Introduction

At the request of several readers today’s column will evaluate the proposal which is finding favour in several highly-indebted Caricom countries for the payment of slavery reparations by the former slave-owning countries to slave descendants in the region, to be made in the form of national debt relief. This proposal will be examined from Guyana’s perspective. Indeed, as a rule slavery reparations should always be assessed from the national perspectives where present-day slave descendants reside in the region.

I shall establish that, from Guyana’s perspective, there are two crucial flaws in this proposal. First, it is made in either ignorance or complete disregard of Guyana’s current national debt situation. Second, today’s international best practices indicate that compensation to victims of calamities and disasters is most effective when made directly to the beneficiaries and not indirectly through governments. In what follows in this and next week’s column I shall elaborate on these two flaws.

Default and official spin

For the purposes of national debt relief the indicator which will most certainly be applied to establish Guyana’s debt burden is the official ratio of its external public debt to GDP. In this and the following section, I shall demonstrate why pursuing this goal makes little sense, given the particulars of Guyana’s present debt situation.

For the purposes of national debt relief the indicator which will most certainly be applied to establish Guyana’s debt burden is the official ratio of its external public debt to GDP. In this and the following section, I shall demonstrate why pursuing this goal makes little sense, given the particulars of Guyana’s present debt situation.

While in the early 1980s, Guyana’s public external debt had peaked at levels in excess of 500 per cent of its then GDP, today the official external debt/GDP ratio has averaged only 46 per cent during 2009-13. The reparations for national debt proposal, therefore, as it stands, is ridiculously undemanding from Guyana’s standpoint. Furthermore, official spin proudly claims far and wide that Guyana no longer has a debt problem! This boast is aimed at striking a sharp political contrast with the 1980s, when Guyana’s external debt burden was so immense that the then government had defaulted on its external debt obligations in 1982.

Since that default Guyana has participated in several globally-sanctioned debt relief schemes, sponsored by the international community. For the benefit of some readers, I shall discuss this more fully later in the hope it would reinforce my proposition that Guyana should not prioritize national debt relief in exchange for reparations payments, even if the rest of Caricom may want otherwise.

Data considerations

There are first data considerations to ponder regarding this matter. According to the publication World Bank Debt Tables, Guyana’s total public sector external debt obligations should include those of 1) the central government and all its agencies; 2) all subsidiary governmental bodies and their sub-divisions; 3) all autonomous public bodies; 4) all state enterprises and other related enterprises (like the Special Purpose Vehicles (SPVs) created by NICIL to partner with foreign investors to execute local projects). All SPVs should be included because they generate implicit and explicit obligations for the government in event of their inability to repay.

My experience suggests that Guyana’s official public sector debt information, as presently reported, may well understate government’s implicit and contingent external liabilities. In particular, this may be occurring in the SPVs that do not enjoy arms length independence from the government. The suspicion expressed here, however, is not officially supported and therefore I am confident it will be ignored in the data provided by official sources.

A second data concern is that rebasing the calculation of Guyana’s GDP accounts on 2006 prices has resulted in substantial increases for the reported size of Guyana’s annual GDP estimates after that year. Indeed simulations show that these increases range from two-thirds to three-quarters of the national accounts values, when computed and compared to the results based on the previous 1988 prices.

The conclusion therefore is that Guyana’s external debt burden will be measured as its official external debt as a proportion of GDP. However, if the official external public debt (the numerator) is underestimated and the GDP (the denominator) is overstated, this yields a smaller debt burden indicator. This resulting smaller debt burden buttresses today’s official spin that Guyana’s debt crisis has disappeared under the PPP/C administration. The unintended consequence, however, is that it reduces the force of the claim that Guyana is today burdened by public debt.

Debt relief

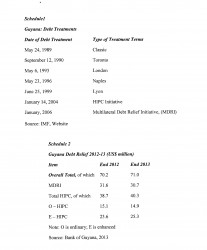

The question to be answered at this stage is: what has accounted for the dramatic turnaround in Guyana’s public debt fortunes after 1982? In large measure this is attributable to the successful global campaign to promote debt relief for beleaguered poor countries. Schedule 1 below provides information on the key debt relief arrangements Guyana had received during this period. These schemes were all aimed at 1) reducing its debt overhang, and 2) returning the country to debt sustainability. As the information shows debt relief was provided through Paris Club; non-Paris Club commercial creditors, HIPC I; HIPC II; and the Multilateral Debt Relief Initiative (MDRI). Readers may be somewhat surprised to learn that debt relief continues to this day, as revealed in Schedule 2.

Next week I shall wrap up this discussion on the proposal that reparations payments should be used to finance debt relief for Guyana by providing further data pertaining to Guyana’s debt situation and afterwards consider the second flaw. My recommendations will be that reparations should go, in the main, directly to slave descendants and not mediated through any Government of Guyana for any so-called ‘national purpose’ whatsoever.