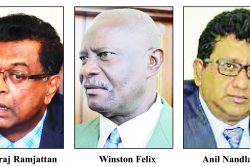

Government is considering using monies from the Consolidated Fund to aid the National Insurance Scheme (NIS), which is finding it difficult to pay out the minimum benefits to its contributors owing to two “reckless investments,” Finance Minister Winston Jordan said yesterday.

He was at the time speaking on the Income Tax (Amendment) Bill, which was passed after a second reading in the National Assembly, where the former PPP/C government was accused of irresponsibly investing NIS money in the now-collapsed CLICO (Guyana) Inc and the construction of the Berbice River Bridge.

The Bill amends section 16(1) of the Act to deduct NIS contributions from the chargeable income of a worker.

Jordan made it clear that government does not want a situation where persons cannot get benefits from the scheme. “This is the scenario now because NIS is constrained from giving better benefits because it continues to lose on this impaired investment. I believe, in some respect, that at the end of the day the Consolidated Fund may be asked to make good on this loss,” he said.

In 2012, the NIS registered its first ever deficit, with expenditure exceeding income. This persisted in 2013 and last year. It is unclear what the trend has been so far this year. The deficit has come in the wake of several actuarial reports which have warned that urgent steps must be taken assure the viability of the Scheme. While deficits have been experienced, the NIS’s insurance fund at the end of 2012 stood at $31 billion.

“It is incumbent on the NIS to be prudent in their investments of our resources that we are contributing so faithfully every month…,” Jordan said, before adding that everyone was hurt by these “reckless investments.” He said the CLICO investment led to the impairment of over $5.6 billion of the scheme’s money. He said too that from 2009 to now the NIS has lost $1.8 billion as a result, to which someone from the opposition benches shouted “that’s criminal man.”

The CLICO (Guyana) Investment was impaired after the monies were transferred to CLICO’s Bahamas’s subsidiary, which was later liquidated.

Jordan said that later the NIS made another “rather suspect investment” in the Berbice Bridge, from which it is yet to collect income. In January this year, the Berbice Bridge Company Inc wrote to the NIS – the holder of $950 million in preferred shares and other stakeholding — saying that it was unable to pay dividends for 2014 as it did not make a profit. The dividends would have improved the NIS’s financial situation.

“So essentially the NIS is in the unfortunate position where it is eating into its capital to make even the minimal benefits that was given available to its contributors but this cannot continue forever,” Jordan said before assuring that government will have to move quickly in addressing the problems facing the Scheme. “It is not going to be easy but it will be a fresh approach,” he further said, while adding and this will include the entrenching of mechanisms so that never again will NIS “be asked to do anything as reckless as they have done.”

According to Jordan, efforts were made to recover the lost money in the Bahamas but they have fallen short.

Opposition leader Bharrat Jagdeo later told the House that the opposition was willing to engage in a debate on the CLICO and the Berbice Bridge investments as well as the state of NIS. The Jagdeo administration had been fiercely criticised over this investment and the absence of adequate controls.

“When that debate takes place, you will see the difference in approach between the government of Guyana and the Caribbean… and even the world,” Jagdeo said, with particular reference to the collapse of CLICO.

Jordan said that the bill speaks to the reinstatement of a benefit that was “previously enjoyed but was inadvertently taken away with movements from a progressive system of taxation to the present regressive tax system. This benefit was taken away in 1991.”

He said that this is a benefit enjoyed throughout the Caribbean and it is critical to employees during their working and non-working life but it is also beneficial to the government. This measure, he said, “continues our quest to provide the good life for all Guyanese by giving back to them by putting more money into their pockets.”

Jordan spoke of the salary and pension increases that are to be paid shortly as well as the removal of VAT from various “poor people items” and said that the bill is another of government’s pro-poor measures.

Explaining how the measure works, he said that an employee earning $60, 000 a month will have a chargeable income of $10, 000 out of which they have to pay 30% along with $3,360 in NIS contributions. He said that as such the take home pay will be ($53,640). “When this bill is passed and the measures goes into effect that same person…will have a prepay of $50,000 that leaves $10,000 but also the $3,360 that they would have paid in NIS contributions for the month will also be deducted from the $10, 000 so that will leave a chargeable income of $6,640 and 30% of that is $1,992. Giving this person a take home pay of ($54, 648), this means that this person would have a saving or an extra money in his pocket every month of $1,008 or $12,096 per year more,” he said as fellow government MPs banged their desks in approval.

This measure, he said, will take immediate effect and that guidelines will be issued as to how “to treat in giving you back the money you have paid up to August and we will issue guidelines to make the appropriate adjustments from September onwards so that you start enjoying your benefits.”

In his budget speech, Jordan had said the measure would have been effective from Year of Assessment 2016.

Jagdeo said that the opposition had indicated it is are willing to support the early passage of all the supporting legislation to give effect to the budget measures. “We thought that when we had that discussion that the politics surrounding the debates had ended and that we would not use the debates or the presentations of the bills… to score political points,” he said.

According to Jagdeo, the calculations made by government have been “very convenient” and misleading and that this will be seen when public sector employees see their pay cheques at the end of the month.

He said the subsidy on NIS contributions has been removed and that the minister is yet to say how much disposable income will be removed from the earnings of public servants or give the net calculation of the withdrawal of disposable income from every family in the country that has school-aged children.