Complicated

In a process complicated by the prorogation of parliament and the holding of elections after the mandatory budget approval period had passed, the Granger administration had to put together a budget for 2015. The window for doing so was tight and the budget of necessity also had to squeeze in government demand for goods and services in 2015 in a finite period of time. The budget is the government’s policy document. It tells what principles the government intends to pursue and the policy lines that it intends to use as a means of achieving its broad goals. The policy lines, actions and policy measures of importance receive monetary allocations which in themselves offer some guide to the priorities of the government. The things of interest to Guyanese are hidden within that thicket of the many elements of public policy.

The general tendency is for Guyanese to look in the budget for the numbers that tell them how much importance the government attaches to them. The standard measure is often how much more money they will receive or will be able to take home as a consequence of adjustments in salary or adjustments in tax rates. In other words, Guyanese often look to see what their government can do for them. Seldom do Guyanese consider the contribution that they could make to increase the benefits that would flow from the government’s intended investment in them. This article looks at the budget to see what policy goals open up opportunities for Guyanese to work constructively with the government to create a better life for themselves.

Together

The 2015 budget presented by Minister Jordan is aimed at individuals, businesses and collectives. Between the interplay of principles, policy lines and measures are a series of instruments that target the welfare of individuals working in the public sector, private businesses and communities. Together they make up the benefits that Guyanese can expect out of the budget. Starting with the individuals, they have been earmarked to receive a series of personal benefits which should help to place them on higher financial ground. A start has begun with a combination of adjustments to the income and support that Guyanese could expect from their government. One area of adjustment is the salary of public servants. The increases range from six per cent to 26.4 per cent depending on where workers were on the salary scale.

The 2015 budget presented by Minister Jordan is aimed at individuals, businesses and collectives. Between the interplay of principles, policy lines and measures are a series of instruments that target the welfare of individuals working in the public sector, private businesses and communities. Together they make up the benefits that Guyanese can expect out of the budget. Starting with the individuals, they have been earmarked to receive a series of personal benefits which should help to place them on higher financial ground. A start has begun with a combination of adjustments to the income and support that Guyanese could expect from their government. One area of adjustment is the salary of public servants. The increases range from six per cent to 26.4 per cent depending on where workers were on the salary scale.

Economic challenges

Before proceeding with a discussion of the implications of the increase, it needs to be kept in mind that the fundamental economic challenge of making alternative choices from scarce resources remains for everyone who benefits from the increase. The higher rate of increase was a commitment by the new government to public sector workers in this country to help them lessen the burden of the economic choices that they have to make.

Spending

People do many things with the money that they receive. Economic thinking contends that persons with lower incomes tend to spend all of their money while persons with higher incomes do not spend the full increase that they receive. Spending all the money and failing to save for a rainy day is often criticized as irresponsible. But for some Guyanese, spending out their money is unavoidable. While the heavy spending is risky for the individual, it produces significant benefits for the economy as a whole. The higher the level of spending, the greater the impact that the salary changes will have on the economy. It is estimated that the marginal propensity to consumer of Guyanese is between 65 and 70 per cent of their income. That level of spending implies that for the rest of the year, the income could expand three times the increase in salaries if the entire increase was spent. This should lead to some positive impact on the economy.

Another personal benefit which has accrued to Guyanese from the budget is the reduction in value-added tax rate on several items. The tax expenditure on this item is $680 million. This is a benefit that is common to all Guyanese. The retention of this money in the hands of Guyanese consumers means that the economy could expand by over $2.2 billion in the remainder of the year if all the revenue returned to Guyanese was spent in that time period. A third personal benefit from the 2015 budget is the increase in old-age pension. This benefit is special to some Guyanese. The extension of that benefit to this special group of Guyanese would place about $8.6 billion in the hands of persons who need the help. A fourth personal benefit that accrues to another special group of Guyanese is the uniform vouchers for schoolchildren. This group of Guyanese will enable the economy to enjoy another $1 billion in revenue. The collective impact of the three programmes is an additional $11 billion injected into the economy.

Image of capital

The tax benefits are not directed at individuals alone. They are also directed at communities. Georgetown is one of those communities that is expected to benefit from the expenditure of the government. The money to be spent on Georgetown with the intent of resuscitating the image of the capital city is cited in the budget at $300 million. From the Georgetown Restoration Programme, Guyanese could expect to see an additional $1 billion impact on the economy. Then there is the community infrastructure improvement programme, though a mouthful, is much more expansive and ambitious than the Georgetown restoration project. Here, the government intends to remodel communities across the country. It also intends to preserve and maintain critical community infrastructure. The work encompasses the rehabilitation and maintenance of drains, small bridges and parapets in various communities across Guyana. Such investment, if fully funded, can add an additional $1.6 to the economy for 2015. Much of this depends on the speed with which the nearly $543 million could be disbursed and spent for the work to be done.

The tax benefits are not directed at individuals alone. They are also directed at communities. Georgetown is one of those communities that is expected to benefit from the expenditure of the government. The money to be spent on Georgetown with the intent of resuscitating the image of the capital city is cited in the budget at $300 million. From the Georgetown Restoration Programme, Guyanese could expect to see an additional $1 billion impact on the economy. Then there is the community infrastructure improvement programme, though a mouthful, is much more expansive and ambitious than the Georgetown restoration project. Here, the government intends to remodel communities across the country. It also intends to preserve and maintain critical community infrastructure. The work encompasses the rehabilitation and maintenance of drains, small bridges and parapets in various communities across Guyana. Such investment, if fully funded, can add an additional $1.6 to the economy for 2015. Much of this depends on the speed with which the nearly $543 million could be disbursed and spent for the work to be done.

Businesses

Businesses will also benefit from the planned expenditure of the government. One connector between communities and businesses is the sustainable livelihood and entrepreneurial development project. The motive for the project, poverty reduction, is the right one. However, one cannot be sure if creating enclaves of economic units without creating opportunities for synergy between them is the right way to do it. No one has been able to see an evaluation of similar types of projects by the PPP/C which were directed at residents in remote communities in Guyana. This information deficiency needs to be avoided by the new government. An equally tight linkage between business and community development interests is seen in the excise tax exemption that is given to the Toshaos on motor vehicles and ATVs. The focus on business moves from the small enclave to entities that operate on a larger scale. Businesses in the fishing industry and small-scale mining operations in particular can enjoy exemptions on a variety of items that are unique to each of the two industries. The exemptions granted to the fishing industry are geared towards occupational safety compliance. The link between safety and the tax exemptions are not that obvious in the mining sector.

Much expected

Despite the many positive features of the budget, one must wonder if beneficiaries of the budget proposals appreciate that much is expected of them in return. The budget appears to downplay this need. While it acknowledges that Guyanese welcome the change presented by the new government, the budget leaves it to the conscience of the people to decide if and how they will respond to the many challenges alluded to in the public expenditure document. One area of challenge which could do with a heavy dose of public-spiritedness is the commitment to fight corruption. Evidence has already emerged about the corrupt practices in parts of the public sector. It is likely more evidence would emerge as the results of the ongoing audits are made known to Guyanese. Those Guyanese with good ethics can contribute to the positive change that is needed in the service to stave off corrupt practices. Persons with the consciousness and the capacity to teach public servants how to negotiate situations of potential compromise could have a huge impact on the service.

Compliance obligations

Another area of interest is that of complying with the tax and NIS obligations. Guyanese taxpayers need to recognize that the government would only be able to deliver on its promises to them if it has the money to do so. That money is expected to come in the form of taxes paid by eligible taxpayers. There is a large gap between potential revenue and actual revenues collected, even after exemptions and zero-rated concessions are factored into the calculation. This gap exists for several reasons, but an important reason is the failure of many taxpayers to pay their taxes and to file tax returns. This failure is most obvious among the self-employed. Self-employment does not imply the need to be selfish, and the delinquent among that category of taxpayers must realize that they too benefit from government’s investment. In addition, some businesses seem reluctant to collect value-added taxes in favour of lowering prices to get the sale. One would hope that both individuals and businesses would make a special effort to bring themselves into compliance with the law without the Guyana Revenue Authority (GRA) having to become aggressive towards them. The free ride on government’s investment could have undesirable consequences. The many responsible leaders of the GRA are willing to work with taxpayers to help them understand how to bring themselves into compliance and avoid unnecessary penalties. They can help taxpayers to become better citizens.

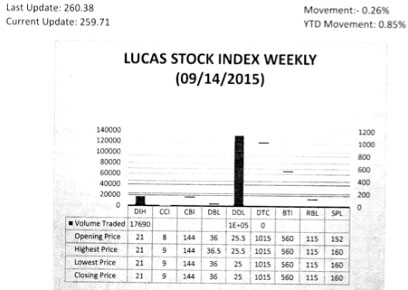

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) fell 0.26 per cent during the second trading period of September 2015. The stocks of two companies were traded with 149,420 shares changing hands. There were no Climbers and one Tumbler. The stocks of Demerara Distillers Limited (DDL) fell 1.96 per cent on the sale of 131,730 shares while the stocks of Banks DIH (DIH) remained unchanged on the sale of 17,690 shares.