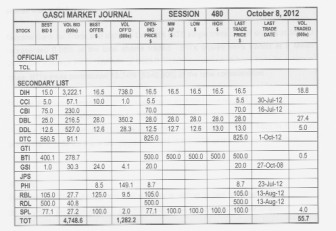

GASCI (www.gasci.com/telephone Nº 223-6175/6) reports that session 480’s trading results showed consideration of $1,786,450 from 55,714 shares traded in 12 transactions as compared to session 479 which showed consideration of $1,685,294 from 29,039 shares traded in 9 transactions. The stocks active this week were DIH, DBL, DDL, BTI and SPL.

Banks DIH Limited’s (DIH) three trades totalling 18,843 shares represented 33.82% of the total shares traded. DIH’s shares were traded at a Mean Weighted Average Price (MWAP) of $16.5, which showed no change from its previous close. DIH’s trades contributed 17.40% ($310,910) of the total consideration. All of DIH’s trades were at $16.5.

Demerara Bank Limited’s (DBL) four trades totalling 27,380 shares represented 49.14% of the total shares traded. DBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $28.0, which showed no change from its previous close. DBL’s trades contributed 42.92% ($766,640) of the total consideration. All of DBL’s trades were at $28.0.

Demerara Bank Limited’s (DBL) four trades totalling 27,380 shares represented 49.14% of the total shares traded. DBL’s shares were traded at a Mean Weighted Average Price (MWAP) of $28.0, which showed no change from its previous close. DBL’s trades contributed 42.92% ($766,640) of the total consideration. All of DBL’s trades were at $28.0.

Demerara Distillers Limited’s (DDL) three trades totalling 5,000 shares represented 8.98% of the total shares traded. DDL’s shares were traded at a Mean Weighted Average Price (MWAP) of $12.7, which showed an increase of $0.2 from its previous close of $12.5. DDL’s trades contributed 3.55% ($63,400) of the total consideration. DDL’s first two trades totalling 4,000 shares were at $12.6 while its third trade of 1,000 shares was at $13.0.

Guyana Bank for Trade and Industry Limited’s (BTI) single trade of 491 shares at $500.0 represented 0.88% of the total shares traded. BTI’s shares were traded at a Mean Weighted Average Price (MWAP) of $500.0, which showed no change from its previous close. BTI’s trade contributed 13.74% ($245,500) of the total consideration.

Sterling Products Limited’s (SPL) single trade of 4,000 shares at $100.0 represented 7.18% of the total shares traded. SPL’s shares were traded at a Mean Weighted Average Price (MWAP) of $100.0, which showed an increase of $22.9 from its previous close of $77.1. SPL’s trade contributed 22.39% ($400,000) of the total consideration.

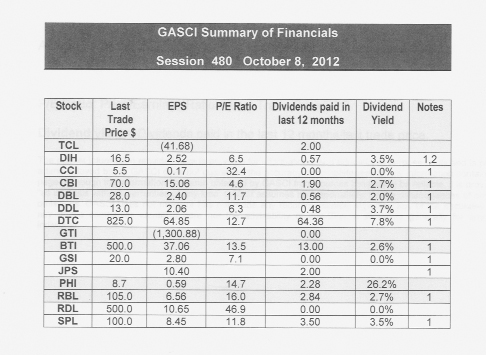

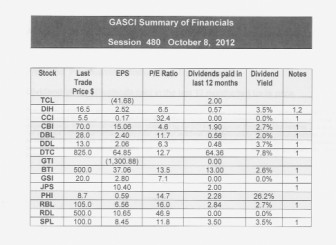

NOTES:

Best bid: The highest price that a buyer is willing to pay for a security.

Best offer: The lowest price at which a seller is offering to sell securities.

Notes

1 – Interim Results

2 – Prospective Dividends

3 – Shows year-end EPS but Interim Dividend

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

EPS: earnings per share for 12 months period to the date the latest financials have been prepared. These include:

2005 – Final results for GTI.

2008 – Final results for PHI.

2010 – Final results for RDL.

2011 – Final results for TCL.

2012 – Interim results for DIH, CCI, CBI, DBL, DDL, DTC, BTI, GSI, JPS, RBL and SPL.

As such, some of these EPS calculations are based on un-audited figures.

P/E Ratio: Price/Earnings Ratio = Last Trade Price/EPS

Dividend yield = Dividends paid in the last 12 months/last trade price.