There has been no adjustment in the 2018 budget to the income tax threshold though the entire personal allowance of $720,000 will now be available to those who only work for a part of the year. Measures were also announced for the private sector, the gold industry and education services in the presentation by Finance Minister Winston Jordan yesterday. The measures follow:

2018 Budget measures as announced by the Finance Minister

A. Measures in Support of Our Green Agenda

Mr. Speaker, in Budget 2017, hybrid vehicles below a certain engine capacity benefitted from tax concessions, while there were no engine capacity limits for electrically powered vehicles. In an effort to further reduce emissions, I propose to:

a) exempt the Excise Tax on vehicles principally designed to accommodate LPG gas, with an engine capacity not exceeding 2000 cc and not exceeding four years old from the date of manufacture to the date of importation. b) amend Part III B (i) of the First Schedule to the Customs Act, Chapter 82:01 to exempt machinery and equipment from the payment of Customs duties to set up refilling stations for such vehicles, as determined by the Commissioner-General. The VAT will still be payable. These measures take effect from January 1, 2018.

B. Measures to Increase Workers’ Income

I Income Tax – Personal Allowance

Mr. Speaker, currently, a person who works for a part of the year can claim only a part of the Personal Allowance of $720,000. By way of an example, if a person works for only six months in an entire year and earns $600,000, he/she would only be able to claim half of the Personal Allowance, or $360,000. Therefore, income tax of $67,200 would have to be paid on chargeable income of $240,000 (the difference between $600,000 and $360,000).

I now propose that the minimum Personal Allowance of $720,000 be given in full, regardless of whether a person works for the whole year or a part of the year. The tax deducted by the employer and remitted to the Guyana Revenue Authority (GRA), will be refunded to those employees whose income did not reach $720,000. This relief will clearly benefit those low income‘ earners who may have been unable to work for the entire year. This new measure will help, also, to simplify the personal allowance calculation, thus easing the administrative burden for GRA. The revenue loss is estimated to exceed $400 million. This measure takes effect from Year of Income 2018.

II Income Tax – Travel Allowance

Mr. Speaker, currently, public sector employees enjoy a tax-free vacation allowance, regardless of whether they spend their vacation in Guyana or abroad. On the other hand, private sector employees are only given the allowance to the extent of the cost of the passage to travel abroad. I propose to remove this anomaly, thereby allowing private sector employees to enjoy the vacation allowance tax-free and to use it as they see fit. As in the case of public sector employees, a tax-free vacation allowance to a private sector employee will be allowed up to a maximum of one month of the employee’s base salary. The GRA will scrutinize these allowances closely to ensure that the previous abuse of this benefit-in-kind, where employees were being paid huge vacation allowances, in lieu of salaries, does not recur. This measure takes effect from January 1, 2018.

C. Measures in Support of the Elderly and those in Difficult Circumstances

Mr. Speaker, since May 2015, the Government has consistently showed its concern for the plight of the elderly and those who find themselves in difficult circumstances. In this regard, we have increased the Old Age Pension, annually, to its present amount of $19,000. In addition, we relieved pensioners from the payment of Departure tax, driver’s licence and passport. With effect from January 1, 2018 Old Age Pensions will rise to $19,500, an almost 49 percent increase in just two and half years. Similarly, effective January 1, 2018 Public Assistance will be increased to $8,000, approximately 36 percent growth over the same period.

D. Measures in Support of the Private Sector

Mr. Speaker, the following measures are proposed in support of the private sector and to stimulate economic activity:

I Forestry

Mr. Speaker, the following package of incentives to the forestry sector is intended to improve its competitiveness and boost output and incomes:

As announced earlier this month, the restriction of the importation of Pine Wood and Pine Wood Products, with effect from January 1, 2018. b) Following strong representation at the recent meeting of the Council for Trade and Economic Development (COTED), an organ of Caricom, Guyana’s request for suspension to increase the Common External Tariff (CET) on Pine Wood and Pine Wood Products, from 5 percent to 40 percent, has been approved. The new tariff will be in effect from January 1, 2018 to December 31, 2019. c) With effect from January 1, 2018, I propose to exempt from VAT, a supply of logs and rough lumber to the sawmilling industry. This would improve the cash flow of operators in the industry by at least $80 million. d) The sum of $120 million has been set aside to commence a forest inventory. e) An amount of $50 million has been allocated, in Budget 2018, as an indication of Government’s preparedness to partner with the private sector in a Public Private Partnership, to establish a Dimension Stockyard.

II Gold

Mr. Speaker, the gold and diamond industry has been making a valuable contribution to Gross Domestic Product, income, export earnings and employment. In recognition of this, the Government has enabled small and medium scale miners to benefit from tax concessions on machinery, equipment and fuel; and waiver and remission of taxes on vehicles, based on gold declarations. For 2016, a total of $47.6 million in taxes was waived on motor vehicles, while, for 2017, such waivers have amounted to $64.4 million for personal motor vehicles and $188 million for fuel, so far. Many operators in the sector have been approved to hold foreign exchange retention accounts; instead of the 10 percent, they have been allowed unlimited retention of foreign exchange to purchase mining equipment.

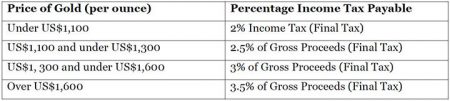

Following strong representation by the Guyana Gold and Diamond Miners Association (GGDMA), I propose the following additional incentives to the industry: a) A reduction in the Tributor’s Tax from 20 percent to 10 percent, with effect from January 1, 2018. Tributors will continue to file annual tax returns and pay any taxes due or be refunded as appropriate. Both the GRA and the GGMC will intensify their efforts to bring operators in the industry within the tax net. b) Replacement of the current ―2% of the gross proceeds‖ regime with a sliding scale percentage that is based on the price of gold:

Operators in this industry will continue to keep records in keeping with the provisions of Section 33E (5) of the Income Tax Act, Chapter 81:01 which states, ―Nothing in this section shall be construed as exempting a gold or diamond miner from the requirement to keep adequate records of the income from mining operations.

III. Housing

Mr. Speaker, in an effort to support the housing sector and encourage the building of low cost houses, I propose to exempt from VAT, complete housing units costing up to $6.5 million, that are built by, or on behalf of, the Central Housing and Planning Authority (CH&PA) or any other approved entity.

IV Transportation

Mr. Speaker, transportation is a critical sector in any economy and the Government has a responsibility, through policies, regulations and investments, to ensure that the sector functions optimally. We recognise that the ability to acquire appropriate vehicles at more affordable prices will increase the number of vehicles operating especially in the hinterland regions, thereby affording increased access to transportation for both businesses and individuals. As such I propose to introduce the following measures, with effect from January 1, 2018:

The reduction in the rates of Excise Tax on the importation of overland transportation used for tourism purposes in Regions Nos. 1, 7, 8 and 9. This concession will be applicable to vehicles between 2,000 cc and 4,000 cc that are used exclusively in the tourism sector for the transport of persons by incorporated entities that have been operating in those regions for at least five years. For vehicles 2,000 cc to under 3,000 cc and which are less than 4 years, the Excise Tax would be slashed from 110 percent to zero; for vehicles over 3,000 cc to 4,000 cc and which are less than 4 years, the Excise Tax would be reduced from 140 percent to zero. (Appendix VIII) b) I propose to grant free vehicle licences to motor buses and motor vehicles that operate in Regions Nos. 1, 7, 8 and 9. c) I propose to remove the VAT on vehicles that are less than 4 years, which are used to transport more than 21 persons. d) I propose to remove the Excise Tax flat rate of US$6,900 and replace it with a VAT of 14 percent, on vehicles 4 years and older that carry between 22 and 29 passengers.

V Small Business

Mr. Speaker, many small businesses do not adequately utilize the various concessions available under the various Tax Acts, the Small Business Act and those offered through Investment Development Agreements (IDAs). In particular, small businesses do not get the benefit of concessions under the Small Business Act. Exemptions go a begging, and the various allowances under the Income Tax Act, the Income Tax (in Aid of Industry) Act and the Customs Act are often not utilised. The Ministry of Business, through Go-Invest, and the Ministry of Finance, through GRA will be embarking on an intensive education programme aimed at sensitizing small businesses to the availability and accessing these concessions. Meanwhile, the sum of $100 million has been allocated in Budget 2018 to replenish the Small Business Development Fund.

VI Educational Services

Mr. Speaker, in Budget 2017, as part of our efforts to widen the tax base, services provided by private educational institutions were standard rated, while educational supplies previously zero-rated were exempted from the payment of the VAT. In view of the representations made, I propose to remove the VAT on the provision of all educational services, with effect from January 1, 2018. At the same time, efforts will continue by the Guyana Revenue Authority to ensure that these institutions become tax-compliant. The potential revenue loss is $342 million.

VII. Day Care Centres

Mr. Speaker, in Budget 2016, I intimated that concessions would be given to employers who provide day care services to their employees, and to businesses that provide and construct handicap facilities. The capital costs and expenses related to such provisions will be allowed in full as an expense to these employers and businesses.

E. Amnesty

Mr. Speaker, I propose to grant an amnesty to all delinquent taxpayers – corporate and individual – who are outstanding in the filing of true and correct tax returns and payment of their true and correct taxes. This amnesty will be in effect from January 1, 2018 through September 30, 2018. Taxpayers who file and pay all principal taxes on or before June 30, 2018 will have all interest and penalties waived, while those who file and pay all principal taxes between July 01, 2018 and September 30, 2018 will have 50 percent of interest and penalties waived.

6.19 Taxpayers who expect to benefit from this amnesty must file true and correct returns. Those found to be in violation will be subject to an audit and the attendant penalties and interest will be applied. The GRA will be devoting increased resources to enforcement of the income tax laws.

F. Deposit to a Board of Appeal and a Judge in Chambers

Mr. Speaker, Section 82(5) Appeals to the Board against Assessments stipulates: No appeal shall lie to the Board unless the person aggrieved by an assessment made upon him by the Commissioner-General has paid to the Commissioner General, tax equal to two-thirds of the tax which is in dispute.

Further, Section 98 of the Income Tax act stipulates that: No appeal shall lie under Section 86(1)(a) to a judge by a person to pay tax aggrieved by an assessment made upon him by the Commissioner-General or by a decision of the Board, unless that person has paid to the Commissioner-General the whole amount of tax which is in dispute under the assessment made upon him.

In several cases, the lodgment of these deposits has proven to be onerous for businesses and ordinary taxpayers. I propose to reduce the deposits for these appeal matters to one-third (1/3) of the tax in dispute, if less than $20 million; and the lodgment of a bond or other acceptable form of guarantee, for disputes that are over $20 million.

G. Filing of Corporate Tax Returns without Audited Financial Statements

Mr. Speaker, over the years, many companies have habitually filed their corporate tax returns after the due date of April 30, thereby incurring needless penalties and interest. In an effort to alleviate this problem, I propose that, in certain instances, as predetermined by the Commissioner-General, draft management accounts be accepted for filing purposes, and the audited accounts filed on or before December 31st of the year in which the return falls due.

H. Provisional Licences for Businesses

Mr. Speaker, statistics show that there are a large number of businesses that operate without licences, because of the difficulties in obtaining some of the requirements, including approved building plans, and safety and sanitary certificates. Many of them businesses have constantly approached the GRA with a view of having their businesses registered. After careful consideration of the current requirements, I propose that a Provisional Licence be issued for a period not exceeding two (2) years, for premises conducting some of the following businesses: Grocery Shops, Variety Stores, and Snackettes. It must be noted that this Provisional Licence cannot be used to acquire any additional licence such as a Liquor Licence. In addition, upon expiration of the Provisional Licence, no extension will be granted. This measure takes effect from January 1, 2018.

Clean up of VAT Legislation and Schedules

Mr. Speaker, in Budget 2017, a suite of amendments were introduced to the VAT Act and Schedules. With the benefit of a thorough review, it is recognised that additional amendments would be necessary to correct errors and omissions, on the one hand, and to bring greater clarity to certain definitions and areas of the law. None of these proposed amendments will negatively affect any individual or business.