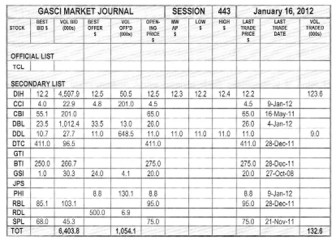

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 443’s trading results showed consideration of $1,614,180 from 132,600 shares traded in 8 transactions as compared to session 442 which showed consideration of $154,401 from 20,000 shares traded in 8 transactions. The stocks active this week were DIH and DDL .

Banks DIH Limited’s (DIH) six trades totalling 123,600 shares represented 93.21% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $12.3, which showed a decrease of $0.2 from its previous close of $12.5. DIH’s trades contributed 93.87% ($1,515,180) of the total consideration. DIH’s first four trades totalling 35,800 shares were at $12.4, its fifth trade of 1,000 shares was at $12.3, while its sixth trade of 86,800 shares was at $12.2.

Banks DIH Limited’s (DIH) six trades totalling 123,600 shares represented 93.21% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $12.3, which showed a decrease of $0.2 from its previous close of $12.5. DIH’s trades contributed 93.87% ($1,515,180) of the total consideration. DIH’s first four trades totalling 35,800 shares were at $12.4, its fifth trade of 1,000 shares was at $12.3, while its sixth trade of 86,800 shares was at $12.2.

Demerara Distillers Limited’s (DDL) two trades totalling 9,000 shares represented 6.79% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $11.0, which showed no change from its previous close. DDL’s trades contributed 6.13% ($99,000) of the total consideration. Both of DDL’s trades were at $11.0.

NOTES:

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

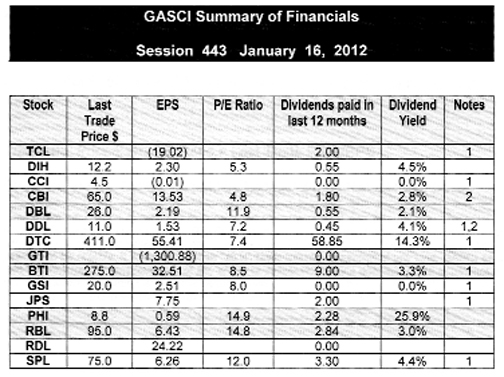

1 — Interim Results

2 — Prospective Dividends

3 — Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2008 – Final results for PHI.

2009 – Final results for RDL.

2011 – Interim results for TCL, CCI, DDL, DTC, BTI, GSI, JPS and SPL.

2011 – Final results for DIH, CBI, DBL and RBL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.

TERM OF THE WEEK

Asset/Liability Management: Active balance sheet management in order to maximize returns and minimize interest rate risk. Thus, a bank might use an interest rate swap to convert a fixed-rate loan (asset) to match the interest basis of its floating-rate deposits (liabilities)..

Source: Dictionary of Financial and Securities Terms