Negative territory

For the first time in five years the stock index prepared by this writer has ended the year in negative territory. A stock index is a manifestation of what investors in the market think would happen to the earnings of companies. For those who study the stock market, the index also serves as a measure of the likely risks associated with those companies. The stock market recorded very good returns in most of the years which are tracked in the Lucas Stock Index (LSI) prepared by this writer. From 2010, the year when the index started, the performance of the market was very robust on the steady appreciation in the price of the stocks that are part of the index. The value of the index rose 16 per cent in 2010. The index continued to rise in 2011 where it gained 28 per cent. The index had equally good years in 2012 and 2013 where many of the stocks continued their positive movement in price. As a result, the index rose 41 per cent in 2012 and 30 per cent in 2013. Last year, however, the index lost nearly seven per cent of the value that it started with. The economic situation could be bad news for the government which might try its best not to reveal it to voters.

Direction

Additionally, the stock index of a country is one of many tools that is used to indicate the direction in which the economy of a country is heading. The companies in the LSI represent over 20 per cent of the market. Since the LSI is market weighted, the decline in value suggests that the overall direction of company profits in 2014 might not be as good as last year. Further, it could be an indication that the overall economy itself might not have done as well as in previous years. The prospects for 2015 might not be good either, though the fall in oil prices could be a wild card in the game. On the one hand, the lower prices could spur both domestic investment and consumption spending while, on the other, it could lead to a scaling down of foreign investment in oil exploration. Unless oil prices remain at their surprisingly low level, Guyanese could expect output to be much lower in 2015 than it was in 2014.

Early availability

The LSI is comprised of companies from the manufacturing, banking and the distribution sectors. These three sectors contribute about 25 per cent of the output of the Guyana economy. As such, the sectors play significant roles in the fortunes of the country and the performance of the companies in those sectors matter to the quality of life that Guyanese enjoy. The companies also have different financial years and report on their performance at different times. The use of calendar and fiscal years means that not all the companies would be ready with their financial reports at this time of the year. About 56 per cent of the companies in the LSI have December as their financial year while 44 per cent of them have September as their financial year-end. But the index speaks about all of the companies and what it says for the future of the economy. The early availability of the results of the index enables us to form an early judgment about the economy. The seven per cent decline in the value of the index seen in the graph below not only represents the biggest decline in the value of the index, it also represents the first time since 2009 that the index did not see positive growth.

The LSI is comprised of companies from the manufacturing, banking and the distribution sectors. These three sectors contribute about 25 per cent of the output of the Guyana economy. As such, the sectors play significant roles in the fortunes of the country and the performance of the companies in those sectors matter to the quality of life that Guyanese enjoy. The companies also have different financial years and report on their performance at different times. The use of calendar and fiscal years means that not all the companies would be ready with their financial reports at this time of the year. About 56 per cent of the companies in the LSI have December as their financial year while 44 per cent of them have September as their financial year-end. But the index speaks about all of the companies and what it says for the future of the economy. The early availability of the results of the index enables us to form an early judgment about the economy. The seven per cent decline in the value of the index seen in the graph below not only represents the biggest decline in the value of the index, it also represents the first time since 2009 that the index did not see positive growth.

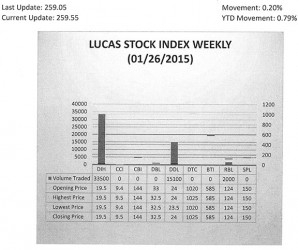

The Lucas Stock Index (LSI) rose 0.20 per cent in trading during the fourth period of January 2015. The stocks of three companies were traded with 50,600 shares changing hands. There was one Climber and no Tumblers. The value of the stocks of Republic Bank Limited (RBL) rose 0.81 per cent on the sale of 2,000 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH) and Demerara Distillers Limited (DDL) remained unchanged on the sale of 33,500 and 15,100 shares respectively.

This development is significant because in 2009 when the LSI fell 1.5 per cent the economy barely rose 1.3 percentage points above the 2008 output. But at that time, gold production and prices were on the move. This time gold production is down with the likelihood that the performance of the economy could be even below two per cent for at least two reasons. One, primary commodities drive the economy and its largest player, gold, is not doing well and one of its other players, sugar, is helping foreigners more than it is helping sugar workers. Two, the stock index suggests that the largest companies in the economy did not perform as well as expected either.

Gold and sugar

The primary commodity sector is essentially the agricultural sector and the mining sector combined. Within that combined group are the gold and sugar industries. Gold production and export sales made significant contributions to the economy since 2008. It started with the financial crisis in the USA which encouraged many investors to seek refuge in gold. The rush to gold sent the price of the precious metal on a continuous ascent until it peaked at the US$1,900 mark. Gold at that price made almost any mining operation successful. The price was more than enough to lure marginal players into the industry. Miners began to expand operations using loans from commercial banks and suppliers of equipment. They forgot that bankers were often thought of as fair weather friends. They lend you an umbrella when the sun is shining and take it back as soon as the rain begins to fall. As a result, when the price of gold began to fall and miners were not earning enough money to repay loans, banks and other companies who leased them equipment began to seize the equipment. Naturally, this development has had an impact on production.

At first the government seemed surprised that production had taken a steep drop in 2014 and began accusing miners of hoarding gold. However, the Guyana Gold and Diamond Miners Association (GGDMA) disagreed with the government and argued that the decline in declarations was a direct result of a decline in production. The government seems to have accepted the reality that gold production was down close to 20 per cent and will have to live with the realization that revenues accruing to the Guyana Gold Board will not rise above 60 per cent of 2013’s earnings. The extra money that people had over the past five years as gold prices soared is no longer there. This shift in consumer behaviour was likely to affect the wholesale and retail businesses as consumers cut back on their spending. The problem of consumers is worsened with the situation of sugar being as bad as it is. The government produces sugar at US40 cents per pound and sells it abroad at US18 cents per pound. This forces all other Guyanese to give up US22 cents per pound of sugar that is never delivered to them. That money is given to the consumers of sugar who live outside of Guyana.

Company performance

In a few weeks, this column will begin to look at the performance of the companies that are part of the LSI to see the extent of the impact of their business and corporate strategies on their performance. It should be noted at this point that the index provides some evidence of their positive or negative performance. Banks DIH has already released its annual report and has already held its annual general meeting to consider the 2014 report. As such, the information is out already where DIH is concerned. The value of DIH’s stock declined three per cent during 2014. The data reveals too that the company recorded a decline in production of about four per cent. The decline in production had to be offset by an increase in price because intermediate consumption costs were up by seven per cent. It is clear however that DIH could not recover all of the higher production costs in the price hike. At the same time, Citizens Bank reported a decline of nearly 56 per cent in its stock value during the same review period. This is a substantial change in value which reflects an unusual movement in the market. If this is indeed the case, then CBI was likely to turn in an even poorer performance in 2015.

While the other companies are yet to release their annual reports and to convene their annual shareholders’ meetings, one could speculate as to what they might report by way of performance. With the exception of CCI, the other manufacturing companies in the LSI on the whole should do rather well, or at least should not be doing any worse than last year. Challenges obviously are there before them, but judging from the performance of their stocks, the situation does not look too bad. Demerara Distillers Limited saw its stock value rise 24 per cent while that of Sterling Products Limited rose 15 per cent. One could expect these two companies to see their profits increase further in 2015 on the strength of the apparent increased demand for their products.

The situation involving the three remaining banks is quite interesting as well. Demerara Bank Limited, the smallest of the three banks, saw its stock value rise two per cent while the value of the stocks of both Republic Bank and GBTI fell by two per cent each. It would appear as if profits for the two larger banks, RBL and GBTI, did not grow as fast as they did in the past year. Again, given the significance of the positive change in stock value, it is likely that DBL could see its profits expand while the other two might have to work harder to grow their profits in the current year. The single company that belongs to the distribution sector saw its value fall seven per cent from that of 2013. The performance of this stock might be a sign of what to expect in the services sector when the government reports on the performance of the economy in 2014.

Slow march

With the economy expected to do badly in 2014, one should not be surprised to see the government slow march the results of the economy in this election year. Several important companies could report results that were worse than expected. Unless economic activity expands in other areas to compensate for the lower gold and sugar production, the prospects for 2015 could be bleak. However, the decline in oil prices might help to limit the damage that could be done.