Dear Editor,

The year 1994 will live in Guyana’s history as one of honour. It was the only year in 30 years (1981-2011) in which Guyana experienced fiscal prudence. The main political players in 1994 were Cheddi Jagan and Asgar Ally. However, our post-Jagan government has learnt little from Dr Jagan, thus this race to an unsustainable national debt position. I listened to Carl Greenidge’s speech and it is a telling reminder of how much Guyana will miss Winston Murray.

Murray always cautioned the government on the consequences of running an unsustainable budget deficit, and today his wisdom has proven prophetic. One can easily see three adverse consequences as a result of the bad management of the economy under Mr Jagdeo.

Budget deficit – the amount by which a Government spends more than it earns.

The three adverse consequences are:

1. The budget deficit measured as a percentage of GDP is rising. In 2009 the deficit was 3.4% of GDP. At the end of 2011 it was 4.4% of GDP. In 2012, the Minister expects this deteriorating trend to continue with a deficit of 4.6% of GDP.

A rising deficit has to be funded, and thus the government will be forced to borrow more internationally to fund the growing gap. Any banker after reviewing our portfolio of debt will demand higher interest since the debt mountain is imminent. At the same time, the Bank of Guyana will be burdened with sterilizing larger amounts of excess liquidity.

The call of Moses Nagamotoo to “bring out the scissors” is the most financially prudent and sensible call I have heard so far. This call should not fall on deaf ears. Guyana does not have the human capacity to spend $75 billion on capital works in 2012. The PPP must remind themselves that much of this $75 billion will be leaked from the economy into private pockets causing prices to rise. This is a challenge that will have catastrophic effects on the working class. I plead with the government, “Bring out the scissors!”

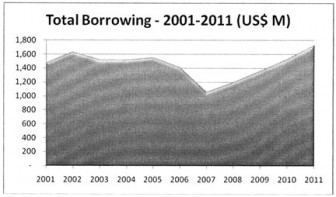

2. An unsustainable budget deficit will lead to a debt mountain. The chart below exposes that Guyana is already on the debt mountain. The chart labelled ‘Total Borrowing,‘ shows Guyana’s external and domestic debt today is some US$1.75 billion. In the last two years alone, some US$0.38 billion was borrowed, and if this trend continues, Guyana’s total domestic and external debt will reach some US$2.1 billion by the end of 2013.

Does the number US$2.1 billion sound familiar? That is the debt Mr Greenidge and the PNC gifted to Dr Jagan in 1992. Guyana would have gone full circle by 2013. Different government, same outcome!

Source: Bank of Guyana, 2012 Budget

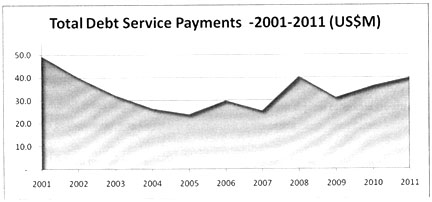

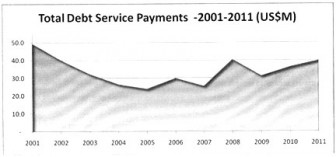

The consequence of a debt mountain is the government has to spend more each year in interest payments to service these debts. The chart below called ‘Total Debt Service Payments‘ holds good to this fact. Since 2009, Guyana‘s interest payments to the bankers who hold our domestic and external debts, increased from US$30 million to US$40 million per year.

Source: Bank of Guyana, 2012 Budget

There is an opportunity cost involved here. That US$10 million per year (G$2 billion) could have been better used on more productive activities. The business community needs a tax break to help create more new jobs and workers deserve a salary increase to motivate greater productivity.

This increase in debt service payments also represents quite sadly, a transfer of income and wealth from workers and the business community to bankers and other holders of government debt.

3. The third adverse consequence of running this unsustainable budget deficit is waste and squandermania in public spending. Since Mr Jagdeo arrived, his macro-economic strategy was designed to crowd out private investment with a mentality of collecting more taxes to increase state spending, including, might I add, to presidential pensions.

The public sector did not spend that $50 billion in a structured and efficient manner in 2010. Can anyone support capital expenditure of $75 billion in 2012?

The end result if this is allowed is more custom-made projects for people like Fip Motilal that end in failure before they really get started at a great financial loss to taxpayers.

That is why the AFC continues to call for a reduction in the corporation tax rate now for the business community.

In conclusion, it has been proven that higher levels of debt can depress economic growth and this can be the answer as to why Guyana is not growing at 8% or 9%.

It has also been proven that increasing debt service payments depresses public investments in the people. Is this why the PPP is reluctant to put monies into providing a living wage for workers and a pension that will allow the pensioner to live a life of dignity?

Sai Baba said “A house must be built on solid foundations if it is to last. The same principle applies to man, otherwise he too will sink back into the soft ground and become swallowed up by the world of illusion.”

This biggest budget ever is but a financial illusion and all MPs have no choice but to force a re-design of it by supporting the passage of a smaller budget with features like a smaller capital expenditure programme, a $10,000 per month pension for senior citizens, a modest salary increase for all workers and most importantly a modest reduction in the corporation tax rate for the business community to give them that extra boost to invest more and thus create new jobs.

The PPP must do the right thing by consulting the relevant stakeholders, especially the trade unions before building the budget next time.

Yours faithfully,

Sasenarine Singh