Introduction

Introduction

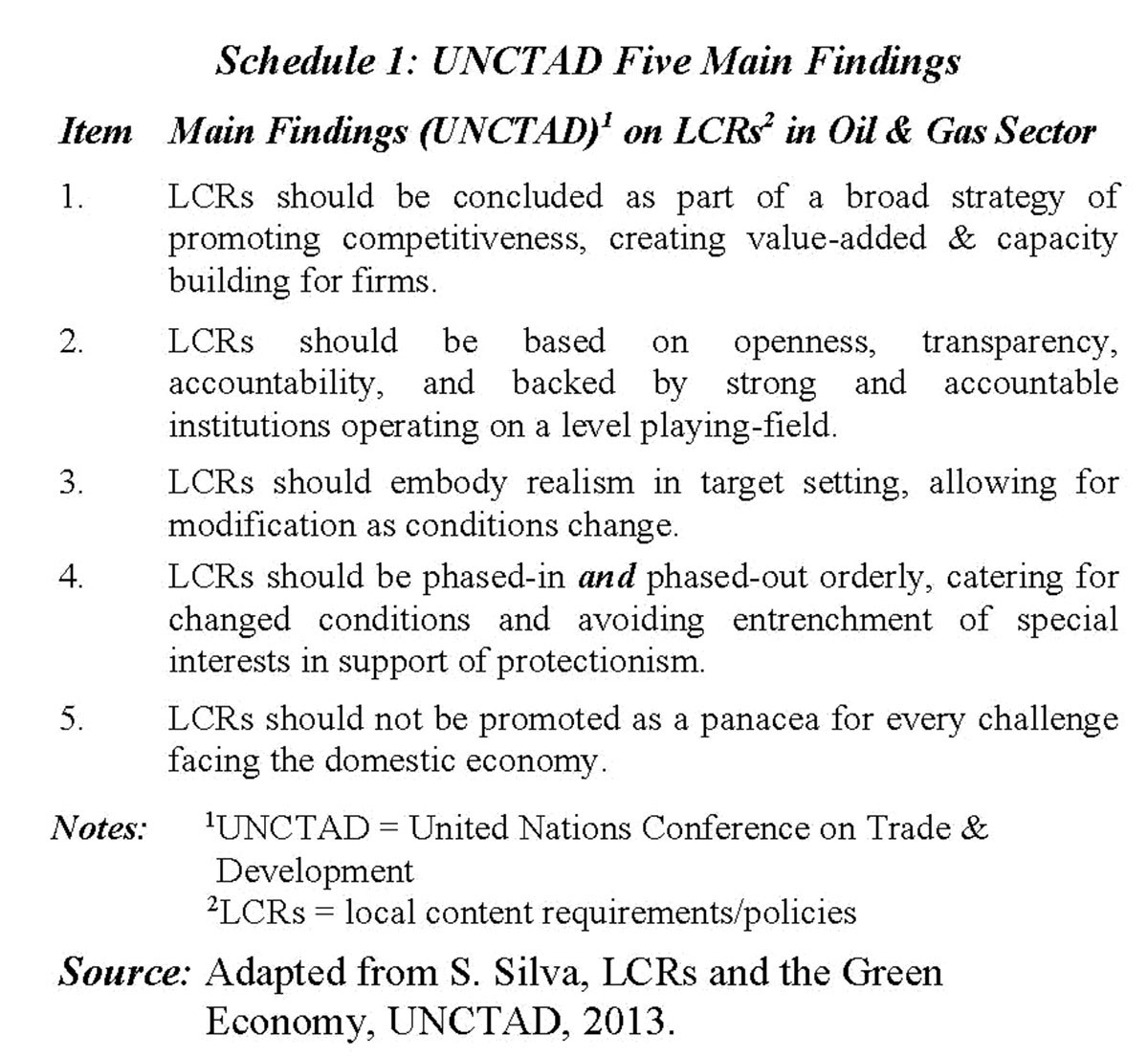

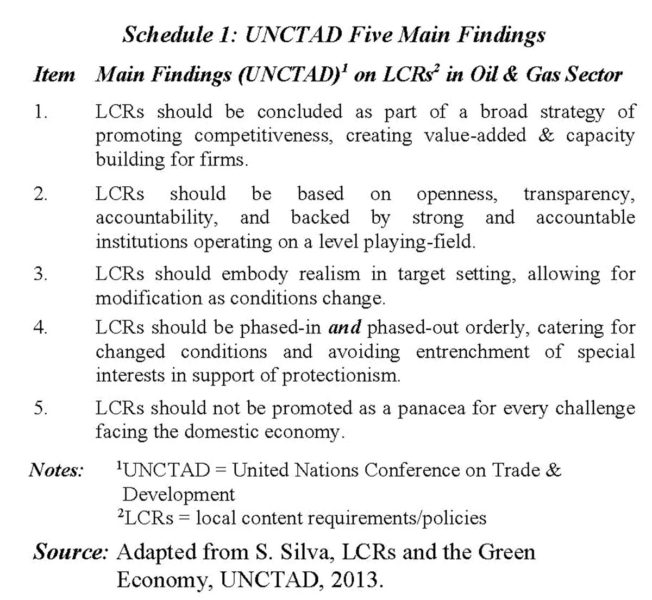

My two previous columns (April 30 and May 7) were devoted to, respectively, the main findings of the United Nations Conference on Trade and Development (UNCTAD) 2013, and the World Bank’s 2013 evaluation/research of the lessons to be learned from global experiences with local content requirements/policies (LCRs) in the oil and gas sector. Regrettably, space in those columns was not enough for me to offer readers a basic schedule, capturing for their convenience the main findings. At the end of last week’s column I had indicated that I would rectify this at the start of today’s.

Schedule 1 below summarizes the five main findings listed in the UNCTAD 2013 study. These findings reference the focus on firm capacity building; competitiveness and value-added for the economy; transparency, accountability and a level playing-field; realism and adaptation to changing conditions; the phasing-in and phasing-out of LCRs; and, the recognition that LCRs should not be portrayed as a panacea for all challenges to the economy. Thus:

LCRs and protectionism

Several weeks ago (March 26), this column was at pains to indicate that, the notion of LCRs had evolved over time, from the basic view of these as referring to “the percentage share of local inputs that must be embodied in a domestic producer’s output” to now where it is considered as a far broader notion, which encompasses ideas of economic localization and indigenous ownership, as deeper economic constructs.

As this evolution occurred, it has raised profound debates as to whether state policies designed to promote localization are not by definition, as it were, creating barriers to trade! If they are, then LCRs are fundamentally inconsistent with the World Trade Organization’s (WTO) trade principles.

I made the observation and further discussed this in later columns (last April), revealing that, as an empirical fact, a wide range of countries, large and small, rich and poor, industrialized and non-industrialized and located on every continent and region of the globe have implemented LCRs in the recent past. And indeed, have continued to maintain them.

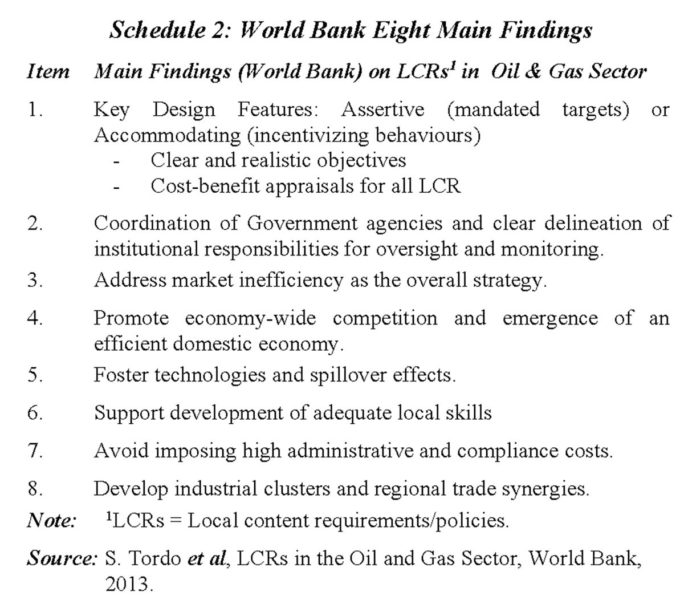

Similarly, Schedule 2 summarizes the eight main findings in the World Bank 2013, study. These refer to the design of LCRs; their coordination and location of institutional responsibility; their overall focus on market efficiency; the promotion of economy-wide competition; fostering technology and spillovers; support for local skills development; avoiding high administrative and compliance costs; and the promotion of industrial clusters and trade synergies. Thus:

This contrast between WTO principles and global practices creates hidden pitfalls, of which local authorities and the broader public should be aware. I had suggested then the best defence of the view which most Guyanese intuitively hold, that is, LCRs for Guyana are fair and just, is indeed rooted in economic theory. I tried, therefore to indicate in those columns “the development rationale for LCRs in Guyana is rooted in the country’s historical experiences of extensive and intensive dependence on the fortunes and misfortunes of extractive industries sales in world markets and the special characteristics of the oil and gas sector”.

I had elaborated on this through specific discussion of 1) the enclave economy; 2) the infant industry notion; 3) economic linkages and spillovers; and 4) Caricom as a production platform for Guyana. I was careful, however, to insist that the reputed case for LCRs as a form of backward backdoor protectionism should not be underestimated and/or dismissed lightly. If the authorities do this, they risk great peril.

WTO and LCRs

As matters presently stand, the WTO regulates LCRs through three general provisions and one plurilateral provision applying to just over two scores of countries. The three general provisions are 1) Trade Related Investment Measures (TRIMs); 2) Agreement on Subsidies and Countervailing Measures (ASCM); and 3) General Agreement on Trade in Services (GATS). The plurilateral agreement relates to Government Procurement Measures (GPM).

Indeed, the empirical material reveals so far that based on statistical analysis and case studies, conservatively, as much as US$93 billion has been the reduction in global trade (exports and imports) generated by LCRs. (Hufbauer et al, 2013). A recent OECD study (2013) using its METRO model also reveal that LCRs have 1) led to a decline in global trade (both exports and imports); 2) occurred in every global region; 3) resulted in those countries imposing LCRs, having lost competitiveness outside the targeted sector; and 4) led to rising domestic costs in all sectors, thereby reducing the beneficial effect of diversification measures.