Introduction

Last week, we took a second look at the NICIL controversy in the light of the recent debate at the State-owned National Communications Network. I provided a historical background to the formation of the company as well as my views on the Management Co-operation Agreement that the Privatisation Unit of the Ministry of Finance, NICIL and the Government of Guyana signed on 31 December 2001. We also examined the governance arrangements for the operations of the company; and the extent to which NICIL has complied with the requirements of the Companies Act, particularly as regards the auditing of NICIL’s accounts and laying them in the National Assembly.

Today, we discuss the issue of whether NICIL is a public corporation. I will then make some concluding remarks.

Today, we discuss the issue of whether NICIL is a public corporation. I will then make some concluding remarks.

Establishment of public corporations

The Public Corporations Act 1988 provides for the dissolution of the Guyana State Corporation and the vesting of its assets in the State. It also amends the law relating to the establishment and management of public corporations.

The Act defines “corporation” as:

(a) Every existing corporation; and

(b) Every public corporation established under Section 3 and every corporation which comes into existence as a result of the reconstitution of any body corporate under Section 6, or merger of two or more corporations under section 7.

Section 3 states that the Minister may, by order, establish a public corporation. Minister here means the Minister assigned general responsibility for the public corporation or, where there is no such Minister, the President. Once the order comes into force, the Act regulates the new corporation. The order is subject to negative resolution of the National Assembly.

In accordance with Section 5, an order made under Section 3 may contain provisions vesting in the public corporation, established by order, movable and immovable property of the State. In addition, by Section 8, the Minister may by order transfer to a corporation, or place under its control the whole or part of: (a) any undertaking of any other corporation or other body corporate owned by the State or in which controlling interest vests with the State; or (b) any commercial, manufacturing or research undertaking of the State.

Section 6 provides that the Minister may, by order, reconstitute any body corporate owned by the State or where controlling interest vests in the State or any agency on behalf of the State. The reconstituted body is deemed a corporation. For this purpose, a body corporate includes a company notwithstanding anything to the contrary in the Companies Act. In addition, the Minister may, by order, provide for the merger of two or more corporations, as provided for by Section 7. The order is subject to negative resolution of the National Assembly

Section 66 also states that the Minister may by notification in the Gazette apply any of the provisions of the Act, with or without modifications, to any body corporate (other than a corporation) owned by the State or where controlling interest vests in the State or in any agency on behalf of the State.

Is NICIL a public corporation?

NICIL is a body corporate owned by the State and a private limited liability company incorporated under the Companies Act. While Section 6 of the Public Corporations Act permits the concerned Minister, by order, to reconstitute a company in which controlling interest vests in the State into a public corporation, this was not done in respect of NICIL. NICIL is therefore not a public corporation in the context of Sections 3 and 6. It follows that Section 5 is not applicable, and therefore movable and immovable property of the State cannot be vested in NICIL.

As regards Section 66, the Minister has not notified in the Gazette that any of the provisions of the Act, with or without modifications, has been made applicable to NICIL. Reference to Section 66 in an order does not satisfy requirements of that section. For example, the caption of Order No. 53 of 1999 vesting 11.0384 acres of property at Plantation Ruimveldt in the name of NICIL reads:

In the exercise of the powers vested upon me by Section 5 of the Public Corporations Act 1988, as applied to the National Industrial and Commercial Investments Ltd. by notification issued under Section 66 of that Act I hereby make the following order.

For Section 66 to be applicable, a specific order had to be issued detailing what aspects of the Act would be applicable to NICIL.

Transfer of State assets to NICIL

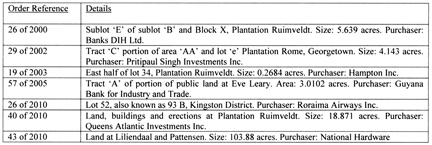

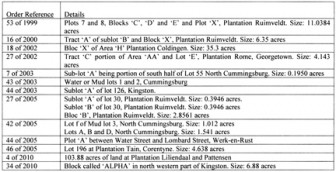

Despite the fact that NICIL is not a public corporation and has not been deemed to be one, numerous State assets were transferred to it since 1999 using sections 5, 8 and 66 of the Public Corporations Act. The following are examples:

In all probability, the transfers would have been made for zero consideration, as was the case of the transfer of Government shares in other state-owned/controlled entities as well as other investments. As such, any disposal of such assets by way of sale would provide NICIL with a windfall gain if the proceeds are not paid over to the Consolidated Fund.

In all probability, the transfers would have been made for zero consideration, as was the case of the transfer of Government shares in other state-owned/controlled entities as well as other investments. As such, any disposal of such assets by way of sale would provide NICIL with a windfall gain if the proceeds are not paid over to the Consolidated Fund.

Disposal of properties by NICIL

Section 23 empowers the concerned Minister to give specific directions in respect of: (a) the disposal of capital assets of a corporation; and (b) the application of the proceeds, including paying over to the Consolidated Fund the whole or part of such proceeds. Capital assets are those assets owned by an entity that are integral to its operations. As such, any disposal would be in relation to assets that are surplus to the operational requirements of the entity.

The Minister did not apply Section 23 to the sale to third parties of numerous State assets that were vested in NICIL. Instead, he incorrectly used Section 8 that refers to transfers to corporations. Nor did the Minister arrange for the proceeds of the sale to be paid over to the Consolidated Fund. Instead, he allowed NICIL to retain such proceeds to be used at the discretion of its directors. The following are examples of the sale of State assets to third parties:

The Minister did not apply Section 23 to the sale to third parties of numerous State assets that were vested in NICIL. Instead, he incorrectly used Section 8 that refers to transfers to corporations. Nor did the Minister arrange for the proceeds of the sale to be paid over to the Consolidated Fund. Instead, he allowed NICIL to retain such proceeds to be used at the discretion of its directors. The following are examples of the sale of State assets to third parties:

Conclusion

Combining last week’s analysis with today’s, the following conclusions are arrived at:

* The governance arrangements are far from satisfactory, given the domination influence of the Minister of Finance: (a) as the Minister responsible for NICIL: (b) as the Chairman of NICIL; and (c) as the Government of Guyana’s designated representative of NICIL as a State-owned company;

* The Management Cooperation Agreement referred to above is a further reflection of the dominance of the Minister since the Privatization Unit reports to him;

* The Agreement is highly irregular since neither the Companies Act nor the Public Corporations Act permits a merger of a company with a unit of a government department;

* The Agreement in effect paved the way for siphoning off State revenues derived from privatization and placing them in the hands of NICIL to be used at the directors’ discretion. This is in complete violation of Articles 216 and 217 of the Constitution that require all such revenues to be paid over to the Consolidated Fund and all public expenditure to be approved by Parliament;

* Since 2002, NICIL considered itself a holding company with a number of State-owned/controlled entities being declared its subsidiaries, with Government’s interest transferred to it for zero consideration. As a result, dividends received from these entities ceased to flow into the Consolidated Fund but instead into the coffers of NICIL.

* There are no audited accounts beyond 2005 for NICIL as a group as well as for NICIL as an individual entity beyond 2001. This is an offence under the Companies Act, and for which the directors are liable;

* NICIL is neither a public corporation nor deemed to be one;

* The Minister has misapplied the provisions of the Public Corporations Act in vesting billions of dollars of State assets in NICIL’s name; in selling them to third parties; and in allowing NICIL to retain the proceeds; and

* The way forward should be a request for a judicial review, if the Government continues to defend its actions and does not take remedial measures.