New Governor

The appointment of a new Governor of the Bank of Guyana would be major financial news in many parts of the world if Guyana was a major world economy. But notice of the new appointment will pass soon and the financial system in Guyana will remain unchanged since the new leadership of the central bank does not anticipate any changes in monetary policy in the foreseeable future. Yet, this very important appointment carries with it responsibilities that can impact the competitiveness of Guyanese products abroad and the profitability of many businesses at home. Among the responsibilities is that of ensuring exchange rate stability as it has the potential of causing the money supply to expand or decline, and as a consequence, impact the rate of inflation in the country. Interest in the behaviour of the exchange rate is just as important as interest in the rate associated with the cost of borrowing money and in making the Guyana economy strong. For this reason, this article examines the exchange rate arrangement of Guyana and the challenges that will confront the new governor and his team from that policy.

Problematic

Exchange rate policy is regarded as the most problematic international monetary issue in the world and Guyana had to confront that problem from the time it became an independent nation. Exchange rate policy involves determining the domestic price of a foreign currency. In other words, it regards the currencies of other countries as commodities and seeks to establish a purchase price for those currencies. It then turns around like any merchant and determines the price at which it will sell the currency, thereby establishing a margin of profit for itself. The relevance of an exchange rate is in its ability to permit residents of different countries to buy from, and sell to, each other with minimal difficulty. Many items of goods enter cross-border trade. The continual advancement of technology has also enabled capital markets to develop and many financial instruments have become part of the cross-border transactions between countries. The existence of exchange rate policies also enables producers to shift resources from one country to another and carry on production through subsidiaries and joint ventures. It also enables the production of standardized products such as those sold by fast-food chains to move overseas without the owners of the products themselves having to move and own the production facilities offshore. The economic exchanges that take place under those various types of transactions are facilitated with the use of foreign currencies that are sold on the foreign exchange market.

Decentralized dealership

The foreign exchange market is the largest market in the world with trillions of dollars changing hands every day. It is not a centralized market but one that is made up of a decentralized dealership structure and limited transparency. It is this fragmented and not well understood market that provides the liquidity that is needed to keep international trade and production going. The market is important for Guyana because of the openness of the economy. The industries in Guyana that employ the most people sell their products overseas. The sugar industry, the rice industry, the forestry industry, the gold industry, the bauxite industry, the fishing industry and the manufacturing industry rely heavily on the export market to sell their products. Some important industries are more dependent than others on the foreign markets. Sugar, rice, bauxite and gold depend almost exclusively on the foreign markets to earn their revenues. Without foreign exchange rates, they would not know how much to price their products.

The foreign exchange market is the largest market in the world with trillions of dollars changing hands every day. It is not a centralized market but one that is made up of a decentralized dealership structure and limited transparency. It is this fragmented and not well understood market that provides the liquidity that is needed to keep international trade and production going. The market is important for Guyana because of the openness of the economy. The industries in Guyana that employ the most people sell their products overseas. The sugar industry, the rice industry, the forestry industry, the gold industry, the bauxite industry, the fishing industry and the manufacturing industry rely heavily on the export market to sell their products. Some important industries are more dependent than others on the foreign markets. Sugar, rice, bauxite and gold depend almost exclusively on the foreign markets to earn their revenues. Without foreign exchange rates, they would not know how much to price their products.

The items to keep the wheels of industry turning and households satisfied also rely on foreign exchange. Fuel is needed to keep cars moving and households and businesses lighted and producing. At this juncture of Guyana’s development, capital equipment that is used in industry and households also are imported. The availability of foreign exchange to meet the demand for those products is critical. Guyana has done this successfully for several decades now. It has been using what the IMF describes as an independently floating exchange rate. This means that the exchange rate is determined by the supply and demand for foreign currency. Intervention by the Governor and his team would have to be to prevent undue fluctuations in the exchange rate, instead of seeking to establish a level for it. The presumption that we could make here is that the governor and his team would pursue an independent monetary policy.

Possible options

The exchange rate arrangement being used by the governor and his team was created by the Hoyte administration in the late eighties following the earlier introduction of the cambio system. It was a choice from among several possible options. Those options included exchange arrangements with no separate legal tender. This would involve a decision to use the currency of another country as is done by Panama which uses the US dollar as its currency. Adopting such a regime implies the complete surrender of independent control over domestic monetary policy. Other options included pegged exchange rates and managed floating exchange regimes. These imply some form of dependence on other currencies or deliberate intervention periodically by monetary authorities to set the exchange rate.

The exchange rate arrangement being used by the governor and his team was created by the Hoyte administration in the late eighties following the earlier introduction of the cambio system. It was a choice from among several possible options. Those options included exchange arrangements with no separate legal tender. This would involve a decision to use the currency of another country as is done by Panama which uses the US dollar as its currency. Adopting such a regime implies the complete surrender of independent control over domestic monetary policy. Other options included pegged exchange rates and managed floating exchange regimes. These imply some form of dependence on other currencies or deliberate intervention periodically by monetary authorities to set the exchange rate.

Guyana chose to adopt the freely floating exchange rate policy after contemplating using a basket of currencies. That policy was consistent with the economic philosophy that the Hoyte government had adopted – a free market approach to development. The exchange rate therefore is determined by the people of Guyana by the amounts that they demand from, and supply to, the market through the cambio system. It is not clear what led the PPP/C administration to retain this Hoyte administration policy, but some speculate that it was the oversight authority of the International Monetary Fund.

This perspective is a reasonable one because the IMF has direct responsibility for managing the international monetary system which includes oversight for exchange rate policies. All member countries of the IMF have to report their choice of exchange rate arrangement to that organization. The IMF takes exchange rate management seriously because its Board of Directors devotes much time to the evaluation of the exchange rate arrangement and economic policies of member countries. The IMF uses for this

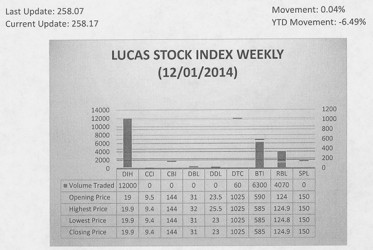

The Lucas Stock Index (LSI) rose 0.04 per cent in trading during the first period of December 2014. The stocks of four companies were traded with 22,430 shares changing hands. There was one Climber and one Tumbler. The value of the stocks of Republic Bank Limited (RBL) rose 0.73 per cent on the sale of 4,070 shares while the value of the stocks of Guyana Bank for Trade and Industry fell 0.85 per cent on the sale of 6,300 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 12,000 and 60 shares respectively.

purpose a tool that is referred to as Article IV Consultations.

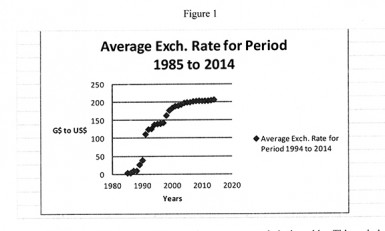

It is this policy of the Hoyte administration that the new governor and his team will continue to work with to ensure price stability, and that exports of Guyana are competitive. The graph below shows that there is something to be said for this Hoyte administration policy once it is implemented properly.

Figure 1

It reveals that from about 2007 to 2012, the exchange rate was relatively stable. This period coincides with the best years for gold prices which enabled Guyana to hold large amounts of reserves. From 1985 to 1992, Hoyte made the choice to allow the exchange rate vis-à-vis the US dollar to be settled by market forces. It is a period that coincides with higher demand for US dollars by households and businesses. Both groups were acquiring more assets during that period thereby allowing the economy to expand rapidly. The graph also shows that the exchange rate appears to be trending upwards in 2014. This is a trend that could be influenced by movements in the price of gold. The decline in gold prices is already leading to lower output and most likely lower amounts of US dollars.

Not alone

The governor and his team will not be alone in this endeavour. The IMF will continue to play the management role that it has for the international monetary system and will keep a watchful eye on Guyana. One could expect therefore that the Hoyte administration policy will continue under the new Governor and his team.