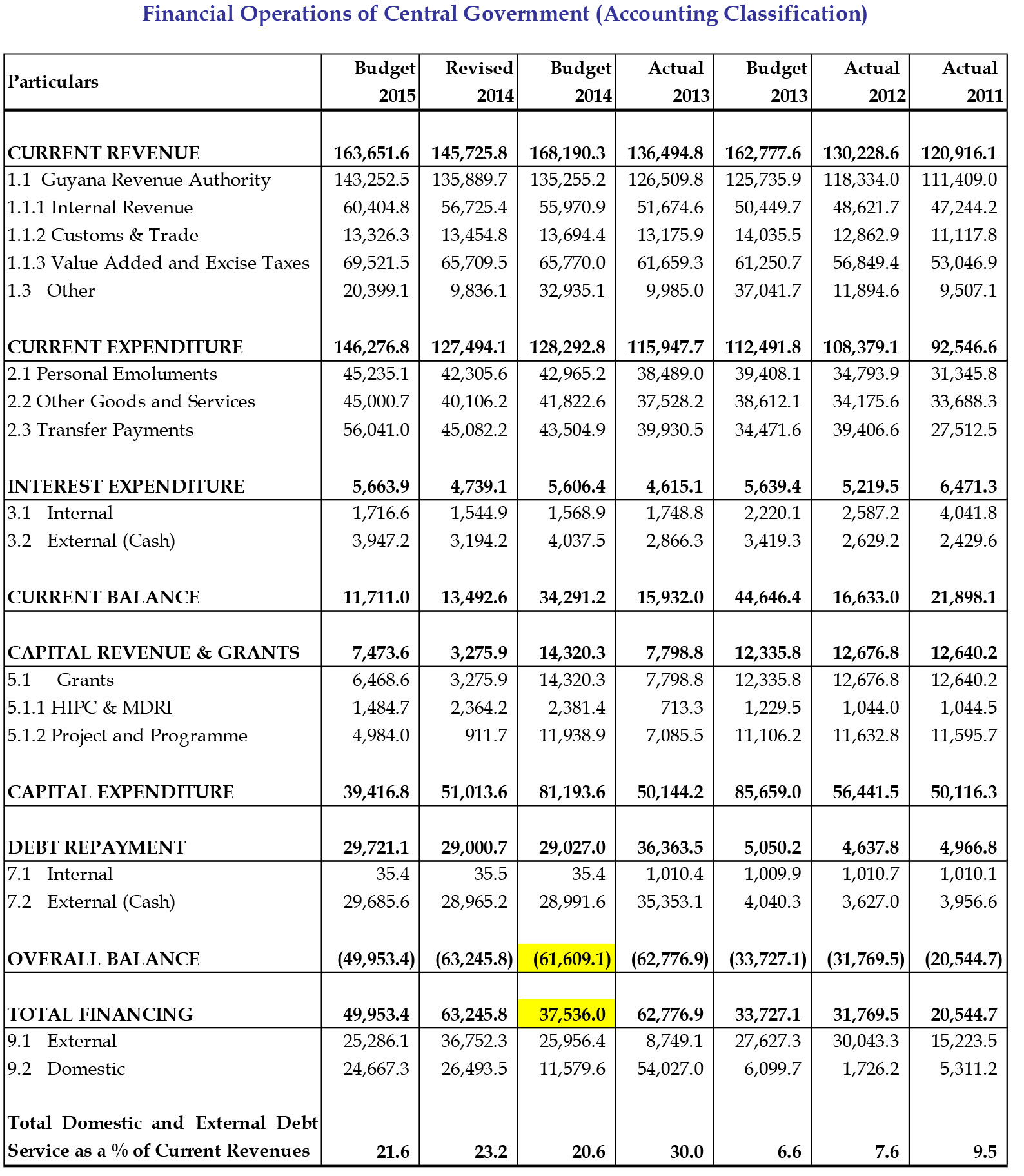

The Government’s projected Financial Plan for 2015 is summarised and tabled on page 27 of this Publication. The current balance projects a surplus of $11,711 million, a decrease of $1,782 million or 13.2% over revised 2014. After capital receipts and expenditure, the plan projects an overall deficit of $49,953 million compared to a deficit of $63,246 million in 2014, 50.1% of which is financed by external borrowing.

The main elements of the 2015 Plan are:

Total current revenues are projected to increase by $17,926 million to $163,652 million or by 12%. Of this, the Guyana Revenue Authority is expected to bring in revenues of $143,253 million or 87.5% of total revenue, an increase of $7,363 million or 5.4% over 2014.

Of the GRA’s collections, the Internal Revenue is projected to bring in $60,405 million compared with $56,725 million in 2014, a 6.5% increase compared to an 8% increase in 2014, while Value-Added and Excise Taxes are expected to earn $69,522 million compared to $65,710 million in 2014, an increase of 5.8% compared to 7% increase in 2014. Collections by the Customs and Trade Administration are anticipated to be $13,326 million, a decrease of $129 million or 1% compared to a 3.9% increase in 2014.

Analysis of capital revenue by type

Capital expenditure of $39,417 million represents a projected decrease of $11,597 million or 22.7% over revised 2014 of $51,013 million. The big ticket items of capital expenditure include the ICT project on which a further $2,631 million will be spent in 2015, $194 million on Basic Needs Trust Fund, $390 million on the provision for tax system, bond, fence, sheds, furniture and equipment for the Guyana Revenue Authority, $1,060 million will be expended on Low Carbon Development Programme and $378 million for the provision of buildings, purchase of vehicles, office furniture and equipment for the Guyana Elections Commission. Additional items include Amerindian Development Fund for the development of projects and programmes to the sum of $287 million, completion, construction and rehabilitation of drainage and irrigation canals and pump stations to the sum of $2,051 million and provision for the upgrading of roads for $1,242 million. The sum of $347 million was also allocated to the Amaila Falls Access Road although the government is not keen on continuing with this project which was fathered by the previous administration.

We also address the allocation of current and capital expenditures and the Amaila Falls Access Road funds allocation in Who Gets What in 2015 on Page 30.

Interest expenditure is projected to increase by 19.5% or $925 million. Domestic interest is projected to increase by $172 million or 11.1%, while interest on external debt is projected to increase by $753 million or 23.6%.

The principal element of debt repayments is projected at $29,721 million (2014: $4,954 million), made up of domestic debt repayments of a projected $35.4 million (2014: $35.5 million), while external debt repayments are projected to increase to $720 million. During 2015, domestic and external debt service as a percentage of current revenue decreased to 18.2% in comparison with 19.9% in 2014 revised.

The projected overall deficit of $49,953 million is proposed to be financed by external borrowings of $25,286 million and from domestic sources of $24,667 million.

Ram & McRae’s Comments

Even with the current slowdown in the economy, the projections anticipate a 12% increase in revenue with tax revenues contributing a significant portion of the increase.

On the expenditure side we note that current non-interest expenditure, a lot of which will have to be financed by borrowing, increased by almost 15%. The current state of the economy does not allow for significant cuts in expenditure but it is hoped that less reliance will be placed on deficit financing in future.

Since 2002 interest expenditure has been declining slightly and has been reasonably flat over the past four years as a result of the debt forgiveness and various restructurings that we have been beneficiaries of. During the same period capital expenditure showed steady increases until declining relatively sharply in 2007, then inexplicably climbing steadily from 2008 through 2012 at the height of the world financial crisis. From 2012 on there has been a steady and consistent contraction in capital expenditure reflecting the low level of investment that the country has been able to attract. On the other hand current non-interest expenditure fuelled by deficit spending has had a steeply and unsustainable upward trajectory.

While the government’s plan relies heavily on tax revenues, the Minister expressed some very strong concerns regarding the independence, integrity and structure of the Authority. Indeed even as the Budget was being presented a large number of senior staff were on leave. Tax expertise is only acquired after several years of training and experience. While the government may have good cause for significant change, it must make sure that the change process itself is properly managed.

The Accounting Classification of the Financial Operations of the Central Government show alarming ratios of Domestic and External Debt Service as a percentage of current revenue. Actual 2013 was as high as 30% falling to 23.4% in 2014 and is budgeted to be 21.6% at the close of 2015. By contrast Actual 2011 and 2012 were 9.5% and 7.6% respectively. The alarming ratios are a direct result of the unavailability of the restatement figures for these years.

As highlighted in yellow in the table above, a variance of G$24,073 million was reflected in the 2015 Estimates of the Public Sector, Volume 1 for Budget 2014 between the figure stated for Overall balance of $61,609 million and the Total financing of $37,536 million. It was explained that this variance represents the borrowing of funds from the PetroCaribe Fund by the previous administration to fund other entities and the restatement figures are not available since previously the PetroCaribe debts were never included in the external debt balance.