Dear Editor,

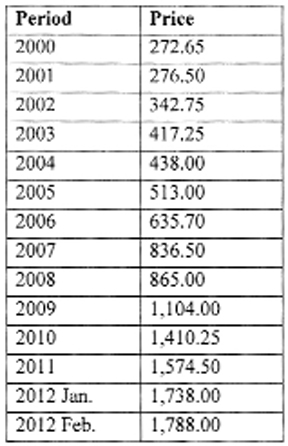

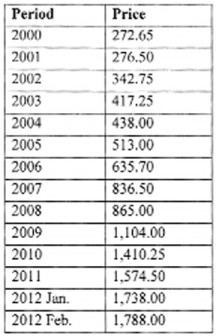

The price of gold fell to US$1,667 an ounce mid-March thus reversing the upward trend experienced when the price continued to rise to reach US$1788 in February 2012. Gold is the most popular of all the precious metals and has not lost its glitter despite the dissolution of the gold standard and the high price of jewellery.

Historically, investors and central banks around the world hold gold as a store of value and to hedge against crisis, be it economic, political or a traumatic currency crisis. The current economic uncertainty of the world‘s major currencies, be it the US dollar, the euro or the Japanese yen will see gold continuing as a main store of value. The price of gold unlike the value of paper or fiat currencies cannot easily be manipulated by economic actors. Gold is therefore the most important commodity money.

What is important to note is the standard text model of demand and supply cannot be relied on solely as the mechanism in the determination of the price of gold.

The last decade especially after the global financial crisis saw the plummeting of Wall Street wealth. Since then gold has regained the special traction that had symbolized it as a safe store of value for more than two thousand years. This coveted value or confidence factor is preserved by the fact that it’s nobody’s liability.

The history of gold as one of the earliest forms of money, the gold standard, the large amount of gold reserves accumulated by central banks, its low correlation with the other metal prices and its price relationship with fiat currencies is a manifestation of gold behaving more like money than a commodity. Despite all major currency pegs being removed from the gold standard, with last being the Swiss franc in early 2000, central banks still hold a major part of their reserves in gold. The central banks in Europe hold on average 58 per cent of their reserves in gold, followed by the Federal Reserve Bank at 50 per cent. In total, central banks along with international organizations like the IMF hold nearly 20 per cent of world gold output. Sir Isaac Newton created the first gold standard in the UK in 1717, and despite breaking from the gold standard central banks have not relinquished that trust in gold.

The gold price rose by the double digits in percentage terms in nearly every year except 2004 in the last ten years. The high demand for gold is also propelled by jewellery and industrial demand that accounts for a large share of demand.

The India jewellery subsector represents 27 per cent of this demand and is the largest market for this segment of demand, followed by China and the US. According to the World Gold Council, annual mine production averaged 2,500 tonnes with some 2,000 tonnes going towards jewellery and industrial production.

The rising middle class in the BRIC countries or emerging market economies have increased the demand for gold as an expression of their wealth status. The CBS ‘Sixty Minutes’ programme early this year analysed weddings ceremonies in India being made prominent with the large display of gold jewellery by both bride and groom. China, especially Hong Kong, boasts of some of the world’s finest fashionable jewellery stores with designs that are in world demand. Persons who had stored up their wealth in jewellery would gain more in real value terms than if the corresponding investments were made on financial products in Wall Street during the last decade.

Gold prices also benefited from the advent in 2005 of the Exchange Traded Products (ETPs) in the market. ETPs allow investors to purchase gold bullion as a share of stock. These shares are traded on the major stock markets. The ETPs’ shares of gold stock are expected to rise to the third highest level in the world by 2012. The ETPs trade gold while profiting from arbitrage in the stock market, thereby creating an element of speculation in gold prices.

In the contemporary era, gold has regained its ‘Midas touch’ and has fascinated investors and savers alike around the world. Savers see gold as a hedge against the depreciation of paper currencies, a hedge against inflation. Investment in gold carries little opportunity cost because of the low interest rates and yield earned on investments in the money market. The price of gold in US dollars increased dramatically in the last decade; however, measured relative to the commodity of oil whose price like gold is tied to the US dollar, it increased more slowly and evenly. The Economist (2011) pointed out that in 1986 an ounce of gold was worth 12 barrels of oil, now it is worth 13.

That will be even less given the hike in oil prices in recent times. In the past, there has been some correlation between the price of gold, oil and a weakened US dollar.

The prominent benchmark for the price of gold has been the London Gold Fixing that meets twice daily via teleconferencing, representing five bullion trading firms of the London Bullion Market. The last meeting of the London Bullion Market Association (LBMA) was very optimistic about the future price of gold. The weakness of the major reserve currencies, the dollar and the euro, means that central banks will continue to trust gold since it is nobody’s liability. The worst is that when large savers like pension funds, health funds, etc, try to find safe haven for their money they face daily headlines like bank bailouts, sovereign debt crises or another recession; given the onslaught on their capital during the financial crisis these fund managers will be risk averse to bet on a commodity such as gold.

There are numerous examples of gold regaining it role as a medium of exchange, for instance the Austrian Raiffisen Zentral Bank now offers clients gold based accounts. SWIFT international payments messaging system now allows payment via gold. Very soon there will be a gold money market and a gold bond market.

“Gold was an anchor or a rule prior to World War 1 but it was compromised and eventually abandoned because it restrained the type of discretionary monetary and fiscal policies that modern democracy appears to value,” Allan Greenspan said in a speech in 1997.

Finally, both the Financial Times and the Economist predicted that the gold price will rise to US$2,000 per ounce by 2015. There will be period of price fluctuation, but given that the global economy is still at a crossroads, it is hard not to be optimistic about the future price of gold.

It is the only means whereby the value of personal savings can be protected without it being confiscated by inflation.

Even if the price of gold does not rise as quickly as anticipated it is the strong trust on its value that makes it indispensable as commodity money.

Yours faithfully,

Rajendra Rampersaud

Gold Prices US$ per troy oz