For the month of April 2011, 95,951,057 shares valued at $33, 361,408, crossed the floors of the six stock exchanges across Caricom, with 63 stocks advancing, 23 declining and 35 remaining unchanged. Cable and Wireless Jamaica was the volume leader with 29,558, 757 shares being traded, Angostura Holdings posted the largest gain of 29.40% for the month, while on the losing end, Montego Freeport fell 20.40%.

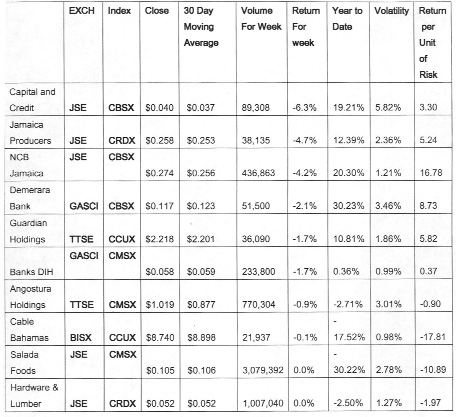

It was a week of light trading but solid gains, all of the broad market and sector indices were up for the weeks For the month, nineteen of the CSX 30 stocks advanced, eight declined and three were unchanged. The CSX 30 gained 47.7 points to close the month at 1,195.6, up 5.62% year to date. On the junior market, nine stocks advanced and one was unchanged. The CJSX advanced 64.0 points to close the week at 1,115.1, down 2.29% for the year. The CJSX was led by Lasco Manufacturing and Dolphin Cove which posted gains of 17.53% and 9.33% respectively. Table 1 provides a summary of the broad market indices for the week as well as some international reference points. Readers should note that on a risk adjusted basis the CSX 30 outperforms a number of international indices, highlighting the value of a well diversified regional portfolio.

Table 1: Broad Market Indices April 25 to April 29, 2011

Sector Analysis

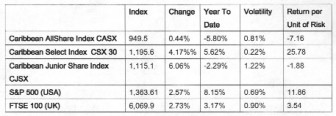

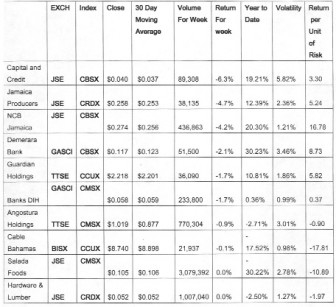

Table 2 provides a summary of the sector indices, followed by details on the performance of the stocks in each sector.

Table 2: Sector Indices April 25 to April 29, 2011

With the exception of the Communications and Utilities Index (CCUX) all the sector indices were in positive territory for the month, and , with the exception of the Tourism and Real Estate Index (CRTX) the sector indices are in positive territory for the year. The CIIX registered the largest gain for the month (6.96%) as ten Insurance and Investment sector stocks advanced, four declined and three were unchanged. The CIIX was boosted by solid gains in Jamaica Money Market Brokers (15.62%), Pulse Investments (15.46%), Guardian Holdings (12.08%), Sagicor Life Jamaica (11.34%), Scotia Investments (11.14%), National Enterprises (9.54%), Mayberry Investments (8.12%), Pan Caribbean Financial Services (6.85%), and First Jamaica Investments(2.72%). Famguard posted a loss of 9.00% and Doctors Health Services lost 3.57%. The CCSX posted the second largest gain for the month (5.38%), as seven conglomerate stocks advanced, one declined and two were unchanged. The CCSX was led by Jamaica Producers (11.98%), Pan Jamaican Investments (4.11%), Banks Holdings (3.90%), Grace Kennedy (3.73%) and Neal and Massey (2.78%). The CMSX was next with a 5.16% gain, as eighteen manufacturing stocks advanced, seven declined and six were unchanged. The CMSX was led by Angostura Holdings (29.40%), Desnoe & Geddes (23.38%), National Flour Mills (17.39%), Flavorite Foods (15.08%), Jamaica Broilers (7.09%), Berger Paints Jamaica (6.94%), Demerara Tobacco Company (4.85%), Unilever (2.43%) and West India Tobacco (2.00%). Caribbean Cement Company shares 6.40% for the month, Salada Food shares lost 4.93% and Kingston Wharves shares lost 4.70%. The CBSX posted a 2.21% gain as six banking stocks advanced, three declined and thirteen were unchanged. While Guyana Bank For Trade and Industry, Scotia Group Jamaica and Bank of Nevis posted gains of 12.27%, 7.04% and 4.35%, these were balanced by Capital and Credit Financial Group, National Commercial Bank of Jamaica and Demerara Bank Limited which registered losses of 6.25%, 4.18% and 2.08% respectively. The other sector indices were generally flat for the week.

Investing School (Value Stocks and Value Investing)

As we said last week, “Value investors” actively seek stocks of companies that they believe the market has undervalued. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond with the company’s long-term fundamentals. The result is an opportunity for value investors to profit by buying when the price is deflated.

Typically, value investors select stocks with lower-than-average price-to-book or price-to-earnings ratios and/or high dividend yields. A value stock is typically defined as a stock that tends to trade at a lower price relative to it’s fundamentals (i.e. dividends, earnings, sales, etc.) and thus considered undervalued by a value investor. Common characteristics of such stocks include a high dividend yield, low price-to-book ratio and/or low price-to-earnings ratio. The big challenge for value investors is to identify true value stocks. Two investors can be given the exact same information and place a different value on a company. For this reason, another central concept to value investing is that of “margin of safety”. This just means that you buy at a big enough discount to allow some room for error in your estimation of value.

Stocks On The Move

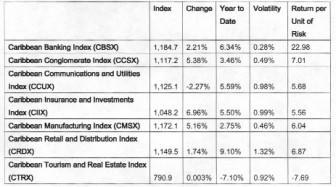

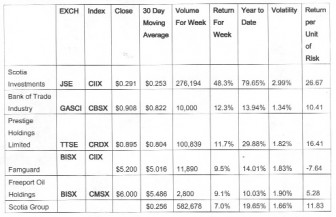

Tables three and four provide some widely used financial metrics on the biggest movers for the week. The ten biggest gainers and losers for the week are highlighted. Readers should note that prices are in US dollars.

Table 3: Advancing Stocks: April 25 to April 29 2011.

Table 4: Declining Stocks: April 25 to April 29 2011.

Department of Management Studies, UWI Cave Hill. Justin.Robinson@ uwi.cavehill.edu