Seven of the eight members of the Board of Directors of the Guyana Bank for Trade Industry Limited (GBTI) were yesterday charged with failing to comply with a court order that was issued by the High Court for the production of documents for an ongoing criminal investigation.

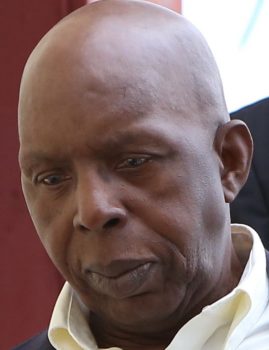

Those charged were Robin Stoby, Senior Counsel, who is also Chairman of the board and Vice-President of the Guyana Bar Association; Shaleeza Shaw, acting Chief Executive Officer of GBTI; Edward Anand Beharry, who is the Chairman of Edward Beharry and Sons Ltd; Suresh Beharry, who is the Vice-Chairman of Edward Beharry and Sons Ltd; Richard Isava, who is an investment banker; Carlton James; and Basil Mahadeo.

They were all released on self-bail by Chief Magistrate Ann McLennan based on an application by attorney Nigel Hughes, who called the laying of the charge an abuse of judicial power.

Another director, Kathryn Eytle-McLean, was also to be charged. However, the court heard that she does not reside in Guyana, and had difficulty getting into the country.

The charge against the accused states that on September 7, they failed to comply with a production order issued by the acting Chief Justice Roxane George SC.

A not guilty plea was entered by each accused after the charge was read by the Chief Magistrate.

Hughes, who spoke on behalf of the attorneys representing the accused, told the court that the documents that were requested by the Special Organised Crime Unit (SOCU) were taken to its office yesterday morning but were refused. This delivery, he noted, was done after the directors would have received an extension by the Chief  Justice to produce the documents. It was on this basis that he argued that the institution of the charge was an abuse of judicial power.

Justice to produce the documents. It was on this basis that he argued that the institution of the charge was an abuse of judicial power.

(The documents at the centre of the charge are pertinent to the

ongoing US$500M Guyana Rice Development Board (GRDB) probe being conducted by SOCU. SOCU has claimed that the bank’s failure to hand over the documents has stalled the probe.)

Hughes went on to request that the directors be released on their own recognisance, while noting that his clients are not flight risks and all have unblemished records.

In response to Hughes’ arguments, SOCU prosecutor Patrice Henry told the court that the defendants attempted to serve the documents on SOCU yesterday morning but were told that the order, which was made on August 29, specifically stated that the documents ought to be served on the Assistant Commissioner Sydney James. Henry added that at the time James was not in the office.

Addressing the charge against the directors, Henry noted that the charges were laid on October 19, pursuant to their failure to comply with the conditions of the order that were to be met since September 7. He added that SOCU bent over backwards to accommodate the defendants.

The prosecutor made no objection to bail being granted but requested that it be reasonable.

Chief Magistrate McLennan subsequently released the accused on self-bail and adjourned the matter until November 10.

Based on an application, Justice George last Friday granted the bank an extension to abide by the order but denied its request to be relieved from having to produce documents. It has said that they have either been destroyed after the retention period had expired or they have been lost and cannot be found despite diligent efforts. It was also explained in the application that some of the documents were likely lost as a result of misfiling.