I was prompted to write this article because of the disclosure by a well-known commentator, Mr. Christopher Ram, on the financial reporting requirements and governance arrangements of the Guyana Energy Authority (GEA). In his articles to be found at www.chrisram.net under the captions ‘As a statutory body the GEA must file annual reports’ and ‘Energy Policy for Guyana – Conclusion,’ Mr Ram observed the following:

Lack of compliance with the International financial Reporting Standards (IFRS) on revenue recognition;

The failure to lay GEA’s annual reports in the National Assembly, as opposed to audited financial statements alone, and the lack of timeliness in doing so; and

Gaps in GEA’s governance arrangements, especially as regards the membership of GEA’s board, and the requirement to have the names of the board members gazetted.

Gaps in GEA’s governance arrangements, especially as regards the membership of GEA’s board, and the requirement to have the names of the board members gazetted.

Today, we examine the accountability arrangements of all statutory bodies, especially as regards compliance with the Fiscal Management and Accountability (FMA) Act. The Act defines a statutory body as a public entity that has been established by law. Statutory bodies are in essence state-owned entities that are governed by their own laws that created them. They are also required to comply with the FMA Act as regards their annual budgets and financial reporting except to the extent that other provision is made under the laws that establish them.

Annual budgets of statutory bodies

Section 79 of the Act requires all statutory bodies to submit to the appropriate minister prior to the commencement of each fiscal year for his or her approval: (a) estimates of revenue as well as current and capital expenditure for the fiscal or calendar year; (b) financing activities intended to be undertaken; and (c) a statement of short-term and long-term debt obligations. The format of the annual budget is to be determined by the concerned minister in consultation with the Minister of Finance who has to also approve of the annual budget. The latter may request additional financial or budgetary information.

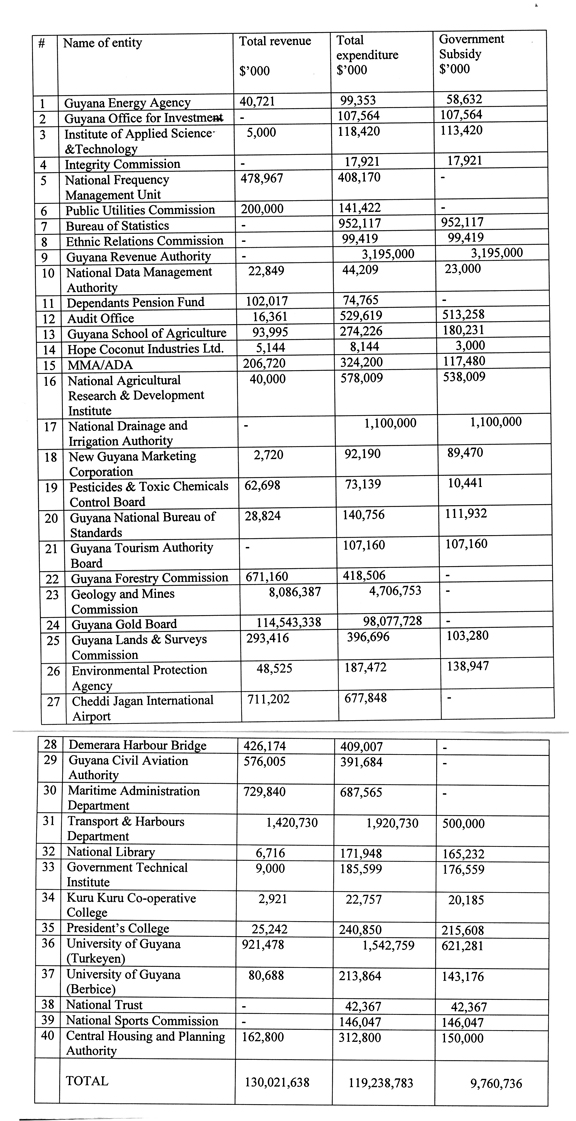

The budget cannot be amended after it has been approved by the Minister of Finance unless he approves of the amendments. An important aspect is the requirement for the minister to submit the annual budgets of all statutory bodies to the National Assembly not later than the time of submission of the national budget. In practice, this is done as part of the submission of the national estimates of revenue and expenditure. For example, the 2012 estimates showed the budgeted current revenues and expenditure statutory bodies as follows:

As can be noted, the total government subsidy for the 41 entities listed above amounted to $9.761

billion. It is especially for this reason that all statutory bodies are required to submit their audited financial statements to the National Assembly in a timely manner to enable the Assembly to satisfy itself that there is proper accountability for the funds appropriated. Even if no subsidies are involved, given that statutory bodies are in essence State-owned entities, there must be a reporting relationship with the National Assembly.

Annual reports and audited financial statements

Section 80 of the FMA Act requires a statutory body to submit an annual report to the concerned minister, including audited financial statements as soon as practicable but not later than four months after the end of the fiscal year. This report is to include a statement of assets and liabilities and a statement of revenue and expenditure, accompanied by the report of the Auditor General. Within two months thereafter, the concerned minister is required to present the report to the National Assembly. In other words, within six months of the close of the financial year, all statutory bodies are required to have their annual reports, including audited financial statements laid in the National Assembly.

The records of the Audit Office showed that there are 48 statutory bodies. However, as noted above, the National Estimates for 2012 listed 41 such bodies. Further examination indicated that some entities reflected in the Audit Office’s list are not in the National Estimates. One example is the World Cup Cricket, the audit of which is yet to be finalized. The Audit Office therefore needs to reconcile its records with those of the Budget Office of the Ministry of Finance.

That apart, the Auditor General’s report stated that many of these entities were significantly in arrears in terms of financial reporting and audit. They are therefore in breach of the FMA Act. As at 31 August 2013, only four statutory bodies have audited accounts for 2012. These are the Bank of Guyana, Guyana Energy Agency, Public Utilities Commission and Central Housing and Planning Authority. These entities are yet to have their annual reports and audited accounts laid in the National Assembly.

The bodies that are more than five years in arrears in terms of having audited accounts are:

Name of entity Year last audited

National Parks Commission 2007

Institute of Applied Science & technology 2003

MMA/ADA 2007

Guyana Information Agency (GINA) 2007

Guyana Civil Aviation Authority 2007

Hope Coconut Industries Ltd 1994

Maritime Authority 2003

Transport and Harbours Department 2007

Guyana Export Promotion Council 1997

Guyana National Bureau of Standards 2005

Guyana Tourism Authority Not stated

University of Guyana Pension Scheme 2001

Sugar Industry Labour Welfare Fund 2004

World Cup Cricket 2006

This is despite the fact that during the period 1 September 2011 to 31 August 2012, the Auditor General finalized 54 such audits, an indication of the level of tardiness on the part of those responsible for ensuring timely financial reporting and audit. However, unlike the case of public enterprises, the Auditor General’s report did not provide an analysis of the types of opinions issued in respect of these entities, ie whether his opinions were unqualified, qualified, adverse or disclaimed. It is no point having audited accounts without knowing the types of opinions issued. In the private sector, the slightest qualification of the accounts may very well result in a shake-up of the management structure of the concerned entity. It boggles the mind that when it comes to government, there is so much complacency as it relates to accountability.

Audited financial statements of GEA

According to the PetroCaribe Agreement between the Government of Guyana and the Venezuelan Government, GEA has been designated the buyer for products contemplated under the agreement. As a result of this arrangement, GEA has presumably decided to treat the proceeds from the sale of petroleum products to oil companies as its revenue while payments to Venezuela and to the Government of Guyana, representing the cost of the products, are shown as office and administrative expenses.

As an agent of the state, it is inappropriate for GEA to treat revenue belonging to the state as its revenue. However, the PetroCaribe Agreement designating GEA as the buyer complicates matters. As a minimum, the payments to Venezuela and the Government of Guyana are certainly not in the nature of office and administrative expenses. The 2012 National Estimates showed the following budget figures for GEA: revenue – $40.7M; expenditure – $99.3M and a government subsidy of $58.6M to meet the shortfall. The Estimates therefore did not recognize the US$350M worth of fuel transactions under the PetroCaribe Agreement not did not they anticipate the above accounting treatment. Despite this, the 2009 audited accounts of GEA showed $14.398 billion as revenue from receipts from oil companies and corresponding office and administration expenses totalling $14.424 billion.

Although GEA’s accounts have been audited to 2012, the annual reports and audited accounts for the years 2010, 2011 and 2012 are yet to be laid in the National Assembly. It is refreshing to learn that the Prime Minister has acknowledged this tardiness and has given the undertaking that this would be done as soon as possible.

To be continued