Guyana has long sought to diversify its economy. Economic diversification refers to broadening the production structure of the country. A country therefore expects to add to the economic activities that are taking place within the society. In that context, Guyana can think of itself as having a diversified economy given that it can identify its economic activities with all the sectors, namely agriculture, manufacturing, mining and services that are usually found in an economy. At one time, the economy was dominated by sugar and with the addition of rice, the dominance was by agriculture.

Now each of the four sectors contributes a reasonable amount to gross domestic product (GDP). The largest contribution comes from services which accounts for close to 63 per cent of output, suggesting that in the process the country has also realigned the economy.

Agriculture over the last nine years has contributed 20 per cent to GDP while mining has contributed 11 per cent. The laggard in the group is manufacturing. With all the sectors making positive contributions to the economy, it possibly raises the thought that economic diversification was not important. Guyana just needed to produce more and things would be fine. Add to that as many as eight major products are part of its export profile.

Yet, everyone seems to agree that, until the manufacturing sector picks up, economic diversification would remain elusive. This article seeks to explore the need for, and the relevance of, economic diversification to the Guyana economy.

Life and living

While economic diversification is essentially an economic concept, it has meaning for life and living. Diversification influences the range of products and services that is available for consumption. It is therefore important to national welfare and the choices that are available to people. Among the benefits of economic diversification are job creation and economic growth. It comes into play as people try to enjoy life and look for different things on which to spend money that they have. Diversification helps to make the lifestyle people want for themselves and family a reality. Guyanese are no exception. They too want jobs and economic growth. They are looking for a life of comfort and safety. They want a life of fun and leisure and it comes from having wealth and a wide range of consumer choices at affordable prices. To get there, economic diversification has to become a reality.

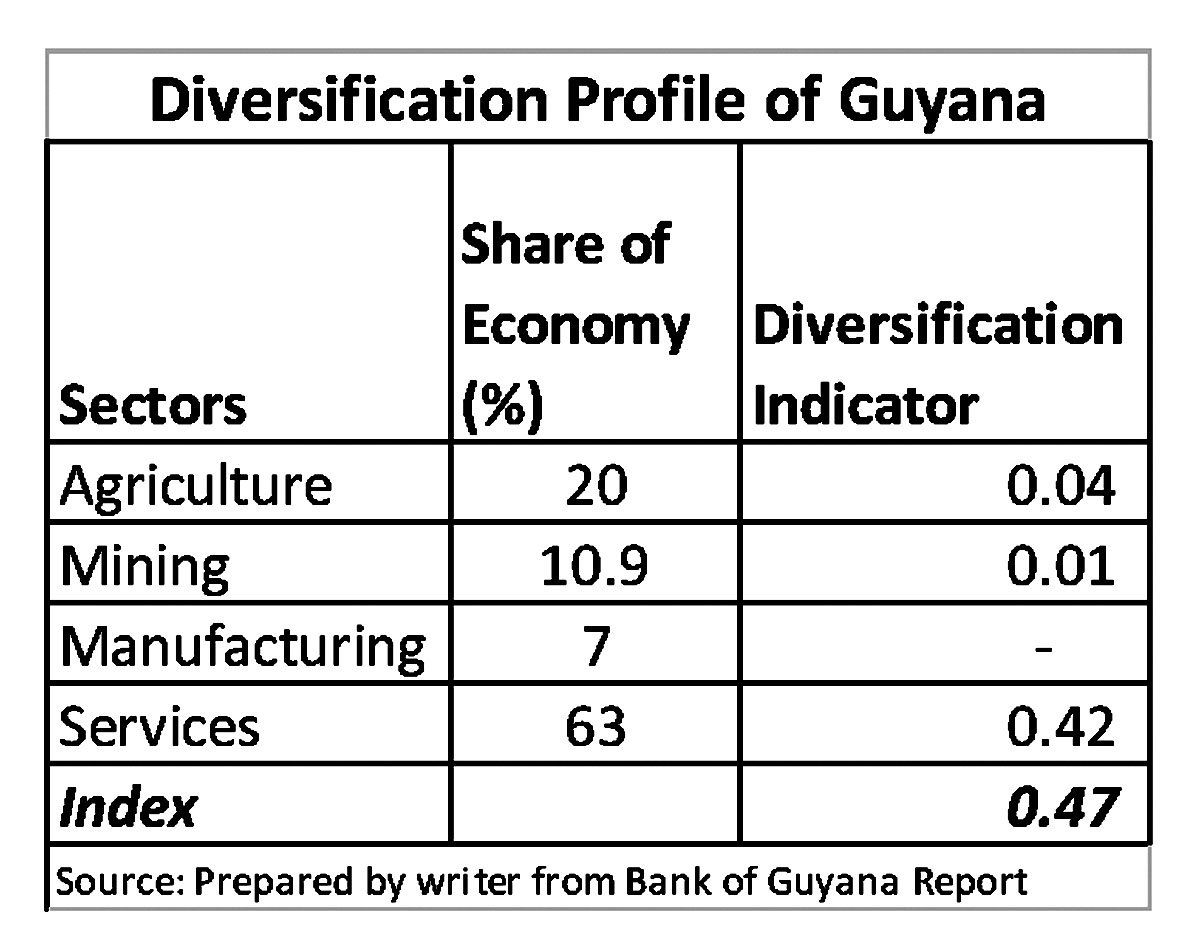

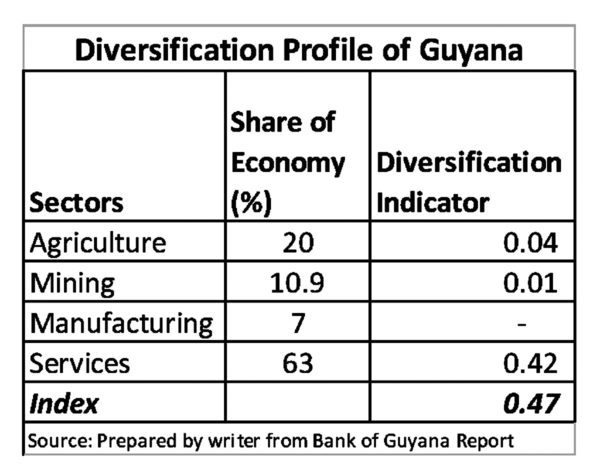

Despite being a multi-sectoral economy, Guyana is nowhere close to being a diversified economy. The best indication of that reality is that the diversification index is still relatively high. That means there is too much dependence on one or two sectors. The data in the Table below confirms that observation. Though below 50 per cent, the economy is heavily dependent on services. It is not something that we would like to think of but it is clear that the resources of the economy are being directed disproportionately towards services. The relatively high index and the dominance of the services sector mask the challenge facing Guyana.

The Guyana economy is still developing and many of the goods that it consumes are imported and not produced in the country. The services sector reflects that bias in the allocation of scarce resources of the country.

TABLE 1

The wholesale and retail trade is the most dominant component of the services sector and the largest in the economy. Most of the goods that are traded in the industry come from abroad. The motor vehicles that are used in the transportation industry, another large industry in the services sector and the economy, also come from abroad. The construction industry, the third largest industry in the services sector and in the economy, also depends on foreign suppliers for equipment and most inputs for the industry.

Weight of the economy

All these things have to be paid for with resources produced by the country. For a country like Guyana, in addition to achieving economic growth and job creation, the acquisition of foreign currency looms large. It is the need to have the ability to earn foreign exchange with some measure of stability that drives the need for economic diversification. The foreign currency earned by Guyana comes from five agricultural or primary commodities. In essence, the weight of the economy is being carried by a handful of commodities whose cash flows are not stable. According to data published by the World Trade Organization (WTO), commodities bring the least value in international trade as a consequence of supply and demand. In addition, the prices of commodities are usually denominated in US dollars with the result that fluctuations in the value of the dollar can also destabilize revenues.

Climate change

There is evidence emerging that show economic diversification strategies are being pursued by countries that see themselves as being vulnerable to climate change. They are also being driven by countries that recognize that their economies might be sensitive to climate change and mitigation policies. Many are placing emphasis on eco-tourism, and the use of energy supplies that are clean and renewable.

Readers no doubt would have an interest in knowing the ways in which Guyana can achieve diversification. Admittedly, it is easier said than done, but as an economy that relies heavily on the private sector it would have to look to the productivity of individual businesses to achieve economic diversification. Firms in Guyana rely on the same type of resources, land, labour, technology and managerial skills, to achieve their output. Studies have shown that it is those businesses which can use their resources in the right mix to gain higher levels of productivity that were best suited and are usually able to bring about diversification. They are able to increase their productivity, control costs and increase their competitiveness in foreign markets. For a country like Guyana where export revenues are important, increased productivity assumes critical importance and should lead to an increase in the number of products entering the export trade. There are many other factors that help to make diversification a reality and this article does not intend to discuss them all in detail. Suffice to note, issues surrounding the real exchange rate, inflation, net inflows of foreign direct investment (FDI) and the terms of trade help to make economic diversification possible.

Different sectors

One might inquire as to how economic diversification is manifested. It is reflected in several ways. It shows up in the vertical integration within sectors or industries. That integration could lead to a straddling of two different sectors. For example, integration forward where crop producers decide to get involved in agro-processing could result in the operations of one business in both the agricultural and manufacturing sectors. The outcome is the emergence in the production structure of products that have greater value-added. Where there is increasing evidence of the crossing from one sector to the manufacturing sector, one can conclude that higher levels of diversification are occurring. The expectation is that higher incomes would be earned by those working in the industry or sector.

People question whether diversification could result from horizontal integration. Part of the problem is that horizontal integration results in businesses staying in the same supply chain operation. A retail business that stays in the retail business does not produce a difference in the production structure, even though it might result in greater control of the market. However, if the integration results in the shift of resources from non-productive to productive use, it could lead to positive results. A most vivid example of that change in use is the introduction of parking meters in Georgetown where idle resources are now being turned into income-generating resources for the city. It creates jobs and add another dimension to the production structure of the country.

Prerequisites

The IMF and other international entities point to the importance of creating macroeconomic stability and supportive regulatory and institutional frameworks to make diversification happen. These they see as prerequisites and unless there is a commitment to making them work effectively, all efforts at economic diversification could fail.

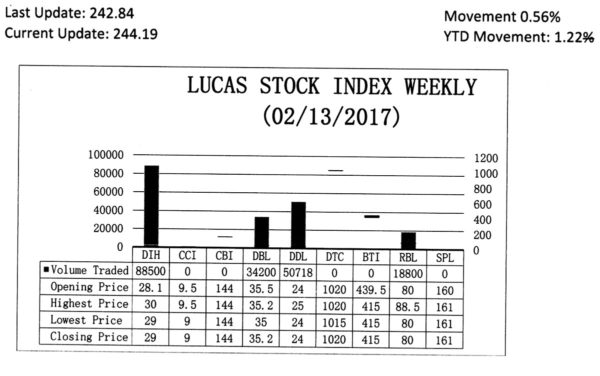

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined 0.56 per cent during the second period of trading in February 2017. The stocks of four companies were traded with 192,218 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 3.2 per cent on the sale of 88,500 shares. On the other hand, the stocks of Demerara Bank Limited (DBL) fell 0.85 per cent on the sale of 34,200 shares. In the meanwhile, the stocks of Demerara Distillers Limited (DDL) and Republic Bank Limited (RBL) remained unchanged on the sale of 50,718 and 18,800 shares respectively.