Government’s tax reform committee has proposed sweeping changes that include a lower VAT rate and an intermediate rate, an income tax threshold of $750,000 with progressive rates of taxation from 20% to 35%, reintroduction of estate duties and levies on tobacco and alcohol.

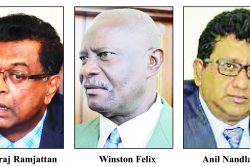

Submitted to Minister of Finance Winston Jordan on January 18, days before the 2016 budget presentation, the proposals will ramp up pressure on the APNU+AFC administration to stick by pre-election commitments such as lowering the VAT rate and also give it an opening for mid-year adjustments to the tax regime.

The 133-page report also backed the implementation of the presumptive tax which was rife with controversy from its inception. Discussing self-employed persons, the National Tax Reform Committee (TRC) proposed that a withholding tax (not a final tax) of between 5% and 10% be imposed on all contract services, “other than employment”. It has also proposed the hiking of the withholding tax, currently paid by individuals in the gold and diamond mining industry from 2% to 5%. This heightened tax should be seen as a payment on account and not a final tax, the TRC said.

The report backs the presumptive tax and recommended the implementation of Section 28A of the Income Tax Act 81:01 as soon as the Guyana Revenue Authority (GRA) has the required expertise and resources to ensure a fair and broad system of presumptive taxation for the most difficult categories. The report, seen by Stabroek News, noted that Section 28A (I) of the Income Tax Act mandates that the presumptive tax shall only apply to persons with turnover less than $10 million annually. The report said that applying this section to hard-to-tax individuals will require an amendment of the law.

For employed persons, the committee which was chaired by Maurice Odle, said that the annual income tax threshold should be moved to $750,000. In this year’s budget it was upped to $660,000 from $600,000.

The report also calls for the removal of income tax exemptions allowed to certain individuals such as the President, the Attorney General, the Chancellor of the Judiciary, the Chief Justice and the Auditor General. Stating that the rationale for these exemptions is difficult to find, the report said that it also sends an entirely wrong message to those that the government is attempting to bring under the tax paying net.

On the Value Added Tax (VAT) rate of 16%, the report proposes a lowering to 14% along with the introduction of an intermediate rate of 7%. The report also offers a suggested revised list of zero-rated items. Bread, rice, brown sugar, milk, salt, uncooked chicken, baby formula but not including baby foods such as Nestum and dried split peas among others would remain zero-rated. However, other items such as oats, sago, margarine, ghee and lard would move to 7%. A range of other proposals were made under the VAT section.

Estate duty

Likely to be controversial is the proposal to reintroduce the estate duty on the wealth of deceased persons which had been abolished in the 1990s. The TRC proposed that there be zero tax on gross wealth less than $100,000, 0.5% between $100,000 and $40 million, 3% between $40 million to $100 million, 5% between $100 million to $200 million and 10% over $200 million.

Property tax reforms were also proposed. The TRC said that for companies, the rate should be 0% on the first $20 million of net property, 0.5% for every dollar of the next $5 million and 0.75% for every dollar of the remainder of net property.

For individuals, the TRC proposes 0% on the first $40 million of net property, 1% for every dollar of the next $5 million and 1.5% for every dollar of the remainder of net property. The TRC is also recommending that the property tax charge be made a deductible expense for corporation tax purposes and that it be made mandatory for properties to be revalued every ten years beginning with 2011 as the base year.

On the question of tobacco, the TRC proposed the introduction of a tobacco levy equivalent to 20% of the value of the Excise Tax applied to it. In its discussion of the proposal, the TRC noted that tobacco products pay the following duties and taxes: Excise Tax – 100%; Duty – 100% and VAT of 16%. It said that this means that a packet of cigarettes with an invoice value of $100 produces taxes of $364. Arguing that tobacco is neither produced nor processed here and so there is little value added, the TRC noted for example that the wages and salaries cost of the monopoly Demtoco in 2014 was $82.6 million or 1.27% of the total revenue earned by the company. Noting that the taxing of tobacco products is “seen to have both health and fiscal virtues,” the TRC recommended that a tobacco levy be introduced equal to 20% of the Excise Tax charged. It said that this would increase the total taxes on the $100 packet of cigarettes from $364 to $410 or 12.6%. The additional revenue from this step is projected at $200 million. The TRC warned however that tobacco taxes are very high and any hike without robust anti-smuggling measures could lead to more evasion.

Health levy

A health levy is being urged by the TRC on the alcohol sector. The Committee noted that the taxes on alcoholic beverages are as follows: Excise Tax – 40%; Duty – 100% and VAT of $16%. The taxes gathered on a $100 product of alcohol would therefore be $225.

“Like tobacco, alcohol is known to cause a range of social and health problems. The rationale behind increasing taxation on alcohol as a policy measure is relatively simple – by making beverage alcohol more expensive, per capita consumption will be decreased and with it the incidence of problems,” the TRC said.

It added that “Alcoholism in Guyana is known to have a range of economic, social and health outcomes both for those who drink and for others around them. The sugar industry is known to suffer from worker absenteeism, lost productivity and poor workplace performance, as well as to the cost of healthcare for those injured as a direct or indirect result of their own or others’ drinking.”

It therefore recommended that on domestic sales there be an imposition of a health levy of one-quarter of the Excise Tax of 40% which will have the cumulative effect on the product price for domestic sales of 10%. The TRC also recommends the introduction of an Export Levy to raise the same dollar value mobilized by the health levy. The combined annual revenue increase is expected to be $300 million.

Corporate income taxes

The TRC is proposing that the corporate tax rate on telecommunications companies be slashed from 45% to 40% this year and on commercial companies from 40% to 35%. It said however that the rates should be reviewed soon after, if the change is made, to give consideration to a reduction in the rate for non-commercial companies and to determine the benefits of a unified rate on all companies.

On the question of tax incentives, the TRC said that these should be underpinned by clear and rational criteria via tax laws which must include provisions for a review and the clawing back of incentives where conditions are not met. This, the committee said, will limit ministerial discretion to the absolute minimum. There should also be an annual statement of tax expenditures and revenues forgone.

Addressing how motor vehicles should be handled under the remigrant scheme, the TRC said that this has been an area of widespread abuse. It proposed that the relief should be limited to engine capacity of 2000 cc for the current 10% regime of Excise Tax. However, for vehicles over 2000 cc, the full tax should be paid. It added that a residency requirement of more than six months in each calendar year for three consecutive years should be applied.

An annual Travel Agency Tax of $100,000 is being proposed along with an additional $25,000 for each additional office/outlet.

The TRC is also proposing a nine-month Tax Amnesty this year for non-filers and to amended returns.

The other members of the committee were Dr Thomas Singh, Christopher Ram and Godfrey Statia.