There continues to be a flurry of activity and plenty conversation about oil and gas in Guyana. This heightened activity in a yet to be fully formed oil and gas industry keeps attracting more than curious onlookers. Consisting of about 53 per cent of global energy sources, oil and gas production in Guyana will only add to the importance of this source of energy for the global community. In a press release issued in July this year, ExxonMobil indicated that it had made an investment decision to begin the first phase of development of the Liza field offshore Guyana. As the company has been saying all along, it intends to begin production in less than four years. Unless additional information is gotten, the gross recoverable resources are estimated at between 2.35 billion to 2.75 billion oil equivalent barrels. This information includes the discoveries at Liza, Payara and Snoek. Averaging the two points of the range, one can say that, for now, Guyana has a reserve of 2.55 billion barrels of oil. One does not know what the later discoveries of Liza Deep and Turbot will add to the reserves when fully evaluated. Yet, these discoveries while important to Guyana are no more than a drop in the bucket of Exxon’s proven reserves and moreso when compared to other countries with significantly larger resources. This article seeks to situate Guyana in the global oil context. (Territorial Sea and Contiguous Zone)

Exclusive Economic Zone

Before doing so, it seems useful to reflect on the set of circumstances that enables Guyana to benefit from the discoveries that ExxonMobil has made off the shores of the country. There are many things that are taken for granted and the control of an Exclusive Economic Zone (EEZ) is one of them. Extending to as much as 200 miles offshore, the EEZ is one of those things that was out of sight. Its furthest points are not visible from shore and do not readily gain the attention of the general public. The EEZ did not always exist. It came alive in 1982 at the United Nations Convention on the Law of the Sea. The Convention gave coastal states sovereign rights over the natural resources in the zone. The coastal state therefore has sovereign rights to explore and exploit the natural resources of the EEZ. It also has the responsibility to conserve and manage the living resources in the zone. Territorial control goes beyond enjoyment of the resources in the zone. It includes the exclusive right to construct and to authorize and regulate the construction and installation of structures.

It is this sovereignty over the area that gives Guyana the right to let ExxonMobil and others explore for oil and to develop the oilfields. Exxon exercised those rights on the basis of an agreement that it had reached with the Government of Guyana. The government was in turn able to extend the right as a consequence of the existence of the EEZ over which it enjoys sovereignty. The discoveries by Exxon and its partners have meaning not only for Exxon as a company, but also for the oil and gas industry as a whole.

Oil reserves

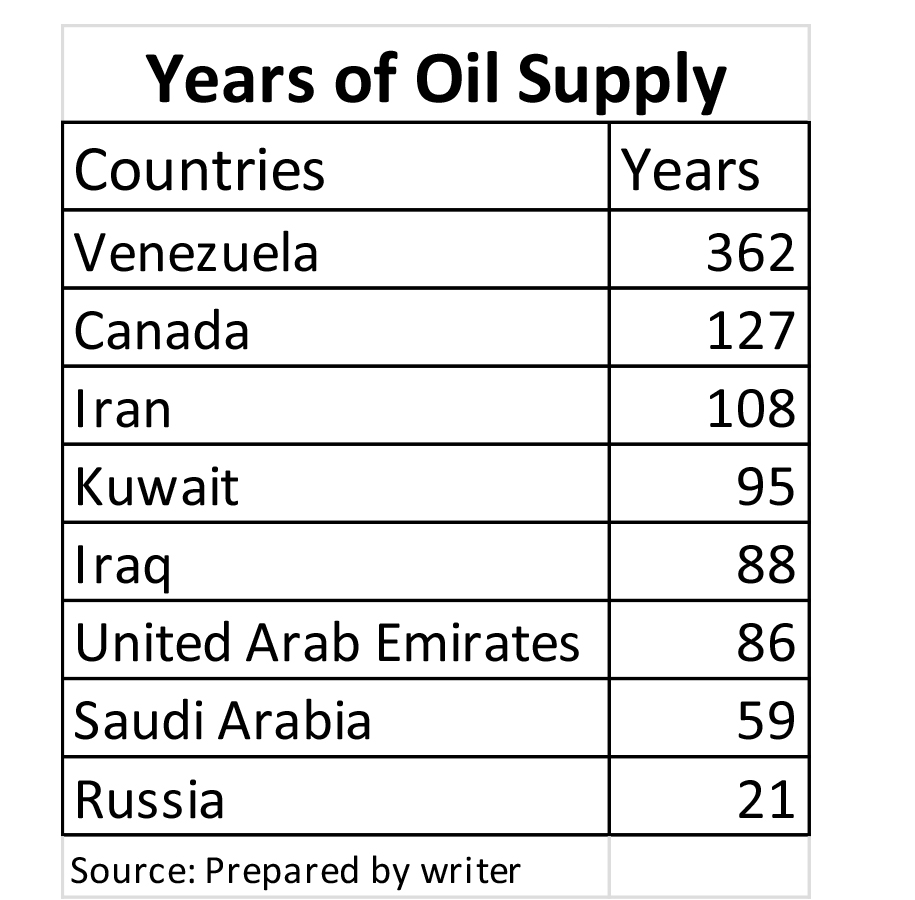

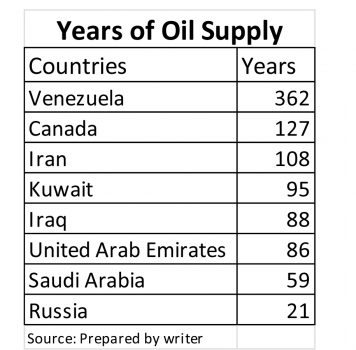

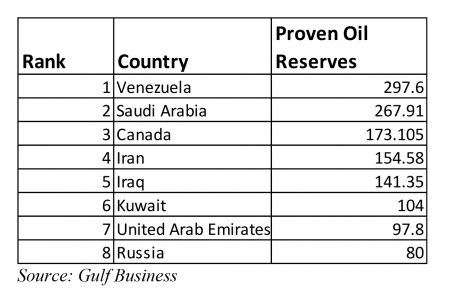

One area of interest is that of oil reserves. Current estimates put the world oil reserves at 1.64 trillion barrels. A review of the table below reveals some interesting characteristics.

TABLE 1

There are only eight countries with oil reserves over 50 billion barrels. It must be a frightening prospect for many that 80 per cent of the world’s oil reserves can be found in just eight countries. Five of the eight countries come from the Middle East which has an estimated 58 per cent of the reserves while one each is from Europe, North America and South America. In addition, the largest reserves sit in Venezuela, a neighbour to the west of Guyana. In the current scheme of global relations, this knowledge might offer little comfort to many. Venezuela is in what S&P calls “selective default” on its debt. The causes might be many, including some that might be self-inflicted. Also, one cannot discount the tremendous economic pressure that the USA has placed on the South American country’s ability to carry on its economic affairs. American investors are unable to buy new debt or equity offerings from Venezuelan companies. Refinancing its debt held by Americans therefore is a problem.

Table 2 shows the number of years that it would take for each of the eight countries to exhaust their oil reserves at current rates of production. It will take well over three centuries for the Venezuelan reserves to be exhausted at current production rates. The reserves in every other country, based on current information, will not last as long as a century, except for Canada and Iran whose reserves barely go past 100 years. The comfort offered by the reserves in the Venezuelan oilfields is something that must occupy the minds of oil company executives. Access to those reserves could only be seen as a must. One could therefore expect further pressure on the South American country until its internal strife has ended and its economic philosophy becomes much more orthodox.

TABLE 2

The other thing is that seven of the eight countries are either involved in some conflict or were involved in a conflict. Saudi Arabi is in conflict with Yemen and tensions remain high between Saudi Arabia and Iran which it has accused of aiding Yemen in a recent rocket attack. Iran and Iraq have gone at each other before while Iraq attempted to annex Kuwait before.

The other thing is that seven of the eight countries are either involved in some conflict or were involved in a conflict. Saudi Arabi is in conflict with Yemen and tensions remain high between Saudi Arabia and Iran which it has accused of aiding Yemen in a recent rocket attack. Iran and Iraq have gone at each other before while Iraq attempted to annex Kuwait before.

Offshore

According to some sources, an estimated 20 per cent of the oil reserves could be found in fields that were offshore. That means with existing data, offshore sites account for about 328 billion barrels of oil. If one were to place the declared reserves of Guyana in the global context, it would amount to less than one per cent. When considered from an offshore perspective, the announced reserves would be closer to one per cent. Unless something happens, either way Guyana will be a minuscule contributor to oil reserves. Even when the proven reserves of ExxonMobil alone are taken into account, Guyana accounts for no more than three per cent of the total 91 billion in reserves.

Resource-dependent

With there being so many producers, in economic parlance, Guyana will be a price-taker. It is a situation that is not unfamiliar to the country. Guyana relies currently on eight products to earn substantial amounts of foreign exchange. Six of these eight products are either agricultural or primary commodities which are described as consumable or transferrable assets. This means that there is little else to do with these assets other than to use or consume them. By 2020, it will add oil to the export basket. Therefore, not only will Guyana continue as a price-taker, it will also continue as a resource-dependent country.