Introduction

In my two previous SN columns I have endeavoured to present to readers a basic, but relatively robust macroeconomic accounting framework, from which one could demonstrate how economists would seek, in principle, to account for, or decompose the slippage that has occurred in the government debt to GDP ratio for Guyana over the past five years. To be frank, I was quite surprised at the number of readers who have been urging me to continue with this type of analysis of the budget. As one reader puts it, this provides a “learning moment” for them by offering richer insights to the inner workings of the Guyana economy.

The effort so far represents the first of two tasks, which as I have previously indicated I must attend to, before concluding the analysis of Budget 2012 in regard to its macroeconomic challenges. In this week’s column turn to the second task, which is to indicate the root causes (or basic political economy) driving the macroeconomic challenges. This task will continue into next week as before I begin I need to respond to a few readers’ queries about the accounting framework.

Readers queries

The first of these queries is whether reports in the financial media to the effect that the crucial dynamics of debt accounting centre on the combined behaviour of government’s fiscal effort, the interest rate, the rate of economic growth, and inflation are accurate. It is true that these are central to the determination of whether government’s indebtedness supports or hinders economic development. As the accounting framework contends government’s fiscal effort may be expressed as either the Budget’s primary balance or overall balance of the non-financial public sector. The exchange rate, which is not listed above, is a key consideration when as in Guyana; a significant component of the debt is owed to foreigners.

Second, careful readers have queried that the crucial economic variables are all expressed as flows, while the debt is a stock of outstanding liabilities. This is indeed correct. And, it is precisely the reason why the balancing factor indicated in the debt accounting framework is termed a stock-flow-adjustment. As a purely practical matter, it is easier to capture the economic flows rather than the debt stock. The balancing item basically indicates this reality.

Second, careful readers have queried that the crucial economic variables are all expressed as flows, while the debt is a stock of outstanding liabilities. This is indeed correct. And, it is precisely the reason why the balancing factor indicated in the debt accounting framework is termed a stock-flow-adjustment. As a purely practical matter, it is easier to capture the economic flows rather than the debt stock. The balancing item basically indicates this reality.

Thirdly with Treasury Bills accounting for over 85 per cent of the domestic debt and with the domestic portion of the debt costing more per dollar than external debt, readers say this begs for further evaluation. Related to this, the global financial crisis that erupted in Q4 of 2007 has ushered in a period of unprecedentedly low interest rates. One is therefore left to ponder if the domestic debt and its cost rise in relation to GDP at this time, what would be the situation if and when the world economy reverts to a less repressed interest rate regime?

Finally, some readers have indicated they are better placed to understand why resort to inflation is tempting for countries as a way of reducing their debt burdens, and why therefore, global investors are placing such immense pressure on Europe and the United States to contain inflation and financial market collapse.

Context

Turning to the second task, at the outset it should be noted that the performance of the economy both reflects and shapes the course of macroeconomic policies. Guyana’s recent performance is reviewed below.

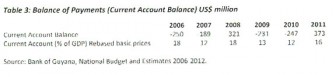

As Table 1 below reveals, real GDP has grown, on average, at about 4.4 per cent annually since 2007 using the rebased GDP 2006 price series data. Its sectoral composition is striking. The strongest sustained growth has come from services and construction. Mining (primarily gold) has had two truly exceptional double-digit years of 14.7 and 19.2 per cent annual growth in 2007 and 2011 respectively.

The performances of the agricultural sector (sugar and “other” crops) along with manufacturing have been quite weak by comparison.

Note: *Budget 2012 estimate.

Sources: Government of Guyana official statistics and 2012 National Budget and estimates 2012.

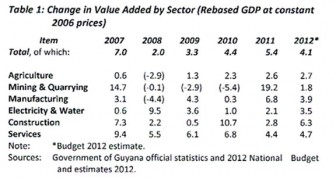

As would be expected because of Guyana’s high export dependence, export performance has been strong. As shown in Table 2 the value of exports of goods and non-factor services has nearly doubled between 2006 and 2011. As a percent of GDP it is presently 63, up from 59 percent in 2006 and a low of 53 per cent in 2009. The strengthening of world commodity prices (especially gold) has contributed hugely to this outcome.

Source: Budget and Estimates 2011-2012.

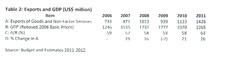

Imports of goods and non-factor services are substantially larger than exports. These also nearly doubled, rising from US$1.1 billion in 2006 to US$2.2 billion in 2011. As a consequence the deficit on the current account of the balance of payments has remained quite significant ranging from 12 to 18 per cent of GDP since 2006. The average for the period was 15 per cent and in 2011 it was 16 per cent (see Table 3).