No one knows

Imagine talking to a friend on the phone while thousands of dollars are pressed to your ears and no one knows it. It is what mobile money does for you. A person who utilizes the mobile money service can literally walk around the place with thousands of dollars of cash in hand, but with no sign of the money. To some people, utilizing the mobile money service might be a status symbol and evidence of technological suaveness. But the use of mobile money goes beyond the aesthetics of modern technological savvy and stardom. It is a practical way to deal with real life development problems, particularly among those who are outside of the banking system. It removes the need to have physical cash on one’s person while still making it possible to have access to liquidity. It has begun to spread access to financial services that would otherwise be unavailable to many. The service has triggered interest in the efficacy of current monetary policy practices and how it could influence behaviour towards banking and financial intermediation. This article seeks to highlight some elements of the varied intricacies of mobile money.

Product mix

Mobile money connotes the act of moving money using a mobile device. To be clear, mobile money as a service refers to moving money from sender to recipient using text message. The mobile money product mix can be grouped into six types across the globe. These are domestic peer-to-peer (P2P) transfers, international transfers, airtime top-up, bill payment, bulk disbursement and merchant payments. P2P transfers and airtime top-up continue to dominate the product markets for the mobile services. Mobile money is part of the broader mobile financial services suite. In addition to transferring money and making payments, the mobile financial services suite includes mobile insurance, mobile savings and mobile credit. The focus of the remainder of the article will be on mobile money.

Global phenomenon

Mobile money has become a global phenomenon that is growing by leaps and bounds. It is available in more than 61 per cent of the developing countries of the world. Just four years ago, there were about 60 million mobile money users in the world. Two years later, the number of registered global mobile money accounts had reached approximately 300 million. This is what was reported by the Global System Mobile Association (GSMA) in its 2014 Annual State of the Industry Report on Mobile Financial Services. At that time, the services were deployed in 89 countries. The importance of this financial service was rising rapidly having increased by 400 per cent in two years. Yet, on a worldwide scale, this type of financial account represented a mere 10 per cent of mobile connections in the markets where mobile money services were available.

The work that the GSMA does in this area is critical to understanding the mobile money market and its usefulness to economic development since it represents the interests of mobile operators worldwide. According to the organization itself, it represents over 800 operators in the mobile ecosystem. These include device and handset makers. It also includes software companies, equipment providers, internet companies and even entities from adjacent industry sectors. With such a comprehensive coverage of the mobile and technology industries, the work of the GSMA on mobile money can prove exceedingly informative and useful.

Popular

The volume of business done by mobile money is substantial. Mobile money users conduct in excess of US$16 billion worldwide. More than half of this represents cash-in and cash-out transactions. Mobile money is popular in Africa which has the largest share of such services among developing countries. The countries in East Africa seem to have taken to this form of financial service with gusto. Kenya has embraced the mobile money service with passion and is regarded as an established leader in using it to achieve financial inclusion. Other East African countries such as Uganda and Tanzania are catching up fast. Other regions of the world too have begun to embrace the use of mobile money. Countries of South Asia, Latin America and the Caribbean, East Asia and the Pacific, the Middle East and North Africa, and Central Asia all follow Africa in the use of the service.

One must ask what it is that separates mobile money from mobile banking. In the case of mobile banking, a person must have a bank account. More importantly, mobile banking comes under the umbrella of online banking where several types of transactions could be conducted. All transactions are conducted through the bank account from a desktop or laptop computer or other mobile device. Payments can be made to vendors. Money could be transferred from one account to another. A person can view the balance in his or her account. In cases where the use of checks is still necessary, a person could order checks. Other services like activating a debit card and tracking one’s personal credit score are also possible from the mobile device. A person does not have to make a trip to the bank in order to access many basic services.

Not connected

It is clear from the foregoing that mobile banking is for persons who are already connected to the banking system. Mobile money, on the other hand, makes it possible for anyone who has access to a mobile device to participate in financial services, especially those not connected to the banking system. These persons are usually described as the ‘unbanked’. The service does not have to be provided by a bank. Non-bank entities can also provide the service. This is the way in which mobile money turns out to be exceedingly useful.

A principal provider of mobile money services in Guyana is GTT. The company has a network of agents in all 10 regions across Guyana with whom persons could register in order to take advantage of the mobile money service. The network of agents is concentrated primarily in Berbice and Demerara. Based on information provided by the company, the number of agent outlets is more than double the bank branches around the country. A person is able to give cash to an agent who then loads the money onto the mobile device. The mobile device serves as an electronic wallet in which cash is stored. The stored money is a form of non-interest savings until the money is used by persons to pay bills and to top-up electricity and telephone minutes. It is also used in some cases to make hire-purchase payments and to transfer money to other persons. All the services that are possible through the mobile money service offered through GTT are confined to the domestic economy.

Benefits

There are several benefits to using mobile money. Once one gains a grip of the technology, mobile money has been seen to offer several benefits of an economic and social nature to many countries around the world. Mobile money reduces the dependence on cash. Many people prefer to keep their money out of the banking system. Stories have been told of people hoarding their money in various secret locations at home. This practice exposes them to the risk of losing their money through theft and banditry. This risk of losing their money diminishes drastically with the use of mobile money. Not having the physical object does not mean not having the liquidity to transact business. As such, it becomes convenient to make purchases and to pay bills.

A hidden value of mobile money is that of increased productivity. Many persons have to take time off from work in order to conduct their personal business such as paying electricity and telephone bills or sending money to, or receiving money from, a relative or friend. That is no longer necessary with those vendors who accept payment and money transfers through mobile money. It is not clear how much work time is saved by enabling someone to remain at work and in a few seconds complete a financial transaction that was important to him or her. Intuitively, however, one can see the likely positive impact that the convenience of the service can have on workers’ productivity.

The challenge

The challenge that many people face is accessing and trusting the technology. A person must have a telephone to use mobile money. But in addition to the telephone, there is need to have access to the internet and they must be able to get to an agent easily. According to GMSA, registering agents is the easy part. The challenge is keeping them active. This writer does not know what the rate of active participation by agents is for GTT and the number of customers using the mobile money service. To give an indication of the problem of agent participation, GSMA pointed out that globally active participation rates hovered around 60 per cent. This participation rate was due largely to the fact that there were insufficient users in the market served by the mobile money agent to make the business worth their while. So registration of an agent does not necessarily mean availability of service. More work would be needed to ensure that the service can serve the interests of distant communities in Guyana.

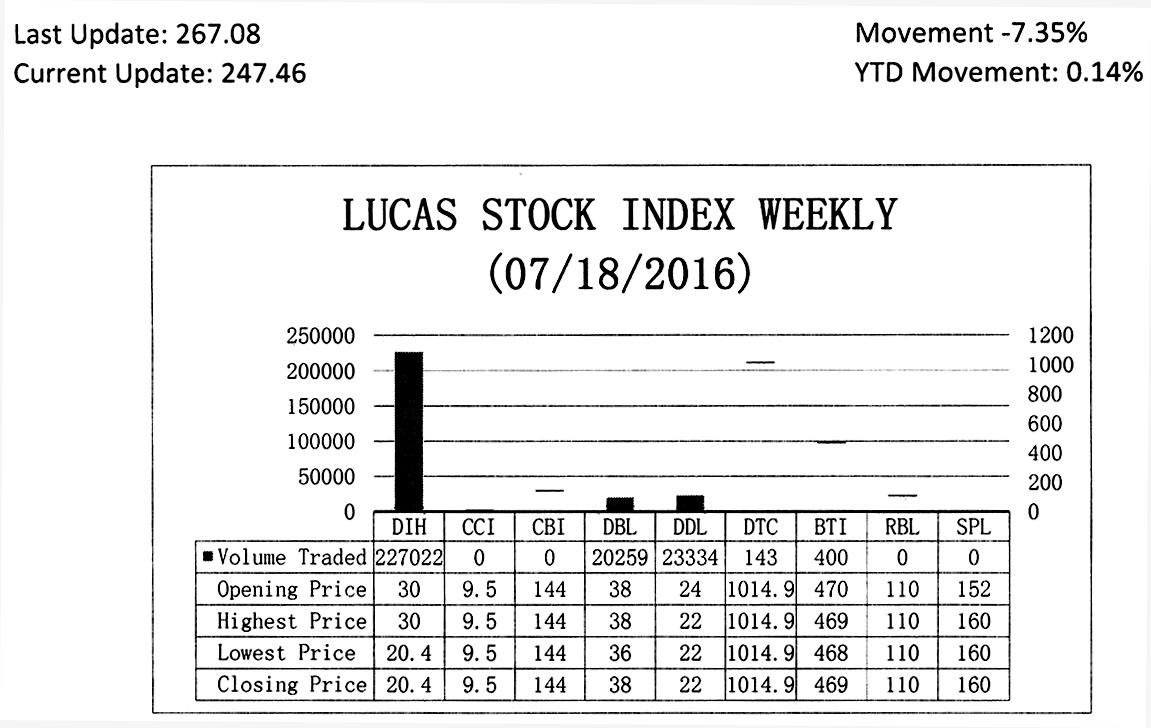

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined 7.35 per cent during the third period of trading in July 2016. The stocks of five companies were traded with 271,158 shares changing hands. There were no Climbers and three Tumblers. The stocks of Banks DIH (DIH) fell 32 percent on the sale of 227,022 shares. The stocks of Demerara Distillers Limited (DDL) fell 8.33 per cent on the sale of 23,334 shares. The stocks of Guyana Bank for Trade and Industry (BTI) fell 0.21 per cent on the sale of 400 shares. In the meanwhile, the stocks of Demerara Bank Limited (DBL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 20,259 and 147 shares respectively.