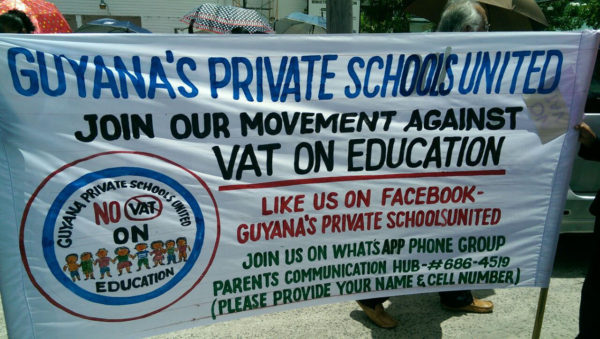

The Guyana Private Schools United turned out for the second week to protest the government’s implementation of VAT on private tuition fees, but this time the group took their grievances to the Ministry of Education’s head office on Brickdam.

The crowd comprised mostly students, local and foreign alike, who, along with parents and the schools’ administrative staff, lined off on each side of the street where the ministry’s buildings are located, as they picketed for the removal of the tax from tuition fees.

“I am protesting with the other parents because we are sending our children to Islamic School, we want them to learn Islamic studies. We want them to learn Arabic, Qur’an and other Islamic studies. The other schools are not going to teach those morals to our kids, so because we choose to send our children to private school that doesn’t mean you need to tax us and VAT us, we’re already paying for it, why are you VATing us on it?” Jomana Cyrus, parent of a student attending the Isa Islamic School expressed.

Principal of the Isa Islamic School Akram Hussain called the education tax a “wicked, evil imposition” by the government, one that has “shackled private schools.”

He said the proprietors of private institutions are helping the government to carry out its mandate in delivering education to citizens and as such, should be greeted with support, rather than being penalized.

“None of the private schools receive any form of subsidy from the government, whether it be text books, lab equipment, or otherwise. We’re educating the sons and daughters of Guyana and we should be supported,” he said.

“We might not have students here from high school or primary school but this extends far beyond that. It extends to anybody who wants to get a higher education, Rakesh Latchana of Ram and McRae stated, adding that the tax is discouraging the development of human resources and reducing access to higher education.

Several who spoke with this media house viewed the VAT as a barrier to the country’s development, one which will dissuade Guyanese from investing in their own educational pursuits, as well as the foreigners who choose these shores to further their studies.

“… Most of us from Texila are not even from Guyana and us coming here builds the country, bringing in foreign currency, so doing this is actually hampering the development of Guyana, Colleen Millaneise, a Jamaican, first year medical student at the Texila University stated.

Millaneise was one of a group of perhaps more than a dozen foreign students from the university who stood on yesterday’s protest line.

Students of the Art Williams and Harry Wendt Aeronautical School were also in attendance, with their spokesperson Yograj Raghunauth raising concerns as to how the school, which he addressed as “one of the premier institutions within the entire Caribbean,” will be perceived by outsiders.

“Look at the image that you’re sending on the school and on Guyana… Our school is the only school that does aeronautical engineering within Guyana, many kids from the Caribbean and other countries come here to do aeronautical engineering, why tax that?” Raghunauth questioned, noting that on average, a student would have to pay nearly $10,000 a month in tax on the school fees.

“I don’t really think it’s a good idea for them to put VAT on education because the government does not have a public aeronautical engineering school. You want to tax education? Fine. Then get a public aeronautical engineering school for us because we don’t have a choice, we have to go to the school, we have to pay the tax.”

Meanwhile, Attorney Christopher Ram of Ram and McRae, expressed that contrary to what people might believe, University of Guyana students will also be at risk of paying the tax on their tuition. “The notion that VAT is not payable on University of Guyana school fees is extremely incorrect and it needs to be addressed,” he said.

“I am sympathetic to the cause of this group here that is protesting the VAT on education. I can understand the Minister of Finance’s need for revenue but I think there are many, many options open to him that would be far more productive, I think this is one of the least good ways to approach the raising of revenue. To tax education is absolutely historical, it has never happened, no service tax, no sort of expenditure tax on education, this is absolutely unprecedented.”

Prema Roopnarine, a committee member of the Guyana Private Schools United, related that correspondence was sent to the President, the Prime Minister, and the ministers of Finance and Education about three weeks ago, and the group was informed that a meeting would be scheduled. They are still awaiting that opportunity for discourse.

Private education became subject to VAT on February 1, following the removal of zero-rated items as a measure of the 2017 national budget.

Minister of Finance Winston Jordan said earlier this month that only private schools that earn more than $15 million a year and are registered for VAT will be expected to charge the tax, which is not being applied to education or educational supplies, but to tuition fees payable to private schools.