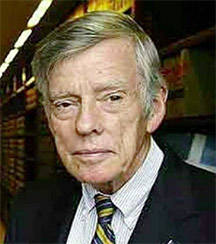

NEW YORK/BUENOS AIRES, (Reuters) – The U.S. judge in Argentina’s long-running debt battle with hedge funds threatened a contempt-of-court order yesterday if the nation did not stop issuing false statements about having made a required debt payment on restructured sovereign bonds.

U.S. District Judge Thomas Griesa in Manhattan railed at Argentina’s lawyers from Cleary Gottlieb Steen & Hamilton following the publication of another so-called legal notice insisting the government has met its payment requirements and was therefore not in default.

Griesa said these notices were “regularly” and “systematically” omitting the vital obligations of the Republic.

Holding a newspaper copy of the notice, which appeared Thursday, Griesa said if the false statements did not stop, a contempt of court order will become necessary.

Griesa said he was not going to go further than a warning for now, but that could change. He repeated that the two sides must continue negotiating with the aide of mediator Daniel Pollack.

“We will continue to work tirelessly to defend the rights of Argentina,” Economy Minister Axel Kicillof said on public television in Argentina, adding that at the hearing in New York on Friday, “Judge Griesa did not resolve anything.

“He created this confusing and extraordinary situation,” said Kicillof, who also played down concerns the case would cripple investment in Argentina.

Griesa did not specify whether he would seek to sanction Argentina or its lawyers, though he said he was “glad” to hear Jonathan Blackman, Argentina’s lead lawyer, say his firm, Cleary Gottlieb, did not aid in preparing the government’s latest legal notices.

In rare circumstances, U.S. judges have held foreign governments in contempt and imposed monetary penalties. But such sanctions can be difficult to enforce, and federal appeals courts have split on whether foreign governments can be held in contempt at all.

Federal law largely protects the assets of foreign governments held in the United States, said Michael Ramsey, a professor of international law at the University of San Diego.

“You can’t put Argentina in jail, so I’m not sure what he’d have in mind besides monetary sanctions,” Ramsey said. “Argentina has refused to pay a valid judgment and I don’t see why it wouldn’t also refuse to pay a valid contempt order.”

Blackman also complained of being attacked and lampooned by the lobby group American Task Force Argentina, which is partly funded by holdout investors.

Argentina missed a coupon payment after a grace period ended on July 30, pushing it into default on restructured debt from a previous default in 2002 on roughly $100 billion in sovereign bonds.

The government settled with nearly 93 percent of its bondholders in two restructurings but two deep-pocketed distressed debt investors held out and did not participate in the exchanges in 2005 and 2010. They are by far not the only holdouts, but have been the most prominent in their fight for full repayment on debt they bought at pennies on the dollar in a case that essentially comes down to a contract dispute.

Griesa, in 2012, awarded these holdout investors led by NML Capital Ltd, an affiliate of the $24.8 billion hedge fund Elliott Management Corp, and Aurelius Capital Management, who won a $1.33 billion judgement.