The question I respond to in today’s column is: Does the prevailing world energy outlook offer useful policy lessons for Guyana’s benefit, in anticipation of its oil and gas production coming on stream in the early 2020s? The demand/supply appraisal of that market, which was presented in my two previous columns suggests that there may be several. In what follows today and next week, I shall portray the most important of these.

The question I respond to in today’s column is: Does the prevailing world energy outlook offer useful policy lessons for Guyana’s benefit, in anticipation of its oil and gas production coming on stream in the early 2020s? The demand/supply appraisal of that market, which was presented in my two previous columns suggests that there may be several. In what follows today and next week, I shall portray the most important of these.

First policy lesson

To begin with, the demand and supply data previously shown, make clear that global economic growth (and development) remains, by far, the most crucial factor governing the world energy outlook. Consequently, estimated global economic growth rates, over the medium and long term, will shape the essential elements of the energy market outlook.

While there are several estimates of medium-term and long-term global economic growth available, those provided in the data sources which I have used thus far for appraising the supply and demand for global energy fall within credible ranges (BP, World Energy Review, (WER) 2015 and OPEC, World Oil Outlook (WOO) 2015). Therefore, in what follows, I continue to rely on these sources.

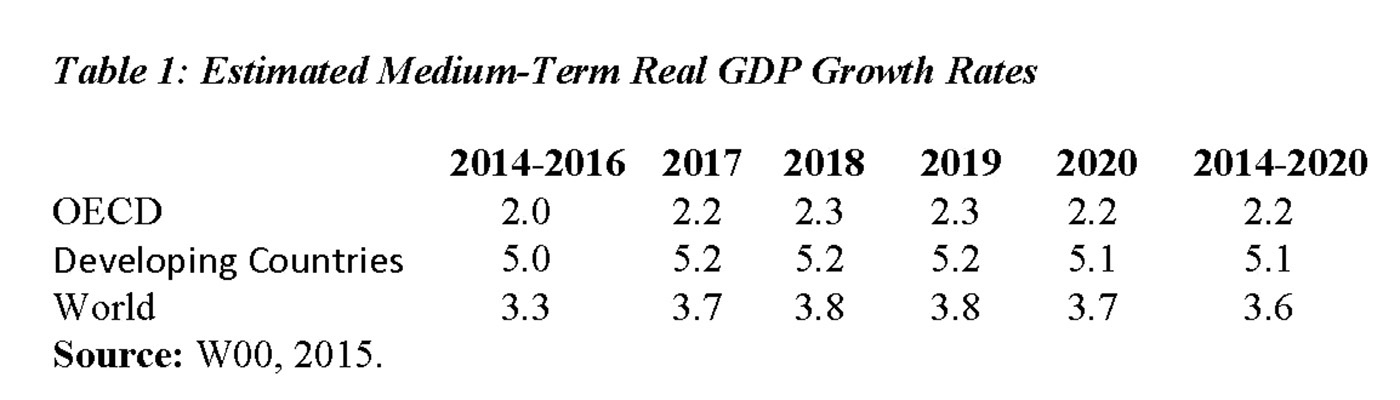

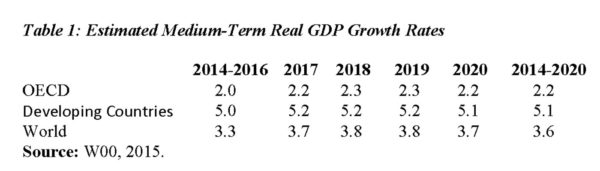

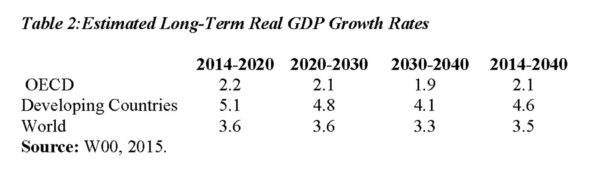

Table 1 shows that estimated world real GDP growth over the medium term (2014-2020) is modest, averaging 3.6 per cent. For developing countries, however, it is much higher, averaging 5.1 per cent.

And real GDP growth in the developed (OECD) countries only averages 2.2 per cent. Of special note, while the estimated medium-term growth rates are modest; in all instances they are above the current rates (2014-2016).

Regrettably, estimated world long-term real GDP growth (2014-2040) is even more modest, averaging just 3.5 per cent. For the developing countries, this rate is reduced from 5.1 to 4.6 per cent. This, nevertheless, remains higher than for the developed countries (OECD), 2.2 per cent. Contrastingly, the long-term real GDP growth rate, in all three instances, is estimated to be lower than the current (2014-2016) real GDP rates.

Regrettably, estimated world long-term real GDP growth (2014-2040) is even more modest, averaging just 3.5 per cent. For the developing countries, this rate is reduced from 5.1 to 4.6 per cent. This, nevertheless, remains higher than for the developed countries (OECD), 2.2 per cent. Contrastingly, the long-term real GDP growth rate, in all three instances, is estimated to be lower than the current (2014-2016) real GDP rates.

The policy lesson to be derived from the above is clear. Trends in energy performance, as indicated in the two previous columns, will most likely be reinforced, rather than swept away by tumultuous economic growth effects, whether positive or negative.

The policy lesson to be derived from the above is clear. Trends in energy performance, as indicated in the two previous columns, will most likely be reinforced, rather than swept away by tumultuous economic growth effects, whether positive or negative.

Second policy lesson

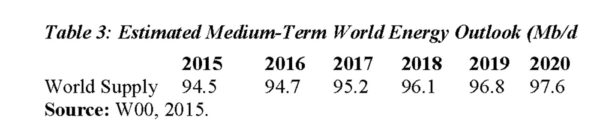

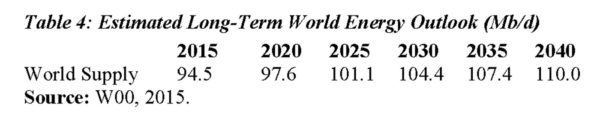

The second policy lesson is that, Guyana’s oil and gas prospects should be firmly situated in a full appreciation of the features of the global energy market. In this regard, I stress the following features as deserving special attention: One is that the world energy market, at the end of the medium term, will likely grow from 94.5 million barrels per day of oil equivalent energy in 2015, to approximately 97.5 mb/d by 2020. And, over the long-term (2040) it will reach 110 mb/d (See Tables 3 and 4).

China and the developing countries will be central to this outcome. And, in turn, their population growth, industrialization, and urbanization, will be the major drivers.

World population at the end of 2014 was approximately 7.2 billion persons, and is projected to rise to 9 billion persons by 2040. The industrialization of China and the developing countries is confidently expected to strengthen, as reducing poverty and increasing incomes spearhead their policy efforts.

World population at the end of 2014 was approximately 7.2 billion persons, and is projected to rise to 9 billion persons by 2040. The industrialization of China and the developing countries is confidently expected to strengthen, as reducing poverty and increasing incomes spearhead their policy efforts.

Further, such efforts are projected to be biased in favour of increased energy efficiency and intensity. This process will indeed be heavily influenced by the drive towards global controls of greenhouse gas emissions, designed to combat global warming and climate change.

There is also the expectation of the long-term aging of the world’s population, projected to result in one of three persons worldwide being aged over 64 by 2040. Further, in every region, the number of persons less than 15 years old is projected to decline. Relatedly, 63 per cent of the world’s population is projected to be living in cities, well up from 33 per cent in 1950.

Guyana’s medium-term growth

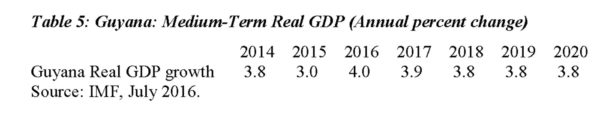

It would help readers if I juxtaposed Guyana’s estimated real GDP growth rates over the medium-term to the world data cited above. Long-term forecasts would not be credible, given the expectation of major economic disruption, as oil and gas come on stream in the early 2020s. While the available medium-term estimates vary, those shown in Table 5 are derived from the recent IMF Guyana Article IV Consultation, dated July 2016.

These data project Guyana’s real GDP growth rates will be above the world average, (at approximately 3.7 per cent for 2014-2020). This is, however, well below those indicated for the group of developing countries. They are though slightly above the 2014-2016 average real GDP growth.

So far I have directed attention to the overall global energy market. At this stage, readers should realize that of equal importance is the mix of fuels, and in particular their individual performance in that market. Next week I shall address this topic and introduce the third key policy lesson Guyana could learn from careful study of the current and likely behaviour of the medium and long-term global energy market.