Dear Editor,

The timing could not be worse – for the announcement of a most derisible agreement dramatically negotiated between two pre-eminent actors in a theatre known for poorly scripted plays: GuySuCo and GAWU, for the Annual Incentive Award for once more not achieving a reduced sugar production target – at the sweet cost of $375 million, reportedly the equivalent of five days pay. How does this play in the latest strategic plan, and with the administration’s admission that the industry needs public funding of $4B?

But there is a spin to this formula. Historically the payout was extended up to management staff, in recognition of having contributed to the achievement of transparently negotiated production targets. This meant that the equivalent payout was made to those staff. It would not be unreasonable to expect that the current managers should be equally treated at this time – earning a range of 16%-20% of monthly salary as incentive.

But there is a spin to this formula. Historically the payout was extended up to management staff, in recognition of having contributed to the achievement of transparently negotiated production targets. This meant that the equivalent payout was made to those staff. It would not be unreasonable to expect that the current managers should be equally treated at this time – earning a range of 16%-20% of monthly salary as incentive.

At this juncture it is left to public servants, politicians and even disinterested observers like the Private Sector Commission, to assess the justice of a non-negotiable 5% increase to workers, who though having not been set explicit targets, would have at least achieved the sustainability of their administration, (albeit in the face of ‘budget cuts’). Critically, however, even within the context of the public service compensation regime, substantial inequitabilities exist, the most egregious of which are the varying levels of pay made to specially selected ‘contracted employees,’ who incidentally are young inexperienced ‘recruits’ and who bring no objectively evaluated expertise that is necessarily greater than those pensionable counterparts, who function at least as effectively in the same or similar jobs. At the end of 2013 these ‘contracted employees’ in pensionable posts would have benefited from 45% tax free gratuity on their inflated salary for the year. Interestingly they have hitherto also benefited from the imposed 5%.

But there are also others who are employed in the myriad of donor-funded projects and are remunerated with non-taxable pay packages. In theory they are responsible for meeting the required tax commitments, including NIS contributions.

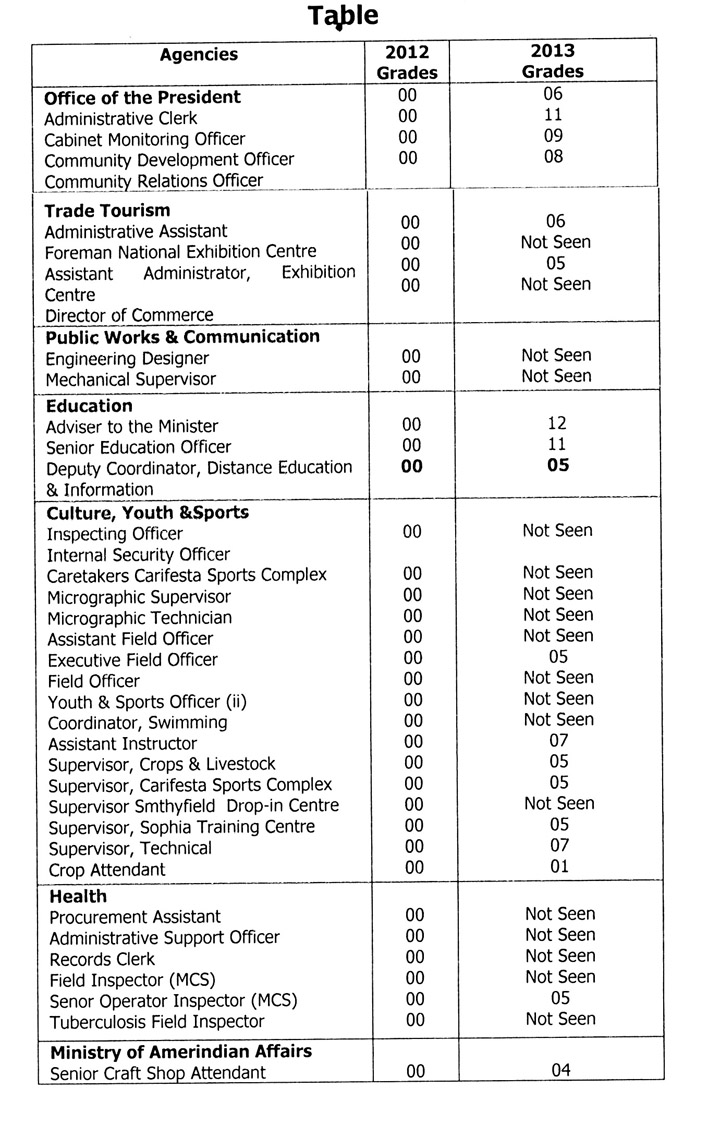

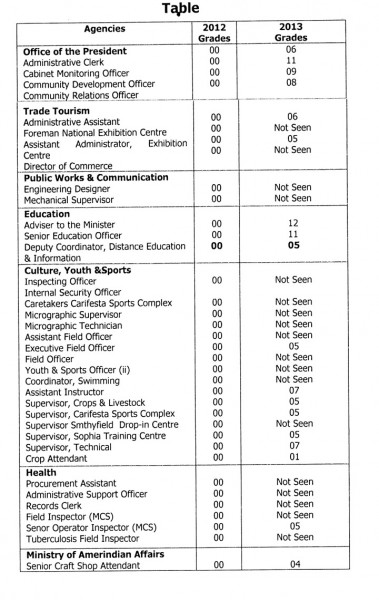

So that the soundbites emerging from the union, employees and politicians alike, bear no substantive clue about the implications of whatever increase they are requesting. They all are totally insensitive to the disaggregation which obtains between pensionable employees and others. Any across-the-board adjustments will still leave the former at a significant disadvantage. Should the lot of them pay close enough attention to the National Estimates, they will see not only their ‘members’ jobs valued by hypothetical salary scales (GS 01 – GS 14), but also so-called pensionable jobs valued in a shadow scale, namely GS 00 up to as late as 2012. However, as can be seen from the table below some posts have since been (re)valued, while others would seem to have disappeared.

Just how could one have calculated 5% on non-valued jobs in the past.

Finally, the less unprofitable, as well as those profitable, state enterprises are likely to find it difficult to compete with GuySuCo’s holiday generosity. They include Guyana Power and Light Inc; Guyana National Newspapers Ltd; Guyana Rice Development Board; MARDS Rice Milling Complex; Guyana Post Office Corporation; Guyana Oil Company Ltd; Guyana National Shipping Corporation; Guyana National Printers Ltd; and National Insurance Scheme.

Hopefully this brief recital will help to make the case for a substantive effort to restore equilibrium to the compensation structures of what passes for one public service.

Yours faithfully,

E B John