The forensic audit report commissioned by the APNU+AFC government of controversial holding company NICIL has recommended criminal and/or disciplinary action against all those responsible for the interception of state revenues totalling $26.858 billion in violation of the constitution.

Similar action has been recommended in the final report of consultant Anand Goolsarran over the expenditure of sums by the National Industrial and Commercial Investments Limited (NICIL) in violation of the constitution.

Though submitted on October 26th this year, the government has been mum on the findings and have not released the report, a sign, observers say, that it is not prepared as yet to follow through on the consequences of the audits it has ordered.

NICIL’s activities had long been a source of contention for APNU and the AFC while they were in opposition and its auditing was one of the earliest assignments after they entered office as a coalition in May this year.

As he and others had argued before, Goolsarran found the sequestering of $26.8b by NICIL between 2002 and 2014 to be a violation of Article 216 of the Constitution and the related sections of the Fiscal Management and Accountability (FMA) Act. Disciplinary action is provided for under the following sections of the FMA Act: (a) Section 48 – Misuse of public moneys; (b) Section 49 – Liability for loss of public moneys; and (c) Section 85 – Liability of official”.

The forensic audit, which saw NICIL being given a chance to respond before the final report was presented to the government also saw a series of damning conclusions on other deals ranging from the sale of the government’s stakeholding in GT&T to the funding of the 2007 Cricket World Cup.

Goolsarran’s report also called for disciplinary action to be instituted against all those responsible for flouting National Assembly Resolution No. 32 of 17 December 2012 requiring NICIL to pay over to the Consolidated Fund “all revenues and proceeds from the sale of all State properties, except for those necessary administrative costs for maintaining and running its operations annually”. There had been a long-running dispute over this issue which eventually led to court action but Goolsarran had maintained that these funds had to be paid over to the Consolidated Fund.

Goolsarran’s report also recommended criminal/ disciplinary actions against all those responsible for other violations, including the failure to properly account for State resources under their control.

He also called for the termination of the Management Cooperation Agreement of 28 December 2001, as provided for under the Agreement and which agreement had resulted in violations by NICIL.

Further, Goolsarran said that NICIL should be liquidated as a private limited liability company under the Companies Act 1991 and a Receiver appointed to oversee the liquidation.

He further pressed for the reactivation of the Privatisation Unit as a department of the Ministry of Finance to manage the Government’s remaining investments after liquidation proceedings have been completed.

He added that his report should be referred to the State Assets Recovery Unit with a view to recovering any State assets/properties that might have been improperly and illegally transferred to third parties. In light of the violations he cited this could impact on several high-profile deals.

Goolsarran, a former long-serving Auditor General, also called for a further independent audit to examine in detail transactions over the last six years at NICIL.

He said that considering the “hostile, arrogant and demeaning response to my preliminary draft report as well as certain restrictions placed on this audit”, it would be desirable for the Executive Director and the Deputy Executive Director of NICIL to proceed on leave to facilitate the transaction audit.

Interpreted

During the period 1991 to 2001, Goolsarran said that the Board of Directors had interpreted NICIL’s mandate in a manner consistent with the wishes of the Legislature. That mandate pertained to NICIL performing a monitoring role for Government’s investments and ensuring that the proceeds from such investments were collected and paid over to the Consolidated Fund.

During the period 1991 to 2001, Goolsarran said that the Board of Directors had interpreted NICIL’s mandate in a manner consistent with the wishes of the Legislature. That mandate pertained to NICIL performing a monitoring role for Government’s investments and ensuring that the proceeds from such investments were collected and paid over to the Consolidated Fund.

He charged that NICIL’s retention of dividends received from public corporations and other entities and the proceeds from the sale of assets from 2002 onwards violated not only Article 216 of the Constitu-tion but also the relevant sections of the FMA Act and successive years’ Appropriation Acts.

“The Executive Director of NICIL acted unilaterally in the interpretation of NICIL’s mandate following the signing of the Management Cooperation Agreement on 28 December 2001. That interpretation saw the retention of $26.858 billion covering the period 2002 to 2014, representing dividends received from public corporations and other entities as well as divestment proceeds, thereby denying the Treasury of the much-needed funds to execute government programmes and activities, as approved by Parliament”, he asserted.

He also argued that the Board of NICIL must also accept culpability as though it advised against the Executive Director’s interpretation of NICIL’s mandate it took no steps to prevent the retention of funds that previously were paid over to the Treasury.

“Cabinet must also not escape responsibility for approving an agreement that violates constitutional and legislative requirements”, he stated in his report.

Goolsarran said that having intercepted State revenues and treated them as its own, NICIL then incurred public expenditure on various projects, including the controversial Marriott Hotel, without parliamentary sanction.

“Most importantly, it has defied the wishes of the National Assembly as contained in Resolution 32 of 17 December 2012 requiring NICIL to pay over to the Consolidated Fund `all revenues and proceeds from the sale of all State properties, except for those necessary administrative costs for maintaining and running its operations annually’”.

Exacerbating matters, Goolsarran said that NICIL received sums totalling $7.320 billion during the period 2007-2012 from other government agencies for payment for works undertaken on behalf of the Government.

“NICIL was essentially carrying out a paymaster function that is typically associated with the operations of the Treasury Department of the Ministry of Finance and was therefore functioning as a `parallel’ Treasury”, Goolsarran found.

He said that NICIL along with government agencies were complicit in avoiding the requirement of Article 217(3) of the Constitution which prohibits withdrawals from any public fund other than the Consolidated Fund to meet public expenditure without the parliamentary green light.

In relation to the sum of $3.757 billion received from the Guyana Geology and Mines Commission (GGMC) for the maintenance of hinterland roads, Goolsarran said that the minutes of NICIL’s board meetings of 13 November 2013, 30 April 2014 and 11 September 2014 recorded the Executive Director as having stated that NICIL was having difficulties in obtaining supporting documents from the then Ministry of Public Works for payments made and that material amounts remained unaccounted for.

In respect to the expenditure on the 2007 Cricket World Cup, NICIL had transferred amounts totalling $650 million to the Local Organising Committee but Goolsarran said it failed in its responsibility to ensure that there was proper accountability for the amounts.

As relates to the ill-starred construction of the 44 High Street property, Goolsarran said that the contract was awarded in 2007 but at the time of reporting the building remained substantially incomplete.

“The building was abandoned, and the structure was expected to be torn down because the floors were not constructed to the required specifications. As the “Project Executing Unit”, NICIL’s role was to ensure that the works were executed according to the agreed specifications and has again failed to discharge its responsibility for this project, resulting in some $350 million of taxpayers’ funds being wasted”, Goolsarran lamented.

Homing in on the GT&T deal, Goolsarran said that NICIL sold the Government’s investment in the company in 2012 for US$30 million of which the sum of US$25 million was received.

“The balance of US$5 million was to be paid within a period of two years. During the period 2002-2011, the Government received $5.261 billion in dividends from these shares, or an average of $526.1 million per annum. By disposing of them, the Government would have lost $1.578 billion, equivalent to US$7.616 million, in revenue during the period 2012-2014. The purchaser would have therefore recovered the cost of his/her investment in less than 12 years by way of dividends while at the same time retaining the investment. This calls into question the merit in the Government’s decision to dispose of GT&T shares”, Goolsarran declared.

He said that the evidence indicates that in addition to the disposal of GT&T shares, there was an acceleration of the disposal of State properties/assets in order to garner financing for the construction of the Marriott Hotel.

“In particular, of the amount of $9.788 billion representing the sale of State assets/properties during the period 2002-2014, sums totalling $7.142 billion, or 73%, relate to the period 2011-2012. NICIL’s financing of the construction of the hotel during the period 2010-2013 was $5.371 billion, comprising $800 million share capital, $3.316 billion (equivalent to US$15.5 million) in interest-free loan and $1.255 billion in advances. As at 7 July 2015, NICIL’s advances increased to $4.521 billion, giving a total funding of $8.637 billion, equivalent to US$41.682 million”, Goolsarran found.

Pradoville 2

On the controversial Pradoville 2 housing scheme occupied by former President Bharrat Jagdeo and other former senior government officials, Goolsarran also made damning findings. Questions had been raised over the removal of a NCN communication tower from the Sparendaam area that later became Pradoville 2.

“The evidence also

suggests that the removal and relocation of the tower were done to facilitate the housing development of the area. Instead of accumulating all the costs associated with the Sparendaam Project, including the market value of the land, in a special account to be applied in arriving at the price to be charged per house lot, NICIL’s board and Cabinet were complicit in charging the related expenditure to NCN in the form of equity investment, and to CH&PA in the form of a receivable. The fact that several key Cabinet members are the beneficiaries of the house lots, renders it highly inappropriate for the very Cabinet to approve of the charging of the expenditure of $257.049 million to the accounts of NCN and CH&PA”, Goolsarran stated.

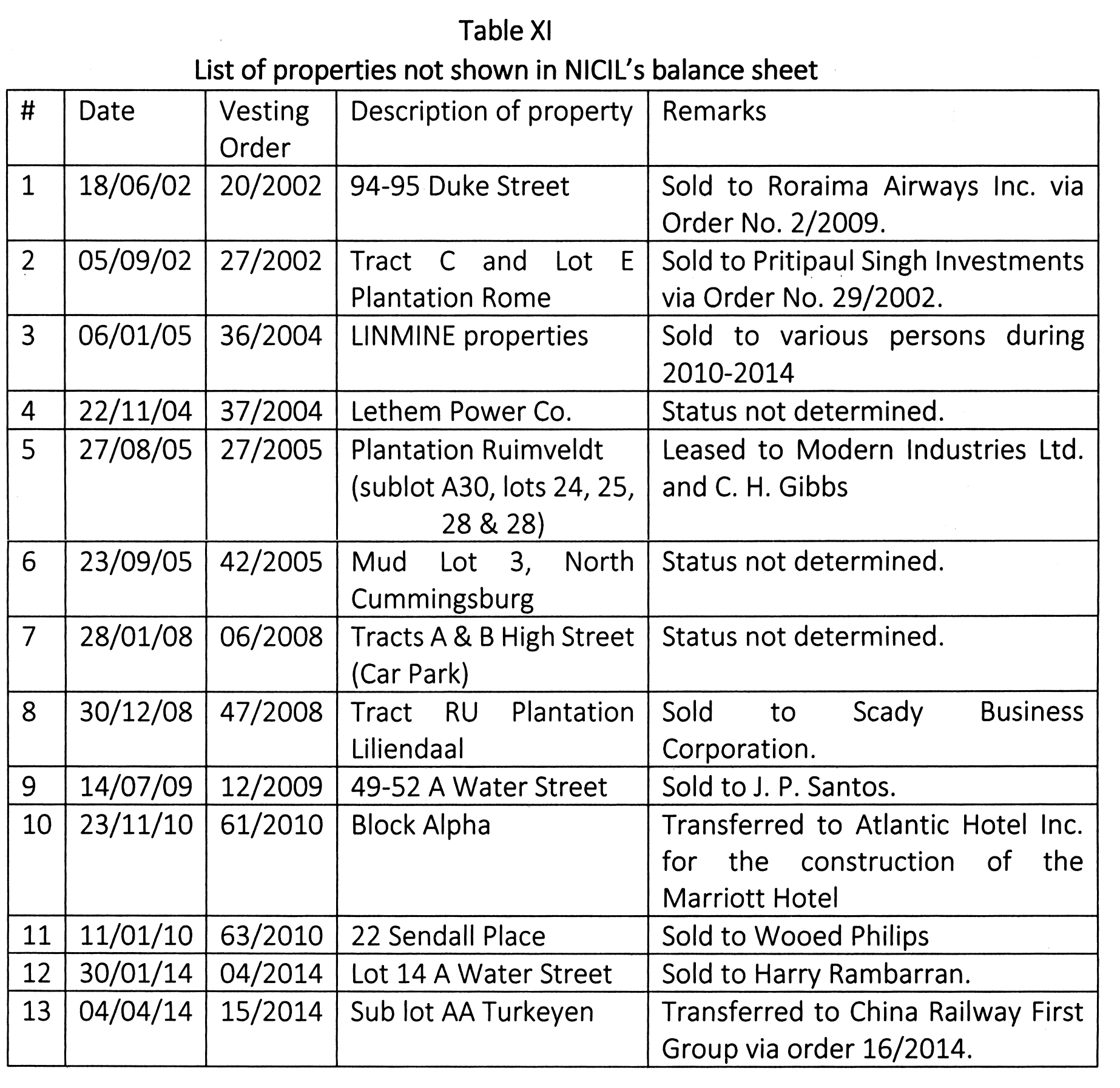

He further noted that during the period 2002-2014, 35 orders were issued vesting State properties/assets in NICIL, 13 of which were not reflected in NICIL’s balance sheet (see table). Goolsarran said that it was evident that these assets/properties were kept outside of the balance sheet because they were identified for sale. More importantly, he said that the Minister applied the provisions of Section 8 of the Public Corporations Act in the transfer of State assets/properties vested in NICIL to third parties. However, the notification of 18 July 2000 issued by then President Jagdeo made reference to the application of Section 5 only to NICIL and not Section 8.

“Therefore, the transfer of assets/properties by NICIL to third parties by way of sale or otherwise does not appear to have a legal basis”, Goolsarran said.

Competitive bidding

He added “There is evidence that properties were disposed of on the same day, or within days, they were vested in NICIL, suggesting clearly that the purchasers had already been identified without any form of competitive bidding. In addition, during the period 1995 to 2011, NICIL recorded 65 disposals of State assets/properties. A comparison of the sale proceeds with the valuations of the properties shows variances of on average of $1 million. In particular, in respect of 30 properties, the valuation and sale proceeds were identical while in respect of 22 properties the difference was a mere $2 million. These two observations reflect an extraordinary coincidence and raise serious doubts as to whether valuations were indeed carried out”.

He noted that despite the size and complexity of its operations, NICIL does not have its own procurement rules and in the circumstances, it would have been more appropriate for NICIL to involve the National Procurement and Tender Administration Board (NPTAB) in the assessment of tenders received for the award of contracts. Instead, the evaluating of bids was done internally and would have lacked the level of independence particularly for large projects such as the Marriott Hotel.

Goolsarran voiced “serious concern” in relation to the selection of the Contractor and the Engineering Supervisory Consultant for the Marriott Hotel project.

“The former was selected at a time when there were allegations of corruption in Trinidad and Tobago. NICIL was yet to provide details of the second bidder’s original and revised bid price to enable me to confirm the basis of the selection of the contractor. In addition, the consulting firm had faced criminal charges in a New York court and was disqualified from participating in the projects of the School Construction Authority until July 2015. By court order, the Head was relieved of his position at the time he signed the contract. Yet he personally signed the contract in August 2012!”, Goolsarran declared.

He further noted that at the end of June 2012, NICIL was in default for eleven years in terms of having audited financial statements. As a result the National Assembly passed resolution No. 14 dated 27 June 2012 calling on the Minister of Finance to provide it with all outstanding audited accounts of NICIL.

Goolsarran noted that on 27 September 2012, three months later, the Auditor General issued his reports on the financial statements of NICIL for the years 2002, 2003, 2004 and 2005. These statements as well as those of subsequent years were given unqualified opinions i.e. a “clean bill of health”, despite serious concerns raised in the Goolsarran forensic audit report and which would have had a significant impact on the financial statements of NICIL.

Further, Goolsarran said that a number of discrepancies and inconsistencies were observed in relation to the minutes of the annual general meetings of NICIL, and the evidence suggested that the minutes were prepared only when they were requested.