While government is yet to provide a date for the launch of the Small Business Bureau (SBB), Chief Executive Officer of the state-run small business support organisation Derrick Cummings has told Stabroek Business that the startup of what is being promoted as the most significant official gesture to support small business development in Guyana is now “imminent”.

Questions persist, however, as to just how much longer the launch of the Bureau will be delayed, the country having had to wait at least eight years after the passage of the Small Business Act for the setting up of the Bureau and its oversight body, the Small Business Council. Cummings declined to comment on reports that the launch of the Bureau had become caught up in official bureaucracy pointing out instead that a critical condition for the full and effective functioning of the SBB, “the signing

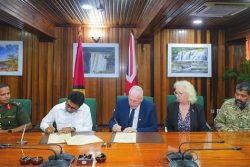

on by government to the loan guarantee arrangement with financial institutions” is now in place. This newspaper understands that two commercial banks and at least one other financial institution have signed on to the loan guarantee arrangement which will allow the Bureau to guarantee small business loans from the commercial banking sector. “What the conclusion of this arrangement has done is to cause the Bureau to be able to embrace those commercial banks as partners in the project. The SBB will now be able to provide guarantees that will enable small businesses and small business aspirants not only to secure loans from those commercial banks but to do so at unprecedented low rates of interest,” Cummings said.

A key operating element of the SBB is the release by the Inter-American Development Bank (IDB) of the first tranche of US$5 million that will position the Bureau to provide loans and grants to local small businesses. Cummings told Stabroek Business that “all of the pre-disbursement conditions” that will enable the release of those funds have now been met.

While declining to comment on reports that the launch of the SBB might coincide with this year’s GuyExpo, Cummings told Stabroek Business that given the importance which GuyExpo attaches to small business promotion “that might not be a bad idea”. He reiterated, however, that he was still not able to give a particular date for the launch of the SBB.

Last week a private sector source told this newspaper that government appeared to be “taking its time” with the launch of the Bureau, pointing out that it could well be that delay was due to the administration becoming “caught up in the political fallout from the Amaila Falls hydro project”. The source said that concerns over the delay in the launch of the project had to do with the fact that thousands of “small businesses and small business project proposals” appeared to be waiting on the services which the Bureau is supposed to provide. This week Cummings confirmed that more than 3,000 individual small businesses and small business groupings in the agro-processing, light manufacturing, craft production, mechanical workshops and poultry production enterprises had already signed up with the SBB. “I believe that it would be fair to say that these enterprises will be keen to know when the Bureau will be open for business,” Cummings told Stabroek Business.

Under the provisions of the 2004 Small Business Act, local small businesses will be allowed to provide at least 30 per cent of all goods and services required by government and Cummings said that one of the objectives of the SBB will be to help position local small businesses to meet that quota in the shortest possible time. Meanwhile, according to Cummings the Bureau will be closely monitoring the performances of the small businesses under its purview in order to ensure that the project meets one of its critical targets, providing or sustaining 2,200 jobs in the local private sector in two years. The mechanisms through which local small businesses will benefit from the provisions of the SBB will include a Credit Guarantee Fund (CGF), a pool of money that will be used to guarantee a portion of the collateral requirement of the lending institutions to allow for the acceptance of loan applications and business proposals; by assuming a significant part of the risk this fund seeks to entice lending institutions into lending to small businesses at attractive rates of interest. A second component of the SBB facility is an Interest Payment Support Facility that will help the borrowing small business to liquidate a percentage of its interest obligations on loans. Aquaculture, fruits and vegetable farming and agro-processing, sustainable forestry, eco-tourism and business process outsourcing are expected to benefit significantly from this facility.

Services under the SBB will also include a Low Carbon Grant Scheme, a pool of money that will be set aside to assist vulnerable persons to access financing for their existing or potential business venture.

Access to business and technical training, including financial literacy, will be addressed through a Skills Voucher Scheme that allows small businesses to access grants that are exchangeable for training. The Bureau has already signed a training agreement with the local organisation EMPRETEC.