Before starting an assessment of the key performance indicators for the Guyana sugar industry, two issues need to be addressed. Firstly, the determination of income transfers (benefits and losses) under the Sugar Protocol (SP) regime; and, secondly, the arrangement through which the European Union (EU) compensates Guyana for its denunciation of the SP.

SP benefits/losses

Several readers have asked me to explain the mechanism through which the SP had generated income transfers (benefits/losses) for its participants. The explanation is straightforward. Let us take the case of Guyana: a  direct benefit is conferred to Guyana on each tonne of sugar it exports to the EU that receives an SP price, which is greater than the price Guyana would otherwise obtain, if the sugar was sold elsewhere. The total benefit is the benefit per tonne, multiplied by the amount of SP sugar exported to the EU. This total benefit is deemed the income transfer from the EU to Guyana.

direct benefit is conferred to Guyana on each tonne of sugar it exports to the EU that receives an SP price, which is greater than the price Guyana would otherwise obtain, if the sugar was sold elsewhere. The total benefit is the benefit per tonne, multiplied by the amount of SP sugar exported to the EU. This total benefit is deemed the income transfer from the EU to Guyana.

Readers should immediately note: 1) as described here, this benefit is a financial or accounting one. It is not an economic benefit simply because its full economic effects would depend on how effectively it is utilized in our economy. 2) On average, Guyana has in the latter decades of the SP, exported approximately 160,000 tonnes of raw sugar to the EU market.

Using similar reasoning, if the SP price is less than the price Guyana could otherwise obtain elsewhere for its export sugar, and yet Guyana continues to meet its export obligations to the EU under the SP, Guyana suffers a loss on each tonne of sugar it sells in this way. The total of this loss would of course be determined by the quantity of sugar it exports in this manner. This loss can alternately be expressed as an income transfer from Guyana to the EU!

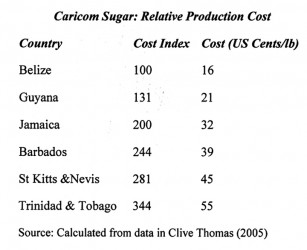

In the latter years of the SP, several estimates of income transfers from the EU to Guyana have been made. I however, prefer to rely on the IMF’s, because of its access to official data on quantities exported and prices received. Their estimates show that in the 1990s the income transfers to Guyana (total accounting benefit) was equal to about 8.5 per cent of its GDP. This declined to 6.5 per cent for the period 2000-05, and was further reduced to 2.75 per cent for the last two years (2008-09) of the staggered reduction in the SP price (36 per cent, during 2006 to 2009). Table 1 shows these data:

EU Assistance

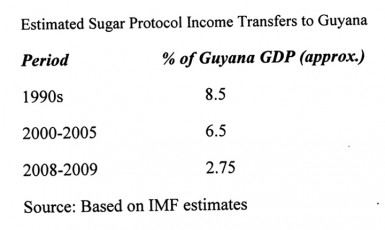

Several readers seem to believe (mistakenly) that, after the EU’s denunciation of the SP, Guyana had reasonably opted to continue its traditional sugar industry, because at that time it was the cheapest producer of raw sugar in the region. The data, however, show otherwise. In the mid-2000s, Guyana’s cost of sugar production was estimated at 21 US cents/lb. This was 31 per cent above Belize (16 US cents/lb). It was, however, substantially below the others as can be seen in Table 2.

Conscience money

EU assistance has been provided as Accompanying Measures to support ACP raw sugar exporters to its market, as they adjusted to the four-year staggered decline in the price of sugar. All beneficiaries are required to develop (together with the EU) national strategies and bodies for the implementation of these Accompanying Measures. Guyana formed the Guyana National Action Programme (GNAP) for this purpose and multiannual programmes were put in place in 2006, the first of which covered 2007-10 and the second 2011-13. The third is presently in place.

Initially, support was provided to specific sugar projects jointly identified by Guyana and the EU. Presently the assistance is given as general budgetary support and therefore paid directly into the Consolidated Fund.

Previously, I had termed this assistance “conscience money”, which Caribbean mendicant governments have accepted in exchange for not legally challenging the EU’s denunciation of the SP. Readers should recall the EU had cynically denounced the SP when it no longer served its interests, although the SP was framed as a treaty of “indefinite duration”, which could not be unilaterally denounced. I stand by that judgment today. Indeed what further concerns me is that, despite abundant evidence, which shows GuySuCo cannot deliver the industry’s salvation, the EU has never championed calls for a National Task Force to consider sugar’s role over the very long run (to 2050); and arising from this, therefore, how its funding could best be directed towards assisting in alternative scenarios. Instead it continues to throw good money after bad, in order to salve its conscience while ignoring the plight of the industry and country.

Up to mid-2013 as much as 91.5 million euros of assistance had been provided by the EU. Nominally, these funds are supposed to be disbursed on the basis of mutually agreed indicators, developed jointly by the EU Delegation to Guyana and the Steering Committee of GNAP. These include specific conditions related to industry investment, and performance areas. I shall assess this as the columns proceed.

In mid-2013, the government had proffered to the EU a Draft Strategic Plan (2013-17) as the firm expression of its commitment to performance improvements. It further promised to finalize the draft shortly. Regrettably, we are at the end of the second month of 2014, and to the best of my knowledge no public announcement has been made about this.

Next week I shall begin to examine the industry’s performance indicators. During that examination I will comment further on the Draft Strategic Plan and the EU’s Accompanying Measures.