Stabroek Business has learnt that the region’s first ever credit-rating agency, the Trinidad and Tobago-based Caribbean Information and Credit Rating Services Ltd (CARICRIS) is currently engaging the Bank of Guyana (BoG) with a view to the local entity becoming a member of its Board of Directors.

The BoG would be joining other regional central banks, the Inter-American Development Bank (IDB), the Caribbean Development Bank (CDB) and a number of prominent regional commercial banks on the board.

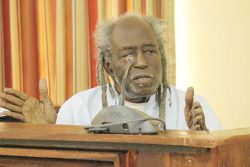

CARICRIS’s Chief Executive Officer Wayne Dass told Stabroek Business in an exclusive interview earlier this week that the entity continues to lobby the Bank of Guyana to join its 29 other shareholders which include the central banks of Trinidad and Tobago, Barbados, Suriname and the Eastern Caribbean in an initiative that seeks to bring more transparency to regional financial markets. Dass added that part of the focus of CARICRIS was on seeking to develop and integrate the financial markets for a number of small, mostly island states in the region and to issue credit ratings to countries, banks, insurance companies, credit unions and small and medium-sized enterprises. Dass told Stabroek Business that in order to ensure “a strong and transparent governance structure” no single shareholder possessed more than a 10 per cent share in CARICRIS. “The idea here is to create a structure that places limits on the influence of central banks,” Dass said.

Dass and two other CARICRIS officials were scheduled to leave Guyana today after conducting a two-day credit risk training exercise for local participants from major commercial banks and other financial institutions. He said representatives from Guyana’s Credit Bureau also participated in the training session. Independent experts recruited by CARICRIS provide for bond issuers, investors and financial market regulators national and regional scale credit ratings which measure the relative creditworthiness of entities in individual countries and the Caribbean as a whole.

Dass told Stabroek Business that apart from supporting the debt-raising efforts of entities in the region CARICRIS’ credit ratings also facilitate a more “scientific and risk-based approach to investment decision-making, bond-pricing and determination of capital requirements, services that make the institution “a critical part of the capital market infrastructure in the region.” He said that at a practical level the entity was able to provide “unbiased assessments of individual businesses that can help them in their search for financing. Dass said that a critical reason for the visit here earlier this week by the CARICRIS team was to continue to create a launch pad for improving relations with the financial and business sectors in Guyana. He said that the entity’s ongoing discussions with the local central bank was a function of its effort to bring the bank on board as a shareholder at the earliest possible time.

Dass said that while CARICRIS had taken “a long-term view” of its efforts to bring the Bank of Guyana on board, in the shorter term it was reaching out to business here in Guyana and in that regard had already started discussions with some of them.

Building stability in the financial system, improving transparency in the financial market and offering credit ratings, a service that is integral to a modern-day, risk-based regulatory framework are among the key desired effects of the relationship which CARICRIS seeks to build with Guyana, Dass said.