CARACAS, (Reuters) – President Nicolas Maduro has ruled out dollarizing Venezuela’s economy as a way to resolve the recession-hit OPEC nation’s chaotic currency situation.

Speculation Venezuela could adopt the U.S. currency emerged after news this month that some local divisions of foreign car companies might charge in dollars due to their difficulties in obtaining greenbacks under the nation’s currency controls.

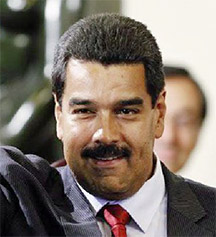

But Maduro, the successor to socialist leader Hugo Chavez, said such talk was far off the mark.

“In Venezuela, there has not been nor will there be dollarization. Our currency, proudly, is and will forever be the bolivar,” he said in a phone call to state TV late on Tuesday.

Venezuelans were shocked last week when the bolivar, in unofficial trade, slid to 423 to the dollar, according to the widely tracked DolarToday web site.

While it strengthened to 343 on Wednesday it still is far weaker than the official exchange rates. Maduro slammed the DolarToday site as being run by “ultra-right” opposition activists in Miami.

When Maduro came to power two years ago, the bolivar was trading at 23 to the dollar on that black market. Its slide has been a factor in creating the worst inflation in the Americas.

The government operates a complex, three-tier currency control system with the strongest rate of 6.3 bolivars per dollar for priority goods such as food and medicine, and the weakest rate of 200 via a “complementary” system called Simadi.

Last year’s tumble in oil prices forced the currency control mechanism to reduce disbursement of greenbacks, spurring shortages of consumer goods and leading to panicked dollar purchases on the unregulated market.

Inflation last year was 68 percent, and economists are widely predicting three-digit price rises this year. The government has not published data for the first four months.

Opposition critics say Maduro has delayed much-needed reforms to the country’s state-led economic model, including an easing or elimination of the exchange controls.