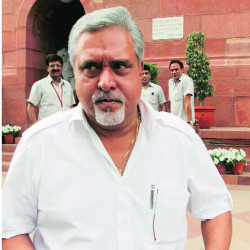

VIJAY MALLYA, the Indian entrepreneur who recently paid the reported franchise fee of US$2 for the Barbados Tridents in the Caribbean Premier League (CPL), and United Breweries Holdings (UBHL), the company he heads, have been declared ‘wilful defaulters’ by three Indian three state-owned banks.

According to the Indian media, the charge was laid last week by the Punjab National (PNB), the United Bank of India (UBI) and the State Bank of India (SBI). UBHL stated last week it was ‘in consultations with its legal counsels’ with a view to challenging the indictment in the Delhi high court.

It is not known what impact the matter might have on the 2016 CPL, scheduled for June and July. Damien O’Donohue, the chief executive officer, said at the players’ draft earlier this month the support of Mallya along with the government was critical to the Tridents’ continuation. Efforts yesterday to contact him at his base in Ireland were unsuccessful.

The Indian Economist commented that Mallya is ‘known for his flamboyance and hosting lavish parties even when his companies have been declared defaulters by lenders.’

He is chairman of the Indian Premier League (IPL) franchise Bangalore Royal Challengers and part owner of the formula one motor racing team, Force India F-1.

He also briefly sponsored the West Indies cricket team through the now defunct Kingfisher Airlines in 1995.

The relevant issue concerns loans taken out for his Kingfisher Airlines that was grounded is 2012 when the Director-General of Civil Aviation suspended its licence after a strike by its employees. UBHL and Mallya himself were held as guarantors.

According to the Indian Express, a consortium of 11 banks, led by the State Bank of India, holds an overall debt of 6,203 crore (US$9.7 million) for Kingfisher. The SBI’s share is 1,600 crore (US$2.5 million), the PNB’s 800 crore (US$1.25 million).

Large overdue debts have become a problem for Indian banks.

‘India’s defaulting business tycoons are under increasing pressure as the RBI (Reserve Bank of India) is prompting lenders to be more proactive in tackling mounting bad loans,’ the Indian Economist stated last week. It revealed that the Supreme Court had asked the State Bank of India (SBI) to provide a list of companies in default for over 500 crores (US$7,850,000) or any loans that were restructured under corporate debt restructuring arrangements.

Announcing his investment in the Tridents earlier this month, Mallaya said his ‘love affair with the Caribbean goes back many years’ with Barbados his favourite island.

He had evaluated the development of the CPL before committing to the Tridents. His reception in meetings with prime minister Freundel Stuart, and sports minister Stephen Lashley ‘was extremely warm and very supportive’. He also met with the Barbados Cricket Association (BCA) and with officials of Kensington Oval Management Inc.(KOMI).

At the 2016 players’ draft, O’Donohue said he had been working with Barbados’ finance minister Chris Sinckler, tourism minister Richard Sealy and Lashley who were also ‘hugely supportive of the work the CPL is doing’.

‘These franchises cannot exist without government support,’ he said. ‘We employ a huge number of people locally and spend millions of pounds so we do need the government to come and support us to make these franchises work.’