Dear Editor,

Republic Bank (Guyana) Ltd (RBGL) has this week released its unaudited half year 2017 performance as at March 2017. That document clearly could not have been great reading for the shareholders, who I am advised are now principally Republic Finance and Merchant Bank Limited which according to Bloomberg is the merchant bank arm of the Republic Bank Group.

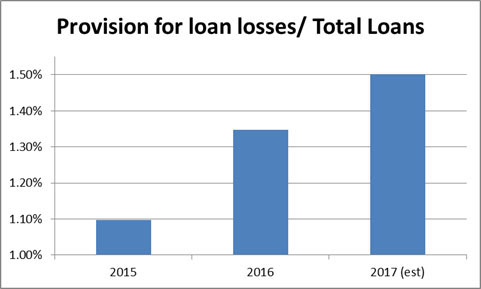

What is concerning to me as a financial analyst is the state of the loan provisioning net of recoveries at this institution since 2015. Between 2015 and 2016, the ratio of provision for bad debt to the total loan portfolio deteriorated by some 23%. At the end of the 2016 financial year in September, loan impairment expenses net of recoveries was $786 million. But to really understand the effect of what is happening, one must consider the ratio of the loan impairment expense net of recoveries to total loans and advances between 2015 and the trended projection for 2017 (which is substantiated with 6 months of actual performance).

From the graph below, one can observe the rapid expansion of the pool of good cash that has to be set aside to fund the write-off of potential bad loans in the bank’s loan portfolio. In 2017, this ratio of good cash set aside to fund the write-off of bad loans is expected to be slightly more than 1.5% of the total loan portfolio, compared to 1.1% in 2015 (see graph below).That is almost a 40% expansion in this ratio and cannot be great news for the shareholders.

I have had cause to write about an even worse performance in their main competitor (GBTI) on April 8, 2017 and this discovery this week confirmed we do have a systemic problem in the banking sector. Houston, we do have a problem!

It is now almost May 2017 and we are still awaiting the Annual Report of the Bank of Guyana for 2016 to confirm how much of the industry’s loan portfolio is categorized as sub-standard according to the Banking Supervision Guidelines. However, with the dataset at our disposal, we can confirm that with respect to RBGL, at the end of their financial year in September 2016, their non-performing loans to total loans were 11% compared to the industry level of 11.3%. Mind you the industry saw the quality of its loan portfolio deteriorate between September 2015 and September 2016 by 1.9% which translated to over $2.5 billion in debts being reclassified from “Acceptable” to “Substandard”. Some $519 million (20%) of that figure came from RBGL, the biggest bank in the industry. This means that the smaller indigenous banks like Demerara Bank and Citizens Bank who do not have an international head office to back them up with capital will definitely be at greater risk than RBGL.

What can be deduced from this situation? President David Granger has to wake up! This country is burning financially under his watch and he has to be held accountable for leading a team that seems hell-bent on driving the regression of the investment climate as they seek to build a new “breed” of private sector players. As chief executive, he should not allow Minister Winston Jordan to continue to determine the future financial condition of this economy. President Granger should own up to his mistake and promptly correct himself by appointing someone who really knows how to frame an economic process and turn around an economy. As I have said before, my choice in the Cabinet Room remains Carl Barrington Greenidge.

In the case of RBGL, post-tax profit declined by some 4% over their 2016 financial year to $2.7 billion. If one looks at the March 2017 published data from RBGL, one will recognize a trend that will see the loan portfolio growing at a quarter of the annualized rate that it grew in the previous year. How do banks make profits? Yes, the loan portfolio. What does that say about the profitability of this bank for 2017?

Those who have eyes will see that not only GBTI and RBGL are in a conservative lending mode, the entire industry is and if the private sector cannot access loans then that single measure will do much damage to the economy in 2017 and beyond. Can someone please pass the Limacol to President Granger?

Yours faithfully,

Sase Singh