available for scrutiny.

Yours faithfully,

Christopher Ram