Introduction

After some introductory material, the lessons dealt with so far in this series on the management of Guyana’s public investment regime have concentrated on: 1) the “basic steps” needed to establish an adequately functioning organization of this regime and 2) the types of failures and weaknesses displayed in public projects during the 2000s. To those readers who have enquired about this, for sure the actual pool of projects considered in deriving the observations on defects exceeds the few items indicated so far.

A more representative pool would include such public projects as: the Moco Moco, Rupununi Hydropower Project, which spectacularly collapsed shortly after construction and has remained throughout the 2000s a derelict site, attracting visitors and tourists to climb its famous “999 steps” up the hillside on  which the hydropower facility was constructed; the more recent Amaila Falls Hydropower Project (AFHP) from which the original investors withdrew; the associated AFHP Access Road project, which carried a cost overrun that doubled the original budgeted project cost of US$30 million; the largest and longest incomplete project, the US$200 million Skeldon Sugar Modernization Project (SSMP); the associated Surendra Enmore Sugar Packaging Plant and irrigation pumps; the US$28 million flood control Hope Canal Project; the East Coast and East Bank roads scheduled for completion two years ago; the Cheddi Jagan International Airport Extension Project, deemed a “white elephant” by analysts, except for its runway extension); the recent collapsed e-governance, ICT, and fibre-optic project, which has been budgeted for to date US$20 million dollars in questionable undertakings and is presently being resuscitated under suspicious circumstances; the Government Specialty Hospital Project caught up in fraud; and, other recently concluded projects, which are already very controversial due to delays and other defects: the Marriott Hotel, Forensic Laboratory, and the Synthetic Athletic Track in West Demerara.

which the hydropower facility was constructed; the more recent Amaila Falls Hydropower Project (AFHP) from which the original investors withdrew; the associated AFHP Access Road project, which carried a cost overrun that doubled the original budgeted project cost of US$30 million; the largest and longest incomplete project, the US$200 million Skeldon Sugar Modernization Project (SSMP); the associated Surendra Enmore Sugar Packaging Plant and irrigation pumps; the US$28 million flood control Hope Canal Project; the East Coast and East Bank roads scheduled for completion two years ago; the Cheddi Jagan International Airport Extension Project, deemed a “white elephant” by analysts, except for its runway extension); the recent collapsed e-governance, ICT, and fibre-optic project, which has been budgeted for to date US$20 million dollars in questionable undertakings and is presently being resuscitated under suspicious circumstances; the Government Specialty Hospital Project caught up in fraud; and, other recently concluded projects, which are already very controversial due to delays and other defects: the Marriott Hotel, Forensic Laboratory, and the Synthetic Athletic Track in West Demerara.

To this litany of well-known troubled public projects one should add 1) funds wasted on diverse “small projects” (road repairs, bridges, culverts, drains, and community and government buildings) as well as “medium-sized projects” (wharves, ports and aircraft landing strips). 2) large bailouts provided to ailing state enterprises without prior independent economic evaluation or required oversight reporting to the National Assembly: especially sugar (Guysuco) and power, Guyana Power and Light (GPL) 3) highly controversial public procurement practices, especially for pharmaceutical supplies 4) the Presidential Spectrum Giveaway prior to the last 2011 national elections.

Of note the systematic/systemic defects earlier highlighted in public projects are not designed either to cast blame or criticize for criticism sake, although that has its place in public discourse; instead the aim is to pinpoint special areas of concern that the newly elected Government might wish to prioritize for reforms. From global experience, analysts have recommended that, timely discussions/analyses of these matters could contribute toward locating “root causes”, which surprisingly, experience shows lie more often than not in a country’s cultural and social environment than its economic and financial!

Today’s lesson 4 begins an assessment of the amount of public funds involved in Guyana’s public investment spending; and, therefore, the resources put at risk if mis -management, fraud, and other inefficiencies determine outcomes. This discussion pays attention first to the onerous burdens Guyana carries arising from criminal fraud in public procurement.

Public procurement spending and fraud

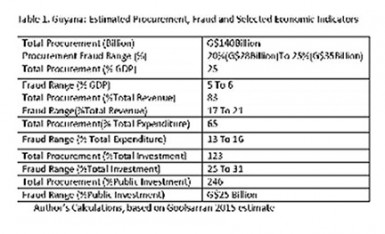

There are varying estimates of the size of Guyana’s public procurement spending and the amount of fraud that takes place. After questioning, insiders have provided “back of the envelope” estimates of this fraud ranging from a low of one-fifth to a high of one-half of total procurement. Fortunately, in a recent column (Public Financial Management post 5/11: An action plan for improvement, Part 11, April 13 2015) former Auditor General Anand Goolsarran has provided an updated estimate of public procurement equal to G$140 billion. He also supplied a further estimate of fraud, which he states ranges from one-fifth (20%) to one-quarter (25%) of this total. Compared to others his estimate is conservative but probably the most informed, because of positions Goolsarran has held in Guyana’s state financial management. These estimates are shown in Table 1 below. They are compared to selected economic indicators in order to highlight their relative size and importance in the management of Guyana’s public investment programme.

Table 1. Guyana: Estimated Procurement, Fraud and Selected Economic Indicators

Table 1. Guyana: Estimated Procurement, Fraud and Selected Economic Indicators

Onerous Affliction

Table 1 reveals total procurement is clearly large (G$140 billion); equaling 25 percent of IMF estimated 2014 GDP at current basic prices (G$570 billion). Procurement fraud, estimated at 20 to 25 percent of the total, yielded a severe economic haemorrhage of between G$28 and G$35 billion. By Guyana’s standards this represents an onerous affliction and, how onerous, is revealed when compared to key economic indicators.

Thus total procurement equals 1) 25 percent of 2014 GDP 2) 83 percent of Government of Guyana projected 2014 revenue (G$168 billion) 3) 65 percent of its projected expenditure (G$216 billion) 4) 123 percent of 2013 actual total investment (G$114 billion) and, 5) 246 percent of 2013 public investment (G$57 billion)

Similar comparisons for procurement fraud reveal this at 1) 5 to 6 percent of GDP 2) 17 to 21 percent of total revenue 3) 13 to 16 percent of total expenditure 4) 25 to 31 percent of total investment and, 5 to 8 percent of public investment.

Conclusion

Criminal fraud of such magnitude in public procurement relentlessly plagues the management of Guyana’s public investment programme; and, synergizes with all the other organizational and process deficiencies and inefficiencies already indicated! Next week I will pursue this topic further.