Part 2

Introduction

As promised last week, I shall conclude my effort to provide a basic accounting of those factors which the macroeconomic data suggest are responsible for the slippage in the government debt to GDP ratio for Guyana that has been observed since 2007.

To recall, the ratio declined to its lowest level of 60 per cent for both 2007 and 2008. But since then the ratio has increased to 70 per cent by 2011. Because of our past history of a highly indebted poor country (HIPC), I have urged readers to share my concern about this slippage in the government debt to GDP ratio, particularly as we would note that the slippage has been mainly confined to an increase in the domestic debt to GDP ratio.

It should be made abundantly clear at this stage that, the analysis of this occurrence, is directly related to the macroeconomic data for the period 2006-2011. This is an extremely fortunate coincidence for the reliability of the analysis, as the national accounts aggregates presented and or utilized in the time series are all derived from the new 2006 price series national accounts aggregates.

It should be made abundantly clear at this stage that, the analysis of this occurrence, is directly related to the macroeconomic data for the period 2006-2011. This is an extremely fortunate coincidence for the reliability of the analysis, as the national accounts aggregates presented and or utilized in the time series are all derived from the new 2006 price series national accounts aggregates.

Variables

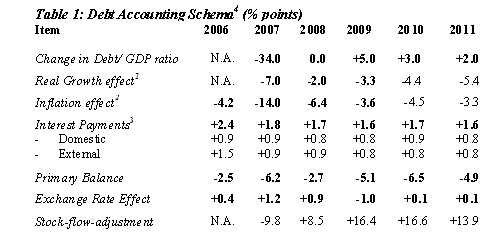

Those economic variables that are needed to account for or decompose changes in the that I have identified so far are 1) growth in the nominal, or current price GDP, which in turn is a combination of a) real growth or constant price changes in GDP value added and b) the rate of inflation (either changes in the consumer price index or implicit GDP deflator); 2) interest payments on the sovereign debt (the sum of external and internal payments); 3) the level of fiscal effort (as indicated by the primary balance of the central government or the overall balance, after grants, of the non-financial public sector); and 4) changes in the bilateral Guyana dollar to United States dollar exchange rate.

In each of those instances we are seeking to identify the impact effect on (or the variable’s contribution to) change in the government debt to GDP ratio. For the purposes of presentation, when the effect or contribution serves to reduce the government debt to GDP relation, we label this with a minus sign in the display table below. When the effect or contribution has an opposite consequence (that is, increases the government debt to GDP ratio) we label this with a plus sign in the display table cited below.

Unexplained residual

Crucial as the factors listed so far are, these will often not fully capture all the changes which contribute to movement in the Guyana sovereign debt stock to GDP ratio. A residual amount of the change in the debt to GDP ratio remains uncaptured or unexplained. What I propose to do in this instance is to follow the method of other studies of debt dynamics on Caricom economies (especially by international financial institutions (IFIs)) and term this residual a ‘stock-flow adjustment (SFA).‘

This term sounds highly technical, but it is used as a label to cover factors that are not fully explained by the variables identified. Individually, these unexplained factors would be expected to vary in their contributions or effects on the government debt to GDP ratio. They, however, would include such considerations as direct or implicit liabilities/debt of the public sector, which is not fully captured in the published sovereign debt statistics on Guyana.

Notes: N.A. not applicable (GDP series starts in 2006)

1Rebased GDP (2006 price series); 2Consumer Price Index; 3as% of GDP

4Minus sign reduces the debt/GDP ratio; plus increases

Source: Author’s calculations based on Government of Guyana Statistics.

Conclusion

While the debt accounting framework presented in the table above speaks for itself, a few concluding observations, however, are necessary for general readers:

Noteworthy is the fact that all the variables portrayed in the table support reduction in the government debt to GDP ratio, except interest payments. The nominal bilateral exchange rate generally depreciated and appreciated only once (in 2009).

Of specific note, economic growth and the effect of inflation indicate that GDP measured at nominal prices has been persistently increasing since 2006 (the new 2006 prices GDP series). Central government’s fiscal effort has also been positive, reflected in a continuously positive primary balance, even though there has been an overall deficit of the public sector, after grants since 2006 (as we noted over the previous two weeks).

The table also reveals that interest payments have been steady, only varying marginally between 1.6 and 1.8 per cent of GDP since 2007. As the table clearly shows, these payments were roughly equally shared between domestic and external interest payments, even though the domestic debt represented on average only about 30 per cent of the total debt over the same period. This indicates that the interest cost of domestic debt is considerably higher than the external costs! The latter as we know includes both debt relief and concessional financing provided by foreign governments and international organizations.

Finally, the residual factor (stock-flow adjustment) showed significant movements over the period under consideration. Indeed, this adjustment was thrice as large as that obtained for Jamaica in similar accounting exercises, done in recent times. This suggests to me that the official debt figures do not provide full coverage of all the public external debt liabilities of Guyana.