The government used its one-seat majority in the National Assembly last evening to defeat a PPP/C motion calling for the restoration of items that were previously zero-rated under the Value Added Tax (VAT), with Finance Minister Winston Jordan once again arguing that the changes were necessary to stem the continuing decline of revenue yielded by the tax.

The motion, which was debated for over three hours,

was moved by opposition Chief Whip Gail Teixeira, who voiced concern that Guyanese are being burdened by the government’s widening of the application of VAT.

The motion challenged the Value-Added Tax (Amendment of Schedules) Order 2016, which moves items which were previously zero-rated to exempted status.

The order comes into effect tomorrow.

Teixeira’s motion, arguing that the changes are likely to have an “unfavourable effect on the people of Guyana and the economy,” sought to have the National Assembly call on the government to repeal the order and for the minister to restore the previous schedules.

Teixeira butted heads with Speaker Dr. Barton Scotland on the relevance of the motion but after a few intense minutes she was allowed to make her opening arguments, which lasted for almost an hour.

She said that it is only recently that there has been information released to the media about the impact of the order and she cited the reported views of the Private Sector Commission, GT&T and NAMILCO, which have said that the order would drive up costs.

She noted that all the food items which were formerly zero-rated have been moved to the exempt category.

“What are you doing to the poor people of this country?” she asked. “Why would you do that to our people? Everything has been put exempt. Imagine you couldn’t even put an eraser,” she lamented.

She said too that ice will also attract VAT since VAT will now be charged on water. She said that the fishermen and all those who made an honest living using ice will suffer and this will have a ripple effect, resulting in the consuming public having to pay the price.

She said that while there are complexities in maintaining government’s manifesto promises, this problem of the VAT, zero-rated and exempted items is not being dealt with like in other countries. She said that a lot of items in Caricom countries were vatable. “What Guyana did shortly after VAT is that we went and incrementally kept zero-rated items…Under the new system, where more zero rated items have become exempt, input VAT cannot be reclaimed and this will result in the increase in prices of many basic commodities. That is the point we are making,” she stressed.

What has happened now, she added, is that zero-rated items have now been exempted and therefore the producer/manufacturer now pays VAT but can’t claim a refund and where the consumer now doesn’t pay VAT he/she will have to pay the indirect cost. “The Guyanese people are feeling tremendous pressure and are very worried,” she said.

‘Most vulnerable’

Junior Finance Minister Jaipaul Sharma, the first government MP to speak on the motion, argued that the changes would benefit the business community. “You won’t be seeing VAT on the receipt and that is what’s important,” he told the House, while adding that the important thing is that the measures implemented by government will benefit the business community.

“Business people do not have to wait for a VAT refund. It is simpler for them. Life is also easier for GRA [Guyana Revenue Authority] who don’t have to spend the time to implement those refunds,” he added, while noting that GRA now has the responsibility for monitoring and sanctioning those who attempt to take advantage of consumers.

Like Teixeira, opposition MP Dr. Frank Anthony said that the Order has “created the false illusion that Guyanese will be better off… The sad reality is that the Order will impose more hardship and would overtax the already highly-taxed citizens of Guyana.”

He argued that more burden has been placed on the shoulders of Guyanese and reminded that when VAT was introduced, services and commodities were placed in three main categories–those that attracted VAT, those to be exempted from VAT and those that would be zero-rated.

He said that in the government’s 2015 manifesto, there was a promise to implement a phased reduction of VAT and the removal of the tax from food and other essential items. He said it is clear that implementing measures of changing items from zero-rated to exempt and from zero-rated to 14% will “create more hardships for everyone in this country.” He stressed that it was for this reason that he and his fellow MPs were against the amendments.

Anthony said that under the law most of the health supplies and health services were zero-rated but most of them were struck off the list by virtue of the order. He pointed out that in the minister’s “good life budget,” only two items that were exempted were glucometers and crutches. All the rest, he said, were moved from zero-rated and will now attracted 14% VAT.

He called out a long list of health services not readily available in the public sector which will be affected by this change, including breast cancer testing and biopsies. Anthony was repeatedly warned about the non-relevance of some of the things he was saying. The Speaker threatened to rule him out of order and move on to the next speaker if he did not speak directly to the motion that was before the House. “With the stroke of his pen the ministry has imposed a 14% tax on the sick, the deaf, the visually-impaired, and the disabled people of our country… These measures have attacked the most vulnerable amongst us,” Anthony stressed.

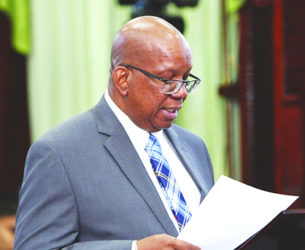

Jordan, during his contribution, told the House that the contents of the motion were keenly debated during the budget debate. He said when the VAT was implemented in 2007, the net VAT was 27.6% of revenue after returns were given back. The following year he said this figure “shot up” to 30.4%. “But guess what, Mr. Speaker? That was the last time… almost nine years ago, almost a decade ago when the VAT, a very important tax in this country ever touched 30%,” he said.

He pointed out that by the time the PPP/C exited government in 2015, the VAT that had reached 30.4% of current revenue in 2008 had regressed to 24.8% by 2015.

Jordan argued that VAT is a very important tax while the economy is growing. He said that there were reasons why the VAT collections were declining, including that the policy measures that were being put in place were weakening the VAT base. He added that government was also guilty of this practice when it attempted to implement a promise it made in 2015 regarding the over 50 food items which were exempted from VAT. He said that by 2016, the VAT base had further declined to 24.5 of total revenue collection.

“How can we continue with a tax that is supposed to be a major tax in this country while its relevance kept declining?” he questioned before adding that one implication of this is that development itself will slow up.

Stressing that government in its 2015 elections manifesto promised that it would reduce the VAT rate and exempt certain food items once in office, Jordan said that it could not fulfill the promises right away because there were a lot of unknown and known issues. He spoke of problems in the sugar and rice industries and developing issues with Venezuela that needed immediate intervention by government.

In her closing arguments, Teixeira made it clear that the public, including government supporters, need answers. “They want to know why you have done this. Why have you taken items that are zero-rated and put them on exempt?” she questioned, before adding that she had listened to Jordan’s explanations but either didn’t agree with or believe them.

Despite her pleadings and the arguments advanced by her colleagues, government members shouted “no!” when the motion was put to a vote the House.