The Bank of Guyana (BoG) yesterday accused the Guyana Manufacturing and Services Association (GMSA) of misleading the public on the effective purchasing rate for the US dollar, while also blaming exporters for negatively affecting currency supply by hoarding foreign currency.

On Wednesday, GMSA issued a statement in which it said that the effective rate for the US dollar was now $230 and called on the government and the central bank to intervene in the market as it warned that this would have severe repercussions for the economy.

The BoG, however, said that the GMSA has publicized “a number of inaccuracies.”

“…The claim by GMSA that the `effective rate for the US dollar is G$230’ is not only misleading, but is of a kind that does nothing more than add fuel to the rising speculative and destabilizing activities in the foreign exchange market, all of which could be harmful to the economy,” BoG said in a statement.

It further explained that the rate quoted by GMSA is not a uniform transaction rate, “but the online rate charged by one of the largest commercial banks in Guyana for its credit and debit card transactions, which represent a very small share of the cambio market transactions.”

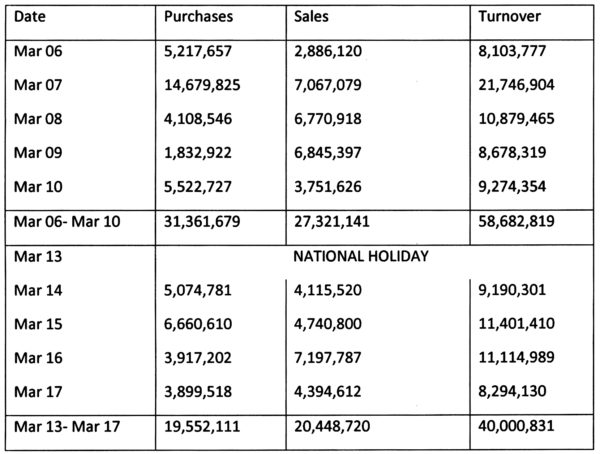

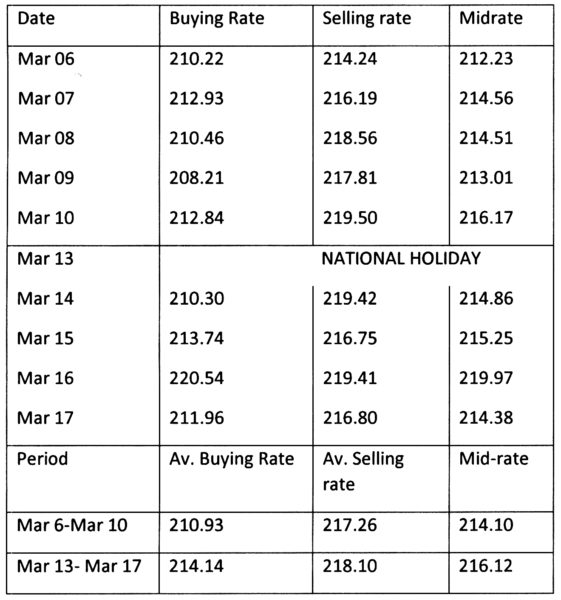

The actual rates for the week of March 14-17, 2017, according to central bank data, is a weighted average buying rate of G$214 and a weighted average selling rate of G$218.

The bank went on to accuse several exporters of contributing to the instability and depreciation of the rate by hoarding foreign currency “as evidenced by the large foreign currency balances that are being held in their exporters’ retention accounts.”

“Instead of using these balances to complete their transactions, they have been sourcing foreign currency in the market. This has added further pressure on the demand for foreign currency and reduced the supply to the market,” BoG said.

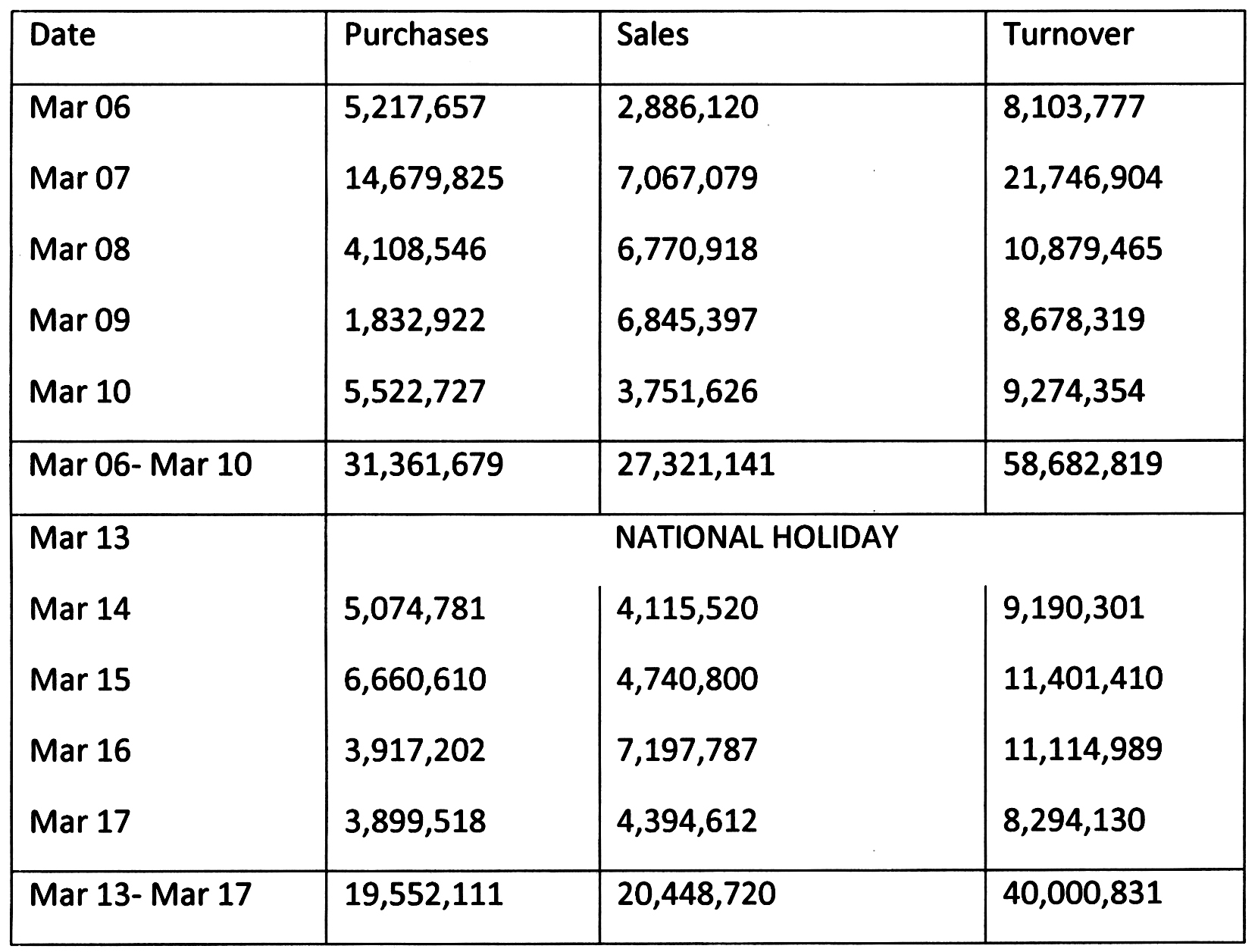

Included with the statement from the BoG were two tables which show the volume of transactions and weighted average exchange rate over the last two weeks.

According to the tables, the turnover for last week was US$40.0 million, while the week of March 6-10 saw a turnover of more than $58.6 million.

“Total purchases and sales at the bank cambios were US$19.6 million and US$20.4 million, respectively. The aggregate working balance at the bank cambios was US$13.7 million at the end of business on the 17th March, 2017,” the statement explained, before adding that one bank accounted for 32.8 % or US$4.5 million of the total working balance.

Also noted was that demand at the end of the week was US$8.0 million, with two banks accounting for the bulk of the demand. Consequently businesses were advised by BoG not to depend solely on one bank, but to pursue other banks to meet their demands for foreign currency at a competitive rate.

Despite these concerns, the BoG reiterated that there is sufficient foreign currency in the market to meet legitimate demand.

“The patience and co-operation of stakeholders are needed, therefore, to ensure that there is no undue speculation and further deterioration in the rate,” the statement said.

Meanwhile, Opposition Leader Bharrat Jagdeo, at a press conference yesterday, said that government needs to urgently address the decreasing currency value because this decrease will lead to an increased cost of living and the International Monetary Fund (IMF) is taking note.