Introduction

Last week I argued the realisation of sufficient economies of scale for Guyana’s sugar industry to make it globally competitive is unlikely simply because these would not result in a substantial lowering of the long-term average cost of production at output levels of 450,000 tonnes. Recall 1) Guyana’s external marketing options lie in the Economic Partnership Agreement (EPA), CARICOM, the United States Sugar Regime, and the “residual” world market for raw sugar and 2) there are a score of global sugar producers, which operate from output levels, double the size of 450,000 tonnes and rising to 40 million tonnes annually. If significant scale economies can be had at 450,000 tonnes, then these would multiply at the much larger volumes of output prevailing among these substantially larger producers.

Readers should also note the benefit from economies of scale in sugar production is a practical and not simply theoretical matter. It would depend therefore, on the actual, not hoped for, lowering of the average cost of production, as output expands in Guyana.

In this regards, worldwide historical experience provides a useful guide. This suggests there are formidable economies of scale to be had, but at outputs far larger than 450,000 tonnes. At the same time, this experience does not lend support for a singular way in which the firms/ enterprises/businesses engaged in producing sugar should be organized.

In this regards, worldwide historical experience provides a useful guide. This suggests there are formidable economies of scale to be had, but at outputs far larger than 450,000 tonnes. At the same time, this experience does not lend support for a singular way in which the firms/ enterprises/businesses engaged in producing sugar should be organized.

Diseconomies and Returns to Scale

Just as there are economies of scale to be obtained from expanding sugar output, there are also the possibilities of diseconomies of scale as output expands. The basis for this concern lies in the consideration that, as the industry gets larger, it becomes more complex and difficult to manage effectively.

A glaring example of potential diseconomies of scale is exemplified in the complicated industrial relations, which have accompanied the centralisation of sugar production in Guyana, (now represented under Guysuco management). In this structure, every worker conflict or dispute has the potential for being magnified across all of Guysuco, no matter how localized it may have been at its point of origin (on a particular estate). Guysuco’s centralized management has in turn led to a corresponding centralized trade union structure, as workers view this to be the only way to deal effectively with Guysuco.

Returns to Scale

Some readers have queried the relation between economies of scale and returns to scale. Despite the conflation of these terms in ordinary usage, they should not be confused as representing the same notion. For economists, returns to scale describe the relation between inputs and outputs as determined by a given production function. That is, it is used to classify the underlying technological condition of an industry. This therefore governs the purely technical relation of its input — output structure. And, in this way, differs from economies of scale.

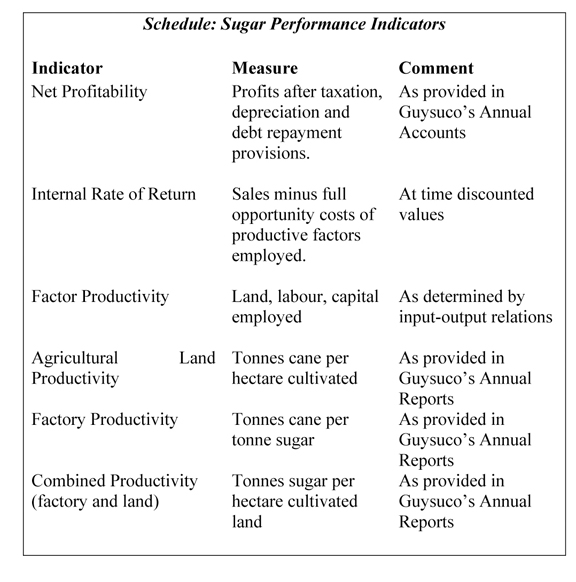

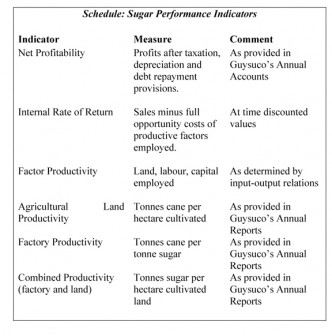

Performance Indicators

I shall now turn to a brief recapitulation of the key performance indicators of the industry (which I have previously addressed). For convenience, these are summarized and displayed in the Schedule below. The first is the net profitability of Guysuco. This is represented as the profits Guysuco earns after paying taxes; provisions for the depreciation of the capital stock; provisions made for offsetting previously incurred debt; as well as, providing the means for funding future investment. The second indicator addressed is the internal rate of return. This derives from Guysuco’s total revenue minus the full opportunity cost of the productive factors employed to generate its sugar output. The third indicator is the productivity of the productive factors sugar employs (land, labour, capital, enterprise) as can be determined from the measurement of their input — output values.

The fourth indicator addresses more specifically the productivity of agricultural land. This is determined by the tonnes cane produced per unit of utilized agricultural land. The fifth indicator is factory productivity, which is determined by the tonnes of cane required to produce one tonne of sugar. Finally, there is the combined land and factory productivity indicator. This is expressed as the tonnes of sugar (the final product) produced by one unit of land (normally a hectare).

The above-listed performance indicators are not exhaustive, but together they provide useful insights into the current viability of Guysuco.

The main two revelations are:

First, Guysuco’s high unit cost of production and its present indebtedness (after taking into account the available prices for its sugar), make it unlikely for the company to be able to return to sustained profitability over the foreseeable future.

First, Guysuco’s high unit cost of production and its present indebtedness (after taking into account the available prices for its sugar), make it unlikely for the company to be able to return to sustained profitability over the foreseeable future.

Second, the performance data indicate a weakening of the industry’s productivity indicators. Indeed, over the years, labour productivity has revealed wide fluctuations and high levels of variability in the total number of person days worked in sugar. Land, factory, and overall productivities also display similar variability, and, additionally, marked declines from the golden period for sugar (during the 1960s).

Conclusion

To sum up, I would venture the general conclusion: 1) concerns over the years about the industry’s performance indicators 2) the probability (and then eventuality) of the EU’s unilateral denunciation of the Sugar Protocol and 3) the mistaken expectation that significant gains from economies of scale could be had, were the three principal drivers behind the Skeldon Sugar Modernization Project and other investments, which Booker Tate and IMF archival documents reveal had been initiated as far back as two decades ago.

Next week I continue the discussion from this observation.