SHANGHAI, (Reuters) – In the two days after Lucy Yang gave birth at Peking University Third Hospital in August 2012, doctors and nurses told the 33-year-old technology executive that while breast milk was the best food for her son, she hadn’t produced enough. They advised her instead to start him on infant formula made by Nestle.

“They support only this brand, and they don’t let your baby drink other brands,” Yang recalled. “The nurses told us not to use our own formula. They told us if we did, and something happened to the child, they wouldn’t take any responsibility.”

For Nestle and other infant formula producers, there is one significant complication for their China business: a 1995 Chinese regulation designed to ensure the impartiality of physicians and protect the health of newborns. It bars hospital personnel from promoting infant formula to the families of babies younger than six months, except in the rare cases when a woman has insufficient breast milk or cannot breastfeed for medical reasons. Nestle told Reuters it supports this code and has tried to strengthen its implementation. Peking University Third Hospital declined repeated requests for comment.

Most women have enough breast milk to feed their infants, scientific studies show. The World Health Organization advocates exclusive breastfeeding for the first six months of life, starting within an hour of delivery. Breastfeeding leads to better health for babies and mothers, including protection against infection for infants and lower rates of breast and ovarian cancer for women, WHO says.

A Reuters examination reveals that global infant formula companies have found ways to skirt and violate the 1995 code, which they support publicly. Reuters interviewed nearly two dozen Chinese women who have delivered babies at hospitals around China over the last two years. Like Lucy Yang, most experienced the aggressive tactics of formula makers.

Until very recently, enforcement of China’s 1995 regulation had been rare. Neither WHO nor UNICEF can point to a single instance where fines had been imposed since it was introduced. Reuters contacted five prominent Chinese law firms and – underlining the regulation’s obscurity in Chinese legal circles – not one was familiar with it.

The National Health and Family Planning Commis-sion, one of the government bodies charged with enforcing the regulation, did not respond to a question about its enforcement. Neither did the State Administration for Industry and Commerce, which also has enforcement authority.

But the enforcement climate may be changing. The new Chinese government that took office this year is in the midst of a widespread crackdown on corruption, and the practices of big formula appear to be in its cross-hairs. On Oct. 14, Paris-based Danone Corp said it would replace managers in China after state-owned CCTV broadcast a report that the company’s formula unit – Dumex – had bribed doctors in the northern city of Tianjin to gain better access for its product.

Dumex China expressed “deep regret” over what it called “lapses” and promised “full accountability.”

The same day, local officials said 13 medical workers in Tianjin had been dealt a range of punishments from warnings to dismissals.

Big formula’s practices in China have also caught the attention of U.S. regulators. In August 2012, Pfizer Inc and its unit Wyeth agreed to pay more than $45 million combined as part of separate settlements with the U.S. Securities and Exchange Commission (SEC) over violations of the Foreign Corrupt Practices Act (FCPA).

In its complaint, the SEC charged that between 2005 and 2010, Wyeth paid bribes to officials outside the United States, including those in Chinese state-owned hospitals, to encourage them to recommend Wyeth’s nutritional products and to gain access to records of new births that could be used for marketing, and then disguised these payments as expense claims. Under the terms of the settlement, Wyeth neither admitted nor denied the allegations.

GLOBAL BOYCOTT

Infant formula is controversial in many countries, and China is no exception. In the 1970s, growing concern that formula marketed to mothers in developing countries was contributing to malnutrition led to a global boycott of Nestle products. It prompted the World Health Assembly, the WHO’s decision-making body, to pass a code curbing the marketing of baby formula. Since then, 103 countries, including China, have introduced legislation to implement parts of this code.

While campaigns promoting the benefits of breastfeeding have tainted formula’s image in the West, in China, public debate about formula is mostly about safety. In 2004, at least 50 children died from malnutrition after drinking fake infant formula with little nutritive value. Four years later, formula sold by local brand Sanlu – laced with the industrial chemical melamine – sickened nearly 300,000 infants and killed six, fueling national outrage over government food safety controls.

The stain of Sanlu has proven hard to erase. Because many Chinese parents still doubt the quality of domestic brands, international formula makers can charge a premium to domestic brands. Foreign formula firms now control about a third of the Chinese market, according to consultancy Euromonitor International. In 2012, two of the three best-selling brands were foreign. Mead Johnson has a 14 percent market share, Danone controls 9 percent and Nestle 7.5 percent.

China is fertile ground for formula makers. A traditional Chinese belief that women should rest for the first month after delivery gives older family members greater say in the feeding and care of newborns. Relatives often prefer formula as it helps babies sleep for longer stretches. Many families, moreover, prize pudgy babies, who are seen as healthier. Formula-fed infants gain weight more quickly, studies show.

China’s high rate of cesarean sections – the world’s second highest at 46 percent of all deliveries – leads more mothers to start their babies on formula. Mothers fear drugs used in the operation will affect their breast milk. There is also a common belief that China’s chronic air pollution is harming mothers’ milk supply.

Government surveys show a low breastfeeding rate – just 28 percent of Chinese women were exclusively breastfeeding at six months as of 2008, down from 51 percent in 2003. Independent researchers suggest the real figure is much lower. One study published in the Journal of Health, Population and Nutrition in 2010 found exclusive breastfeeding rates at six months in parts of China were as low as 0.2 percent.

With infant formula sales in the United States declining because of a falling birth rate and a rise in breastfeeding, developing nations – China foremost among them – are formula companies’ biggest opportunity.

In 2008, China surpassed the United States to become the world’s largest formula market. Euromonitor expects sales of infant formula in China to double from $12 billion last year to $25 billion in 2017.

FREE SAMPLES

Under China’s 1995 code, companies may not distribute free formula or samples to pregnant women, their families and hospitals. They can’t sell products at a discount. Nor may they offer hospitals funding, equipment or information in order to promote their product.

The regulation bars hospitals and academic institutions from accepting gifts or help from formula companies or promoting infant formula products. It requires medical institutions to “actively advocate” the advantages of breastfeeding.

Penalties for violations, however, are lenient – the maximum fine is 30,000 yuan ($4,900). Enforcement is complicated by its division across several government bodies: the National Health and Family Planning Commission (NHFPC), the State Administration for Industry and Commerce, the State Administration of Radio, Film and Television, and the General Administration of Press and Publication.

Public awareness of the regulation is low. Chinese research firm Beijing Shennong Kexin Agribusi-ness Consulting counts hospitals as one of the four primary channels for sales of infant formula, alongside supermarkets, baby product stores, and the Internet.

Doctors and their recommendations have the largest impact, it wrote in a November 2012 report. Consumers find “organizing activities inside hospitals around nutrition more scientific and persuasive.”

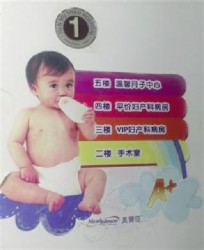

Reuters found formula company advertising and promotion commonplace inside hospitals. In August, visitors to the maternity ward at Hangzhou Tianmushan Hospital in eastern China were greeted with banners from Mead Johnson that read: “Healthy babies, happy mothers” and “Give baby the best start in life!”

A picture of a baby drinking from a bottle and the Mead Johnson logo adorned the floor guide. On the VIP maternity wing, nurse Xia Lingling – a new mother herself – said Mead Johnson representatives regularly visited to drop off samples for new mothers and to give talks to the staff. Xia explained that every patient who delivers at the hospital and stays on the VIP wing receives a free container of Mead Johnson upon the baby’s birth. Mead Johnson “promotes their infant formula here . . . it’s a form of advertising,” said Zhang Yueqin, an obstetrician at the hospital. A Hangzhou Tianmushan spokesman, who would only give his name as Fan, denied the hospital touted Mead Johnson formula to mothers. He said promotional materials were intended to improve the medical knowledge of expectant and new mothers. The hospital displayed no branded posters from Mead Johnson, he said. By late September, the posters had been taken down, Reuters confirmed.

In a statement emailed to Reuters, Mead Johnson said it does not provide formula directly to mothers in hospitals. It does give samples to health care professionals “for the purpose of professional evaluation or research, and all of them are clearly marked ‘For medical use only – Not for Resale’ on the label,” the statement said.

Mead Johnson said it provided posters and “other materials to display in or around maternity wings” if requested by hospital staff. These materials “fully comply with the laws and regulations in China,” it said.

PUSHING FORMULA

Mothers whom Reuters interviewed said formula was pushed to them in myriad ways: doctors gave them discount cards for infant formula during prenatal checkups; hospital staff strapped identity bands branded by formula companies to their babies’ limbs; formula representatives entered their hospital rooms to distribute samples as they recovered from giving birth.

At Beijing Tiantan Hospital, representatives from companies, including Nestle and Wyeth, visited with formula samples for mothers and presents for doctors, said Dr. Yang, who worked as an obstetrician there until 2009. “We weren’t given a commission, just small gifts.”

She declined to elaborate on the nature of the gifts, or be identified by her full name. Kuang Yuanshen, a hospital spokesman, said that without more detail, it was impossible to confirm Dr. Yang’s allegations. Wyeth said by email that company representatives were “strictly forbidden” from visiting hospitals to distribute free samples.

Four former formula company representatives, however, confirmed these kinds of dealings take place. A former Nestle sales representative said she brought samples to doctors and took them to dinner. A former Nestle marketing executive said it was standard industry practice in China to provide financial incentives to doctors to recommend a certain brand of formula. Chinese doctors, she said, expect it.

In an emailed response to questions, Nestle confirmed it has “a medical-trained team who visits hospitals to provide factual information about our product features and up-to-date nutrition and health-related information to doctors.” Nestle “does not provide any free supply to hospitals nor incentivize doctors to promote our products,” it said.

Many underpaid and overworked doctors in China’s state-dominated healthcare system have no choice but to rely on incentives from companies, however, says John Cai, director of the Centre for Healthcare Management and Policy at the China Europe International Business School in Shanghai. The official annual take-home pay for an obstetrician with nearly two decades’ experience in a public hospital might be only $5,000, depending on the services she offers, doctors said.

“A company might approach you and say they’d like to support your work,” says Qiu Liqian, an obstetrician and associate professor at the Women’s Hospital at Zhejiang University Medical School. “If you’re organizing an academic conference, or you’re organizing an event on nutrition, or an event on preventing infection, they would offer their assistance.” Formula companies pay for prominent Chinese doctors to attend academic conferences, which she called “free holidays”.

Bribery to obtain an unfair business advantage is illegal under both China’s Anti-Unfair Competition and Criminal Laws. Bribery can include paying for sponsorship, scientific research and travel expenses under the Anti-Unfair Competition Law; under an interpretation of the Criminal Law, paying travel costs is one of many recognized forms of bribery.

UNDERGROUND MARKET

Some formula companies also utilize a large underground market in hospital patient information. This gives them immediate access to the names, phone numbers and due dates of pregnant women and new mothers, according to a medical researcher and sales executive who have seen name lists of pregnant women for sale at hospitals in Beijing and Shanghai.

Under a 2009 amendment to China’s Criminal Law, it is illegal for employees in the medical sector to sell patients’ personal data. Stealing or acquiring such information illegally is also a crime.

Contacting mothers through prenatal classes is one way formula companies get access to expecting mothers. At one such class taught by Abbott at Shanghai East International Medical Center, participants received a 400-gram (15-oz) tub of Abbott formula, according to Gao Meng, a 33-year-old office manager from Shanghai who attended.